- United States

- /

- Machinery

- /

- NasdaqGM:SYM

Symbotic (SYM) Valuation Check After $550 Million Share Offering and Fresh Analyst Downgrades

Reviewed by Simply Wall St

Symbotic (SYM) just raised $550 million in a follow on stock offering at about $55 a share, landing fresh capital right as several big banks turned more cautious on its warehouse automation story.

See our latest analysis for Symbotic.

All this offering and downgrade noise comes after a huge run, with a 141.60% year to date share price return but a 113.60% one year total shareholder return shows momentum is cooling at the edges even as the long term automation story stays very much intact.

If Symbotic has you rethinking where growth and robotics trends go next, it could be worth exploring other high growth tech and AI names through high growth tech and AI stocks.

With shares now trading just below Wall Street targets after a 200 percent plus run, are investors finally getting Symbotic at a discount, or is the market already fully pricing in its next leg of growth?

Most Popular Narrative Narrative: 17.5% Overvalued

With Symbotic last closing at $59.70 against a narrative fair value of $50.82, the story leans rich and hinges on aggressive growth assumptions.

The analysts have a consensus price target of $48.6 for Symbotic based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $60.0, and the most bearish reporting a price target of just $10.0.

Want to see what kind of revenue ramp, margin lift, and earnings power could back such a wide target range? The narrative lays out a bold trajectory, anchored in rapid top line expansion and a transformed profit profile. Curious how those moving parts add up to today’s fair value call, and why expectations split so sharply? Dive in and unpack the full set of assumptions driving this valuation path.

Result: Fair Value of $50.82 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution hiccups around next gen deployments, as well as any slowdown or renegotiation from major customers like Walmart, could quickly challenge today’s growth rich narrative.

Find out about the key risks to this Symbotic narrative.

Another View: Cash Flows Tell a Different Story

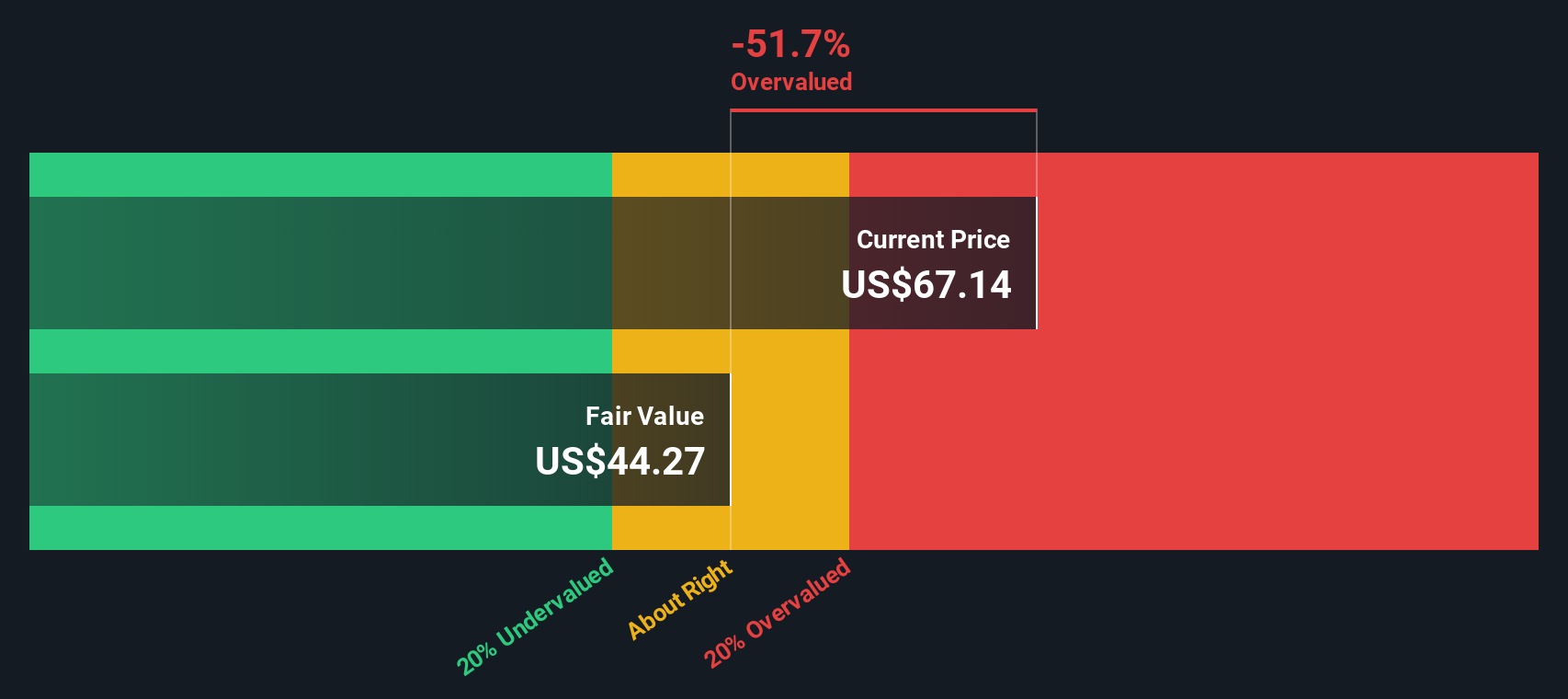

While the narrative fair value suggests Symbotic looks 17.5% overvalued, our DCF model points the other way, implying shares trade about 16% below fair value at roughly $71.30. One perspective indicates that optimism has gone too far, while the other suggests that the market is still too cautious. Which future do you consider more likely?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Symbotic for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 907 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Symbotic Narrative

If the current storyline does not quite fit your view, or you prefer to dig into the numbers yourself, you can build a custom narrative in minutes, starting with Do it your way.

A great starting point for your Symbotic research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next opportunities now by using the Simply Wall St Screener to uncover stocks that align with your strategy and edge.

- Capitalize on mispriced growth stories by scanning these 907 undervalued stocks based on cash flows that may be trading below what their fundamentals suggest.

- Ride the next wave of innovation by targeting these 26 AI penny stocks positioned at the heart of transformative artificial intelligence trends.

- Boost your income potential with these 15 dividend stocks with yields > 3% that can add reliable yield alongside capital growth in your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:SYM

Symbotic

An automation technology company, develops technologies to enhance operating efficiencies in modern warehouses.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026