- United States

- /

- Electrical

- /

- NasdaqGS:POWL

Has Powell Industries Run Too Far After Latest Project Wins and Sharp Price Swings?

Reviewed by Bailey Pemberton

- Wondering if Powell Industries is still a smart buy after its remarkable run? You are not alone, as many investors want to know if there is real value left on the table.

- Powell’s stock price has experienced dramatic moves lately, climbing 14.6% in the last week but dropping 20.9% over the past month. It still reports a 41.3% gain so far this year.

- Recent headlines have focused on Powell’s increased project wins and notable contract announcements, which have contributed to both optimism and volatility. These industry developments highlight why the stock’s price has recently fluctuated.

- Currently, Powell Industries has a valuation score of 3 out of 6, indicating that it is considered undervalued in about half of the standard checks used. We will break down exactly how that score is determined using different valuation approaches, and there will be an additional method to assess value at the end of the article.

Approach 1: Powell Industries Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today’s dollars. It offers a forward-looking perspective that relies on the company's underlying cash-generating potential.

For Powell Industries, the latest reported Free Cash Flow (FCF) stands at $155 million. Analysts have provided cash flow forecasts over the next five years, with projections showing FCF remaining in the range of $110 to $149 million through 2030. Beyond that, Simply Wall St extrapolates additional years to extend the outlook up to a full decade.

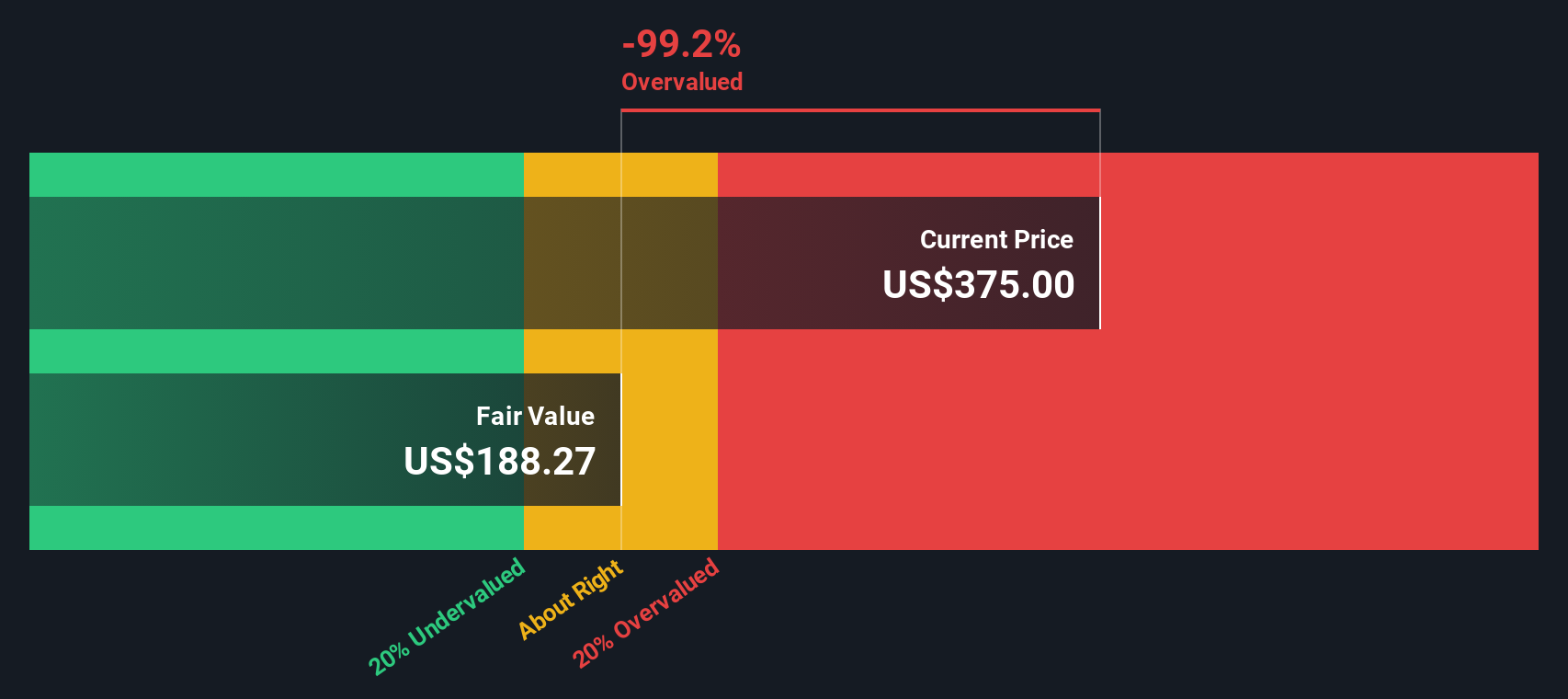

All cash flow projections are represented in US dollars. Growth appears modest according to both analyst and extrapolated figures, with Powell’s projected FCF for 2030 reaching $149 million. The two-stage DCF valuation model uses these inputs to calculate a fair value of $190.83 per share.

Comparing this intrinsic value to Powell Industries’ current share price, the DCF suggests the stock is 69.4% overvalued.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Powell Industries may be overvalued by 69.4%. Discover 921 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Powell Industries Price vs Earnings

The Price-to-Earnings (PE) ratio is the most widely used valuation metric for profitable companies like Powell Industries, as it directly relates a company’s share price to its actual earnings. Investors rely on the PE ratio as a quick measure of how much they are paying for every dollar of current profits.

A “normal” or “fair” PE ratio depends on a company’s expected profit growth and how much risk investors perceive. High-growth and lower-risk companies typically justify higher PE ratios, while slower-growing or riskier firms tend to trade at lower multiples.

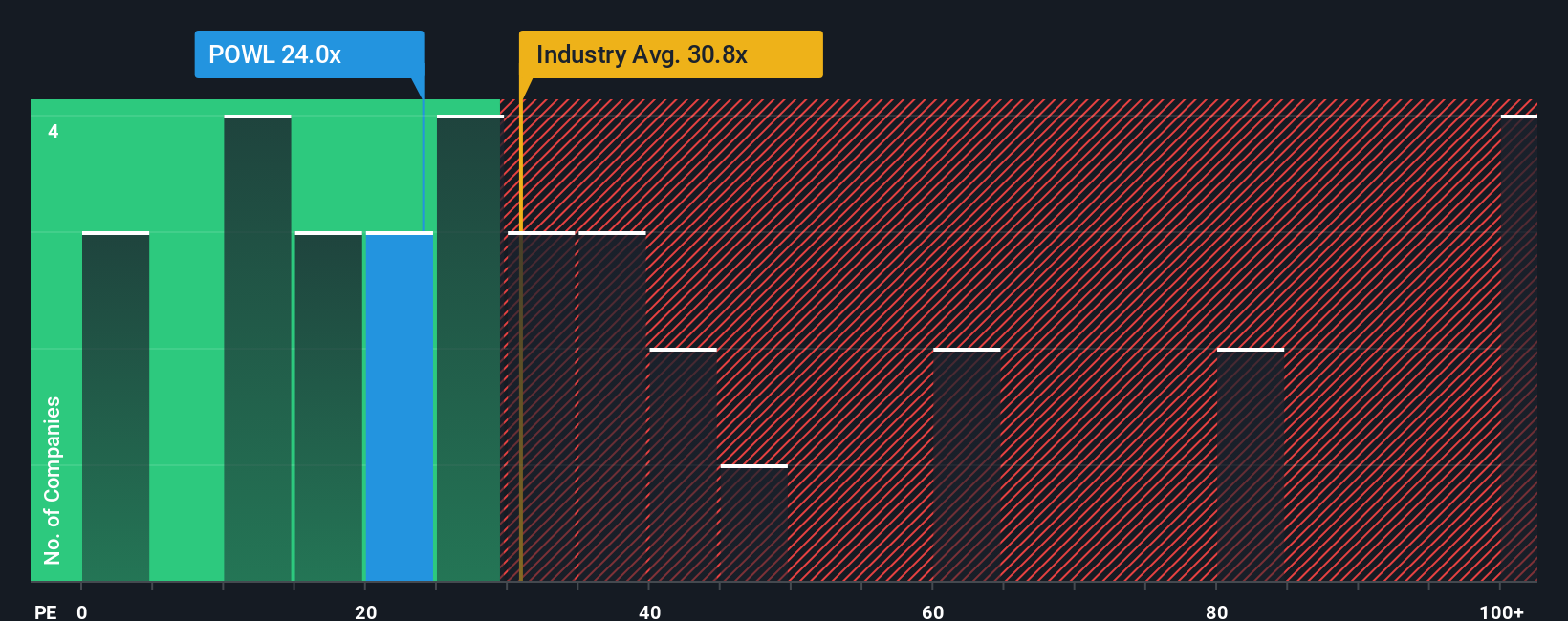

Currently, Powell Industries trades at a PE ratio of 21.6x. This is well below the average for its Electrical industry peers at 31.0x, and also lower than the peer group average of 45.1x. Based strictly on those comparisons, Powell would seem attractively priced.

However, Simply Wall St’s proprietary “Fair Ratio” model goes further. The Fair Ratio for Powell, calculated as 24.1x, considers not only sector averages but also specific company qualities including earnings growth, profit margin, market cap, and risk profile. This proprietary approach gives a more tailored valuation reading than simple peer or industry comparisons can.

When compared, Powell’s current PE of 21.6x is slightly below its Fair Ratio of 24.1x. This suggests the stock is trading close to its fair value at present.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1438 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Powell Industries Narrative

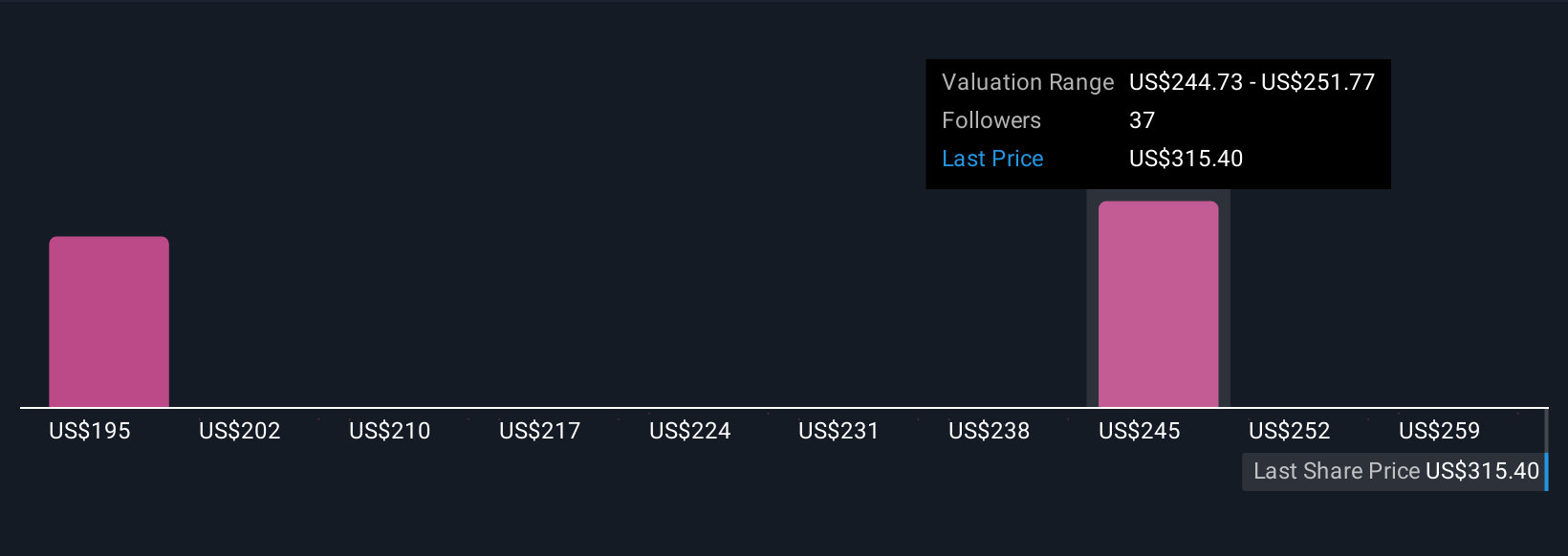

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is a simple, yet powerful tool that lets you attach your own story or perspective to a company’s numbers, including what you believe are fair values, and your unique estimates on Powell Industries’ future revenue, earnings, and profit margins.

With Narratives, you connect Powell's business story directly to financial forecasts, resulting in your forecasted fair value. This approach goes beyond ratios and models, making it easy for anyone, from beginner to experienced investor, to build, compare, and update perspectives using the Community page on Simply Wall St’s platform.

Narratives help you decide when to buy or sell by visually comparing your fair value with the company’s current share price, and are kept dynamic as fresh news or earnings are released. For example, one investor might believe Powell’s earnings will drop as margins normalize, leading to a lower fair value of $224.78 per share. Another could see expanding end markets and improved profit margins justifying a bullish $280.00 per share estimate. Narratives make it clear how your outlook and numbers drive your investment decision and let you easily track how your view stacks up as reality shifts.

Do you think there's more to the story for Powell Industries? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:POWL

Powell Industries

Designs, develops, manufactures, sells, and services custom-engineered equipment and systems.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.