- United States

- /

- Machinery

- /

- NasdaqCM:MVST

Analysts Are Optimistic We'll See A Profit From Microvast Holdings, Inc. (NASDAQ:MVST)

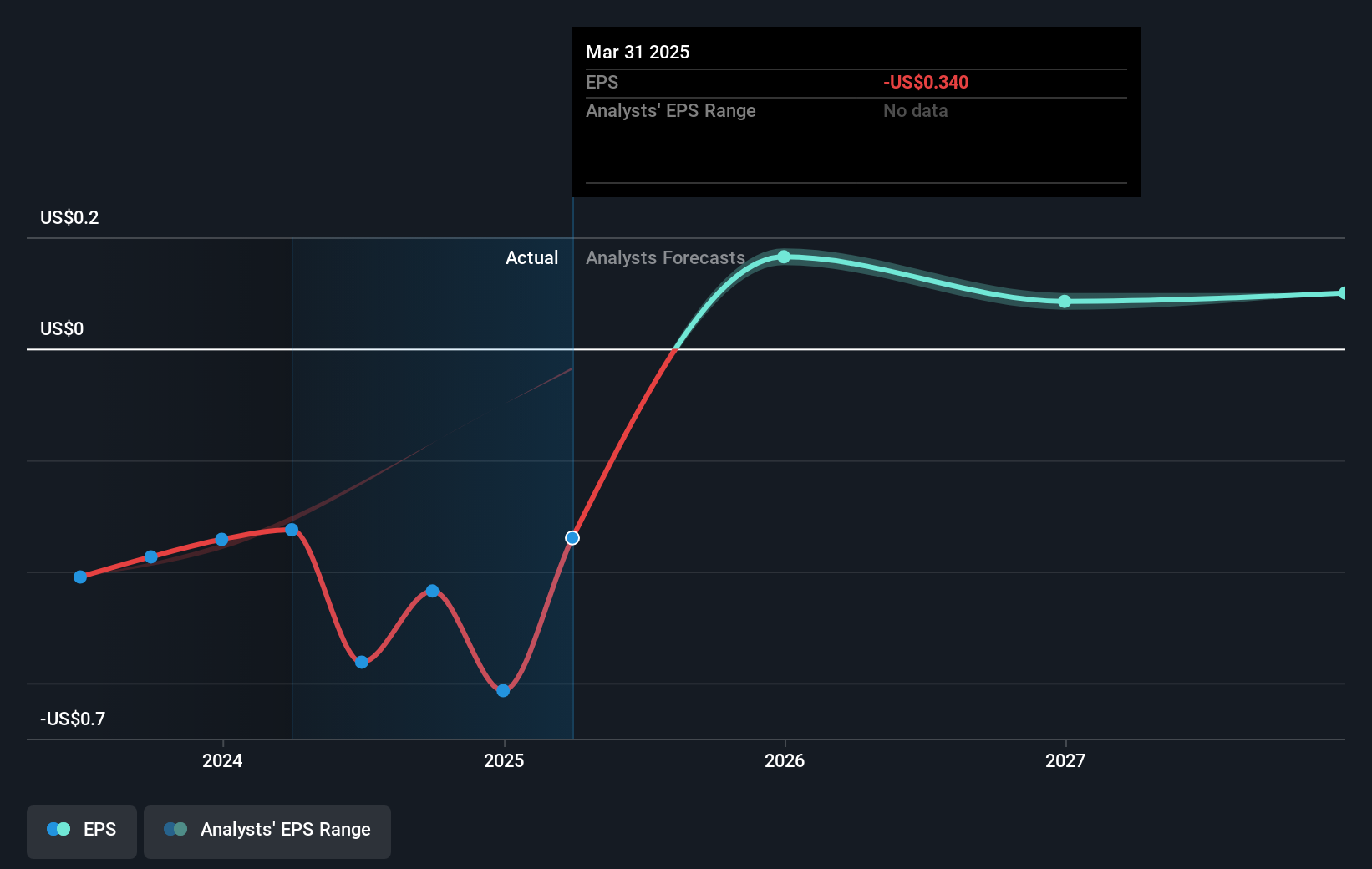

Microvast Holdings, Inc. (NASDAQ:MVST) is possibly approaching a major achievement in its business, so we would like to shine some light on the company. Microvast Holdings, Inc. provides battery technologies for electric vehicles and energy storage solutions. The US$935m market-cap company’s loss lessened since it announced a US$195m loss in the full financial year, compared to the latest trailing-twelve-month loss of US$109m, as it approaches breakeven. The most pressing concern for investors is Microvast Holdings' path to profitability – when will it breakeven? In this article, we will touch on the expectations for the company's growth and when analysts expect it to become profitable.

Consensus from 3 of the American Machinery analysts is that Microvast Holdings is on the verge of breakeven. They expect the company to post a final loss in 2024, before turning a profit of US$62m in 2025. The company is therefore projected to breakeven around a year from now or less! How fast will the company have to grow to reach the consensus forecasts that anticipate breakeven by 2025? Working backwards from analyst estimates, it turns out that they expect the company to grow 45% year-on-year, on average, which signals high confidence from analysts. Should the business grow at a slower rate, it will become profitable at a later date than expected.

We're not going to go through company-specific developments for Microvast Holdings given that this is a high-level summary, but, keep in mind that by and large a high growth rate is not out of the ordinary, particularly when a company is in a period of investment.

See our latest analysis for Microvast Holdings

Before we wrap up, there’s one issue worth mentioning. Microvast Holdings currently has a relatively high level of debt. Generally, the rule of thumb is debt shouldn’t exceed 40% of your equity, which in Microvast Holdings' case is 61%. A higher level of debt requires more stringent capital management which increases the risk around investing in the loss-making company.

Next Steps:

There are key fundamentals of Microvast Holdings which are not covered in this article, but we must stress again that this is merely a basic overview. For a more comprehensive look at Microvast Holdings, take a look at Microvast Holdings' company page on Simply Wall St. We've also compiled a list of relevant factors you should further research:

- Historical Track Record: What has Microvast Holdings' performance been like over the past? Go into more detail in the past track record analysis and take a look at the free visual representations of our analysis for more clarity.

- Management Team: An experienced management team on the helm increases our confidence in the business – take a look at who sits on Microvast Holdings' board and the CEO’s background.

- Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:MVST

Microvast Holdings

Provides battery technologies for electric vehicles and energy storage solutions.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success