- United States

- /

- Machinery

- /

- NYSE:MTW

3 Undervalued Small Caps With Insider Buying Across Regions

Reviewed by Simply Wall St

The United States market has shown resilience, remaining flat over the last week while achieving a 9.8% increase over the past year, with earnings projected to grow by 15% annually in the coming years. In this context, identifying stocks that are potentially undervalued with insider buying activity can be an intriguing strategy for investors looking to capitalize on growth opportunities within the small-cap segment.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Lindblad Expeditions Holdings | NA | 0.9x | 34.52% | ★★★★★★ |

| Columbus McKinnon | NA | 0.4x | 41.14% | ★★★★★☆ |

| Industrial Logistics Properties Trust | NA | 0.7x | 47.52% | ★★★★★☆ |

| Citizens & Northern | 10.6x | 2.6x | 49.76% | ★★★★☆☆ |

| S&T Bancorp | 10.3x | 3.5x | 45.74% | ★★★★☆☆ |

| Myomo | NA | 2.6x | 36.19% | ★★★★☆☆ |

| Thryv Holdings | NA | 0.7x | 28.35% | ★★★★☆☆ |

| MVB Financial | 13.8x | 1.8x | 35.60% | ★★★☆☆☆ |

| Standard Motor Products | 11.5x | 0.4x | -2174.35% | ★★★☆☆☆ |

| BlueLinx Holdings | 13.7x | 0.2x | -68.48% | ★★★☆☆☆ |

Here's a peek at a few of the choices from the screener.

Industrial Logistics Properties Trust (ILPT)

Simply Wall St Value Rating: ★★★★★☆

Overview: Industrial Logistics Properties Trust is a real estate investment trust focused on owning and leasing industrial and logistics properties, with a market cap of approximately $0.19 billion.

Operations: The primary revenue stream is derived from the ownership and leasing of properties, generating $441.99 million in revenue. The gross profit margin has shown a trend around 86%, indicating efficient management of direct costs associated with property operations. Operating expenses, including depreciation and general administrative costs, significantly impact net income margins, which have been negative in recent periods due to high non-operating expenses.

PE: -3.2x

Industrial Logistics Properties Trust, a smaller U.S. company, is navigating financial challenges with recent strategic moves. They secured $1.16 billion in fixed-rate mortgage financing to replace existing debt, potentially lowering interest expenses and stabilizing cash flows. Despite a volatile share price and reliance on external borrowing, insider confidence is evident as an executive purchased 20,000 shares for US$66,228 in March 2025. Although the first quarter showed a slight revenue dip to US$111.91 million and net losses narrowed slightly to US$21.53 million from last year, these actions suggest efforts towards long-term stability amidst market fluctuations.

Titan Machinery (TITN)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Titan Machinery operates as a distributor of agricultural and construction equipment with a focus on markets in Europe, Australia, and North America, boasting a market capitalization of $1.12 billion.

Operations: The company's revenue is primarily driven by its Agriculture and Construction segments, contributing significantly to its overall earnings. Over recent periods, the gross profit margin has shown a notable trend, peaking at 20.31% before declining to 13.67%. Operating expenses include significant allocations for general and administrative costs.

PE: -7.3x

Titan Machinery, a small company in the U.S., has recently faced financial challenges with a net loss of US$13.2 million for Q1 2025, compared to a profit last year. Despite this, insider confidence is evident as insiders have been purchasing shares since March 2025. The company's sales reached US$7.85 million in Q1 2025, showing slight growth from the previous year. Although debt isn't well covered by operating cash flow, earnings are projected to grow significantly at 75% annually.

- Navigate through the intricacies of Titan Machinery with our comprehensive valuation report here.

Gain insights into Titan Machinery's past trends and performance with our Past report.

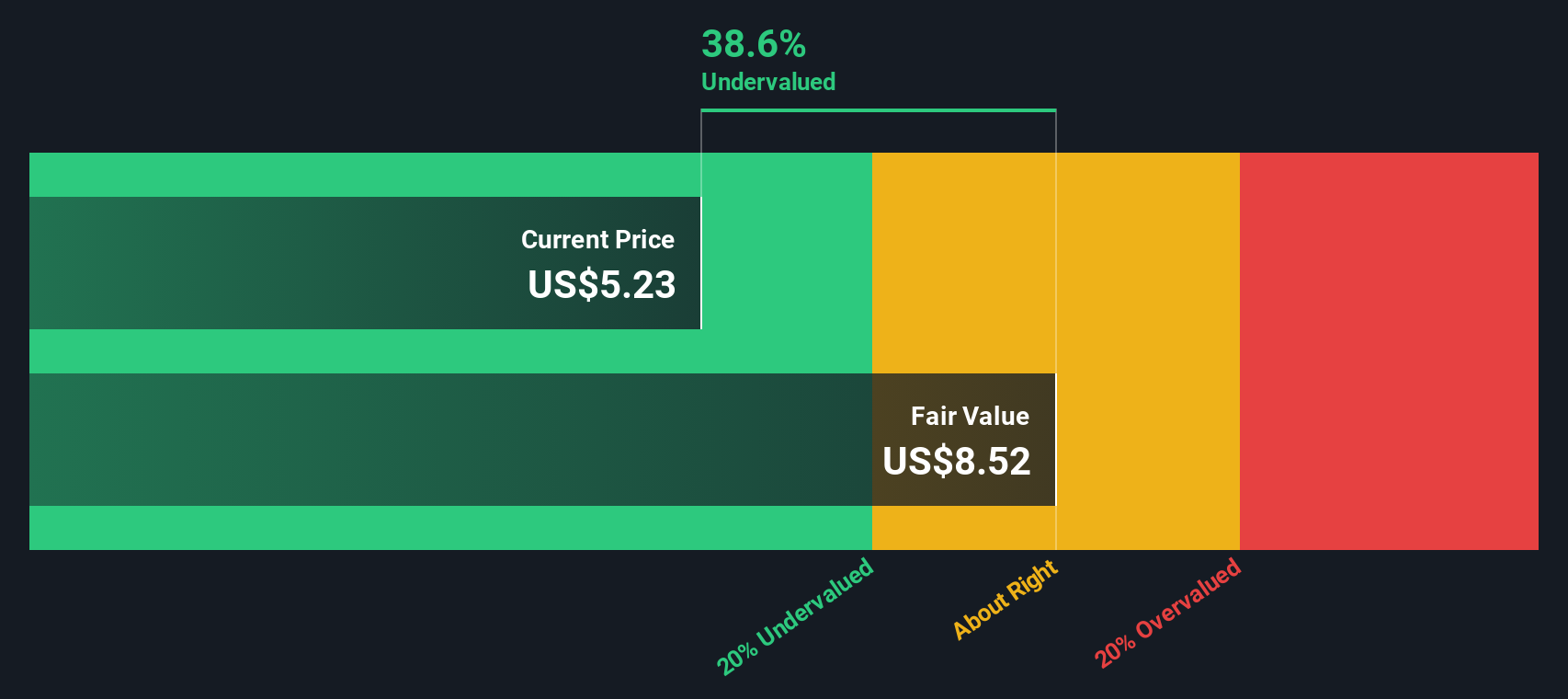

Manitowoc Company (MTW)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Manitowoc Company specializes in the design, manufacture, and distribution of cranes and lifting solutions, with a market cap of approximately $0.98 billion.

Operations: In the most recent period, Americas contributed $1.17 billion to revenue, while EURAF and MEAP added $618.60 million and $361.50 million respectively. The gross profit margin showed fluctuations but reached 19.64% in September 2023 before slightly decreasing to 17.29% by March 2025. Operating expenses have consistently been a significant portion of costs, with general and administrative expenses being a major component within this category over time.

PE: 8.9x

Manitowoc, a smaller player in the industrial sector, faces challenges with its interest payments not well covered by earnings and reliance on external borrowing. Despite these hurdles, insider confidence is evident as they have been buying shares since November 2023. Recent financials show a decline in sales to US$470.9 million for Q1 2025 from US$495.1 million the previous year, with a net loss of US$6.3 million compared to prior profits. However, earnings are projected to grow annually by 11.32%, suggesting potential for future value realization amidst current financial pressures.

- Get an in-depth perspective on Manitowoc Company's performance by reading our valuation report here.

Summing It All Up

- Investigate our full lineup of 87 Undervalued US Small Caps With Insider Buying right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MTW

Manitowoc Company

Provides engineered lifting solutions in the Americas, Europe, Africa, the Middle East, the Asia Pacific, and internationally.

Proven track record and fair value.

Similar Companies

Market Insights

Community Narratives