- United States

- /

- Construction

- /

- NasdaqGS:ROAD

A Fresh Look at Construction Partners (ROAD) Valuation Following Recent Pullback

Reviewed by Simply Wall St

See our latest analysis for Construction Partners.

After posting strong revenue and earnings growth, Construction Partners’ share price has cooled off lately, falling more than 14% over the past month. Still, solid fundamentals have fueled a 20.8% year-to-date share price return and a massive 234.7% total shareholder return over three years. This suggests momentum may simply be pausing after an extended run.

If you’re thinking about what else is driving market momentum right now, it could be a great opportunity to discover fast growing stocks with high insider ownership.

With shares trading well below analyst targets while also coming off significant gains, the key question is whether Construction Partners remains undervalued or if the market is already reflecting all of its future growth prospects.

Most Popular Narrative: 19.1% Undervalued

With the most followed narrative assigning a fair value of $131.17, Construction Partners’ last close of $106.12 positions shares at a meaningful discount in the eyes of analysts, despite recent market volatility. This dynamic sets up a compelling story for what could be ahead if the narrative’s bullish assumptions prove accurate.

Ongoing vertical integration through investment in owned asphalt plants and material sourcing, combined with increasing scale, is already enhancing operational efficiencies and supporting margin expansion, as shown by record adjusted EBITDA margins despite weather disruptions. This trend may drive higher net margins and improved earnings resilience going forward.

Curious how record-setting margins and a sharp efficiency play could fuel the company’s potential re-rating? The projections in this narrative are based on significant assumptions about future profitability and business scale. Explore the leverage points and financial turning points that analysts believe could influence Construction Partners’ next chapter.

Result: Fair Value of $131.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained labor shortages or a slowdown in public infrastructure funding could challenge robust growth forecasts and change Construction Partners’ bullish outlook.

Find out about the key risks to this Construction Partners narrative.

Another View: More Pricey Than It Looks?

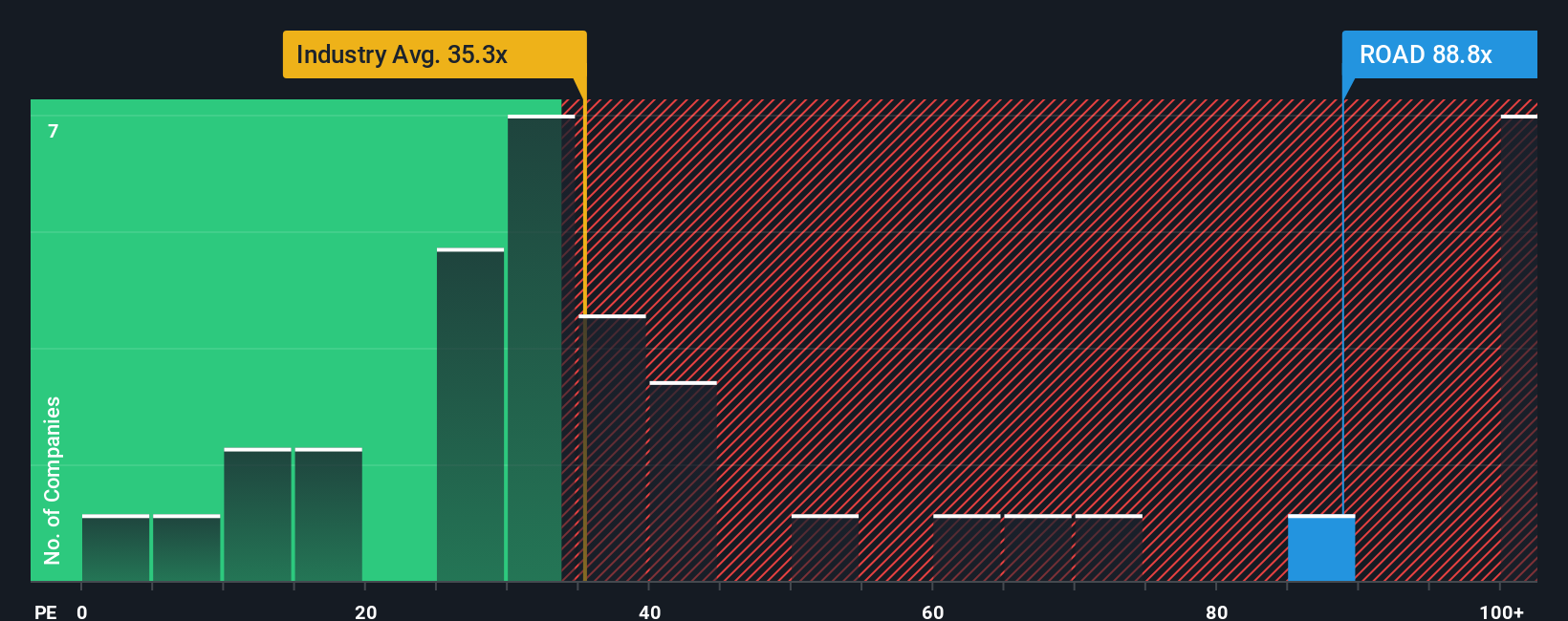

While analyst narratives see Construction Partners as undervalued, our model suggests the company's price tag is actually steep compared to peers. Its price-to-earnings ratio is 79.9x, well above the US Construction industry average of 33.9x and the fair ratio of 35.8x. This significant gap could mean extra risk for new buyers, especially if growth cools or the market revalues the stock. Could a premium like this hold up if future results disappoint?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Construction Partners Narrative

If you have a different perspective or want to dive deeper into the numbers yourself, you can quickly craft your own story for Construction Partners in just a few minutes. Do it your way.

A great starting point for your Construction Partners research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Your next winning pick could be just a click away. Use the right filters to identify new trends before they become widely recognized.

- Capitalize on market inefficiencies by exploring these 873 undervalued stocks based on cash flows, where stocks are trading below their true value and may be positioned for a turnaround.

- Benefit from the digital transformation trend by seeking growth opportunities among these 28 AI penny stocks, which are involved in advancing artificial intelligence innovation.

- Access reliable income streams with these 15 dividend stocks with yields > 3%, which features above-average yields and the potential for steady returns in various market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ROAD

Construction Partners

A civil infrastructure company, constructs and maintains roadways in Alabama, Florida, Georgia, North Carolina, South Carolina, Tennessee, and Texas.

Reasonable growth potential with questionable track record.

Similar Companies

Market Insights

Community Narratives