- United States

- /

- Electrical

- /

- NasdaqGM:SHLS

Shoals Technologies Group (SHLS): Evaluating Valuation After Strong Quarterly Earnings and New 2025 Guidance

Reviewed by Simply Wall St

Shoals Technologies Group (SHLS) is in the spotlight after it reported third-quarter results showing a solid jump in sales and a positive swing in net income compared to last year. The company also shared fresh guidance for the rest of 2025, which has sparked more investor conversation.

See our latest analysis for Shoals Technologies Group.

Fresh quarterly results and leadership appointments have helped Shoals Technologies Group grab investor attention, with the latest share price up 3.9% in a day but still down 22.6% over the past month. Despite recent volatility, its total shareholder return over the last year sits at an impressive 84.1%. This suggests that momentum around earnings improvements may be reigniting optimism after a challenging stretch.

If you're looking for more opportunities in the renewables and engineering sector, now is a smart moment to discover fast growing stocks with high insider ownership.

But with shares still well below their recent highs and the company trading at a notable discount to analyst price targets, the question remains: is the market undervaluing Shoals Technologies Group, or is future growth already reflected in the price?

Most Popular Narrative: 3.8% Undervalued

Shoals Technologies Group’s widely followed narrative points to a fair value of $8.73 per share, slightly above the last closing price of $8.40. This small gap sets the tone for a debate about whether the market is catching up to the company’s improving fundamentals or if some factors remain underestimated.

Shoals is actively expanding its product suite into fast-growing adjacent markets, such as battery energy storage systems (BESS) and international solar projects. This positions the company to capture new revenue streams and reduce dependency on U.S. policy, which is expected to support top-line growth and diversification.

Behind this calculated optimism is a bold set of projections for margin expansion, international expansion, and robust earnings growth. The heart of the narrative is driven by a few aggressive assumptions about Shoals’ profitability, revenue mix, and future profit multiples that shape this fair value estimate. Want to know how much the market assumes Shoals can grow and what financial levers analysts believe are most critical? Dive deeper to see the full story behind these numbers.

Result: Fair Value of $8.73 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, prolonged margin compression and ongoing legal costs remain significant risks. These factors could challenge the recent optimism surrounding Shoals Technologies Group's growth story.

Find out about the key risks to this Shoals Technologies Group narrative.

Another View: Market Multiples Tell a Different Story

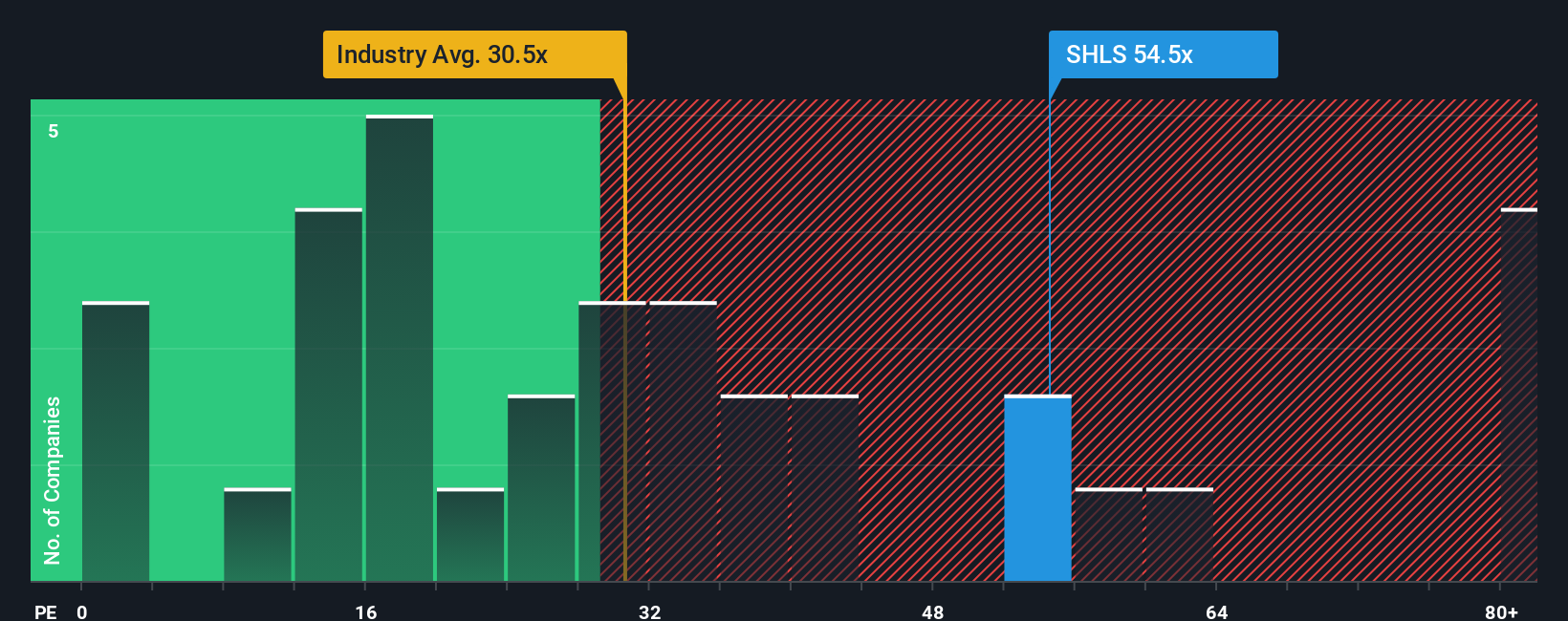

While the fair value narrative points to undervaluation, the market’s price-to-earnings ratio paints a more complex picture. Shoals trades at 42.2 times earnings, which is above the industry average of 29.4 but below the peer average of 48.9. Even so, the fair ratio suggests the market could eventually move toward 49.8. This leaves investors to weigh whether the company’s current premium represents future opportunity or signals caution ahead. Should investors trust the optimism or be wary of the risks?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Shoals Technologies Group Narrative

If you want to see the numbers for yourself or prefer to chart your own course, you can quickly craft a personalized view of Shoals in just a few minutes. Do it your way

A great starting point for your Shoals Technologies Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Step ahead of the crowd and uncover stocks with unique growth trajectories. Don’t let another opportunity slip by. Find your next move with these tailored screens:

- Power up your portfolio with market leaders in artificial intelligence by starting with these 25 AI penny stocks that are transforming industries.

- Unlock fresh opportunities with underappreciated businesses. See which names made the cut in these 879 undervalued stocks based on cash flows.

- Target reliable income and greater stability by checking out these 16 dividend stocks with yields > 3% with potential for consistent returns above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:SHLS

Shoals Technologies Group

Provides electrical balance of system (EBOS) solutions and components in the United States and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives