- United States

- /

- Electrical

- /

- NasdaqCM:PSIX

Is Jefferies’ Positive Coverage Altering the Investment Case for Power Solutions International (PSIX)?

Reviewed by Sasha Jovanovic

- Jefferies recently initiated coverage on Power Solutions International (PSIX), providing an in-depth analysis along with a positive outlook on the company's potential.

- This marks a significant recognition from the financial community and highlights PSIX's standing within the broader industrial sector.

- We'll consider how Jefferies' confidence in PSIX's growth prospects shapes the company's investment narrative moving forward.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

What Is Power Solutions International's Investment Narrative?

To be a shareholder in Power Solutions International today, you need to believe in the company’s ability to remain a key player in power systems and capitalize on strong end-market demand, especially in areas like data centers where management has forecast significant growth. The recent initiation of coverage by Jefferies, with a bullish price target, may renew interest in PSIX and help shift attention toward its value and earnings momentum, particularly after a period of substantial share price volatility and profit growth. However, while Jefferies’ coverage is positive recognition, the most immediate catalysts, ongoing contract wins, index inclusions, and demand from partners, likely remain unchanged, but increased analyst attention could improve liquidity and sentiment in the short term. The biggest risk remains board instability and lingering concerns from an earlier auditor ‘going concern’ warning, factors that investors must weigh carefully against earnings progress. Short-term volatility, especially after very large recent gains and a sharp pullback, is also an important consideration. In contrast, board changes and turnover remain a key risk investors should not overlook.

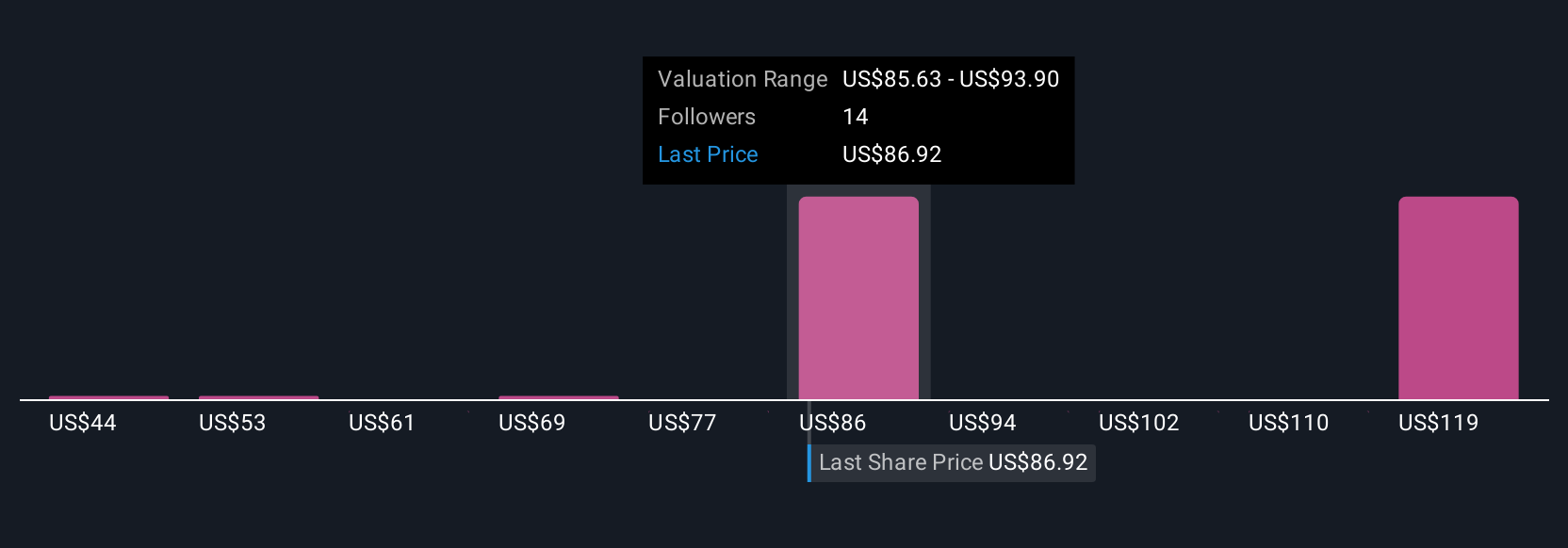

Despite retreating, Power Solutions International's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 8 other fair value estimates on Power Solutions International - why the stock might be worth over 4x more than the current price!

Build Your Own Power Solutions International Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Power Solutions International research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Power Solutions International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Power Solutions International's overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:PSIX

Power Solutions International

Designs, engineers, manufactures, markets, and sells engines and power systems in the United States, North America, the Pacific Rim, Europe, and internationally.

Flawless balance sheet and undervalued.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026