- United States

- /

- Electrical

- /

- NasdaqCM:PLUG

Plug Power (PLUG): A Fresh Look at Valuation Following Recent Share Price Volatility

Reviewed by Simply Wall St

See our latest analysis for Plug Power.

Plug Power’s year has been eventful, with a volatile share price reflecting changing sentiment around hydrogen and renewable energy stocks. After a recent uptick, momentum looks mixed; its 3-year total shareholder return has slumped over 86%, yet gains in the last quarter suggest investors are tiptoeing back in.

If Plug Power’s rapid swings have you scanning for tomorrow’s movers, now’s a smart time to check out fast growing stocks with high insider ownership.

With its mixed track record and a share price still trading well below analysts' targets, investors are left to wonder if Plug Power is now undervalued or if future prospects are already fully reflected in the stock price.

Most Popular Narrative: 31.1% Undervalued

Plug Power’s most widely followed narrative places its fair value significantly above the last close, suggesting notable upside potential from current levels. This prompts a closer examination of the factors influencing the valuation.

Operational improvements such as gross margin enhancements from Project Quantum Leap, restructuring, facility consolidation, and favorable hydrogen supply agreements are already yielding sharply better margins and targeting breakeven gross margin by Q4. This may contribute directly to improved net margins and earnings.

Curious what makes analysts so optimistic? The valuation hinges on a set of future earnings and margin assumptions rarely applied to unprofitable companies. There is one critical forecast—which is not just about rapid top-line growth. Intrigued by the key number that justifies this price? Click through to uncover the details and see what is really driving the high fair value.

Result: Fair Value of $2.79 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent negative gross margins and delays in large-scale hydrogen projects could quickly undermine these optimistic forecasts and have a negative impact on Plug Power's valuation outlook.

Find out about the key risks to this Plug Power narrative.

Another View: Is Plug Power Actually Overvalued?

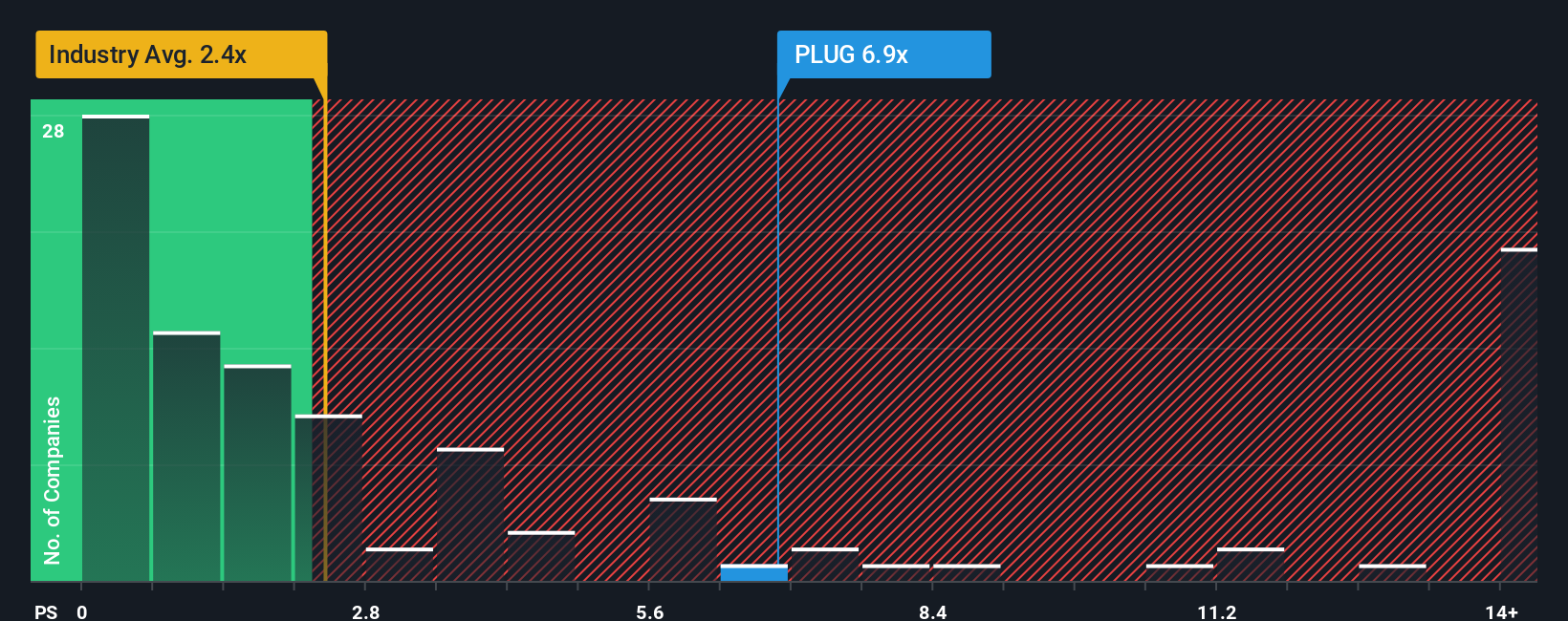

While fair value estimates show Plug Power to be deeply undervalued, a glance at the price-to-sales ratio paints a more challenging picture. The company trades at 3.9 times sales, which is well above both its fair ratio of 0.2 times and the US Electrical industry average of 2 times. This premium suggests the market is pricing in a lot of future growth, raising the stakes if expectations are not met. Could this gap signal heightened valuation risk for investors?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Plug Power Narrative

If these narratives do not align with your own outlook, dive into the data and craft your unique perspective in just a few minutes. Do it your way.

A great starting point for your Plug Power research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Opportunities?

Stay ahead by tapping into handpicked stock ideas that others might overlook. Your next winning move could be among them. See which themes catch your eye below.

- Grab the chance to uncover strong yields and reliable income streams with these 14 dividend stocks with yields > 3% offering above-average returns in today’s market.

- Ride the momentum of cutting-edge tech by checking out these 25 AI penny stocks that are at the forefront of artificial intelligence innovation.

- Capitalize on hidden value by investigating these 929 undervalued stocks based on cash flows packed with stocks trading below their intrinsic worth before everyone else catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:PLUG

Plug Power

Develops hydrogen fuel cells product solutions in North America, Europe, Asia, and internationally.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026