- United States

- /

- Electrical

- /

- NasdaqGS:POWL

Powell Industries (POWL): Assessing Valuation Following Strong Fourth Quarter and Full-Year Earnings Growth

Reviewed by Simply Wall St

Powell Industries (POWL) caught investor interest after releasing its fourth quarter and full-year earnings, highlighting sequential gains in both sales and profits compared to last year. The latest results signal positive momentum for the company.

See our latest analysis for Powell Industries.

Powell Industries' upbeat results have added fuel to an already impressive streak, with its share price notching a 21.16% gain over the past three months. Looking longer term, the company’s total shareholder return sits at 16.84% for the past year and a remarkable 1,116.82% over three years. These figures highlight persistent momentum and optimism from investors around the business’s growth potential.

If this kind of momentum has you curious about what else is out there, consider broadening your watchlist and discover fast growing stocks with high insider ownership.

With shares soaring after consistent earnings beats, the key question for investors is whether Powell Industries remains undervalued at current levels or if the stock’s rapid climb already reflects all its future growth prospects.

Most Popular Narrative: 18.7% Overvalued

Current sentiment from the most widely followed narrative puts Powell Industries’ fair value at $269.26 per share, which is meaningfully below the last close of $319.59. This sets the stage for a deeper dive into the assumptions and catalysts behind this valuation disconnect.

The market may be pricing in sustained outsized revenue growth and backlog conversion driven by robust order activity in electric utility, data center, and offshore energy infrastructure. These sectors are benefiting from the accelerating buildout of electrification and grid modernization, which could result in potentially over-optimistic top-line expectations.

What hidden drivers are inflating this price tag? Dive into the nuts and bolts behind the anticipated margin shifts, conflicting profit outlooks, and future earnings projections that hold the keys to this valuation. The most intriguing assumptions are waiting just below the surface.

Result: Fair Value of $269.26 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, robust growth in data center demand or successful expansion into automation markets could quickly alter the outlook and justify current valuation levels.

Find out about the key risks to this Powell Industries narrative.

Another View: What Do Multiples Say?

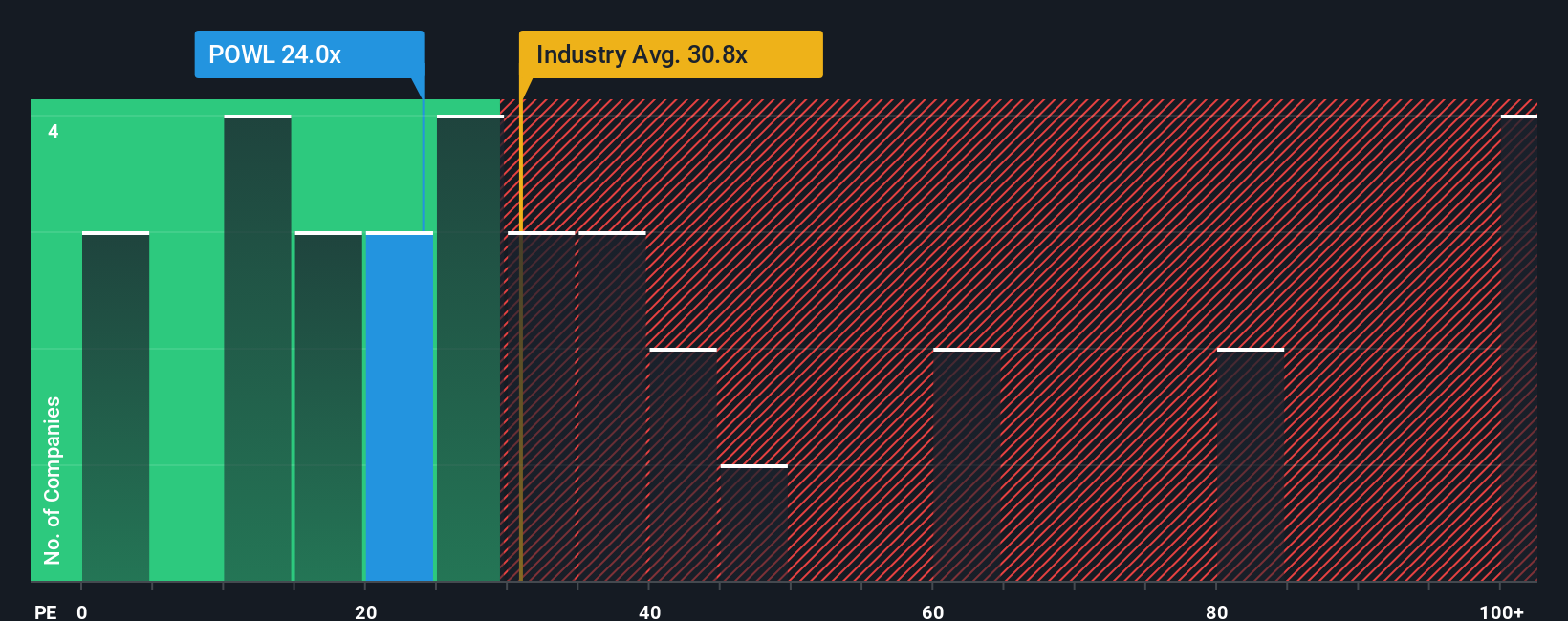

Looking at the company’s price-to-earnings ratio from a different perspective, the picture appears more attractive. Powell Industries trades at 21.4 times earnings, which is noticeably below both the US Electrical industry average of 31x and the peer average of 44.1x. However, this is just slightly above its fair ratio of 21.2x, suggesting the market may be close to fully reflecting current fundamentals. Does this modest gap indicate valuation safety or leave less margin for error if growth slows?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Powell Industries Narrative

If you see the story unfolding differently or want to test your own ideas, it takes just a few minutes to explore the data and build your personal view. Do it your way.

A great starting point for your Powell Industries research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let your next investment opportunity slip away. Unlock new opportunities with exclusive stock picks and trends using the Simply Wall Street Screener. These smart ideas could reshape your watchlist in moments.

- Tap into tomorrow’s breakthroughs in science by evaluating the innovations of these 28 quantum computing stocks, making waves in cutting-edge computing.

- Power up your potential passive income with these 14 dividend stocks with yields > 3%, offering impressive yields that keep your portfolio working for you.

- Spot promising companies leveraging artificial intelligence before the market catches on by checking out these 25 AI penny stocks now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:POWL

Powell Industries

Designs, develops, manufactures, sells, and services custom-engineered equipment and systems.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026