- United States

- /

- Machinery

- /

- NasdaqCM:MVST

3 Growth Companies With High Insider Ownership And 95% Earnings Growth

Reviewed by Simply Wall St

As U.S. stock indexes edge higher following key inflation data, investors are closely monitoring the Federal Reserve's upcoming policy decisions, which could impact market dynamics. In this environment, growth companies with significant insider ownership can be particularly appealing due to their potential for strong alignment between management and shareholder interests.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (SMCI) | 13.9% | 50.7% |

| StubHub Holdings (STUB) | 14.2% | 73.5% |

| SES AI (SES) | 12% | 68.9% |

| Niu Technologies (NIU) | 37.2% | 93.7% |

| Credo Technology Group Holding (CRDO) | 10.4% | 28.0% |

| Cloudflare (NET) | 10.2% | 43.5% |

| Bitdeer Technologies Group (BTDR) | 33.4% | 131.7% |

| Atour Lifestyle Holdings (ATAT) | 18% | 24.4% |

| Astera Labs (ALAB) | 11.9% | 29.0% |

| AppLovin (APP) | 27.5% | 27.3% |

Let's explore several standout options from the results in the screener.

ASP Isotopes (ASPI)

Simply Wall St Growth Rating: ★★★★★☆

Overview: ASP Isotopes Inc. is a development stage advanced materials company focused on producing, distributing, marketing, and selling isotopes with a market cap of $635.11 million.

Operations: The company's revenue segments include $4.56 million from Specialist Isotopes and Related Services, along with a segment adjustment of $3.82 million.

Insider Ownership: 17%

Earnings Growth Forecast: 70.8% p.a.

ASP Isotopes, with significant insider ownership, is poised for substantial growth as it forecasts revenue expansion of 66% annually. Despite recent volatility and a net loss of US$12.87 million in Q3 2025, the company is expected to become profitable within three years. Recent strategic moves include a US$210.3 million equity offering and a supply agreement for enriched silicon-28, positioning ASP Isotopes strongly in advanced materials and quantum computing sectors.

- Click here to discover the nuances of ASP Isotopes with our detailed analytical future growth report.

- Our valuation report here indicates ASP Isotopes may be overvalued.

Microvast Holdings (MVST)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Microvast Holdings, Inc. specializes in battery technologies for electric vehicles and energy storage solutions, with a market cap of approximately $1.15 billion.

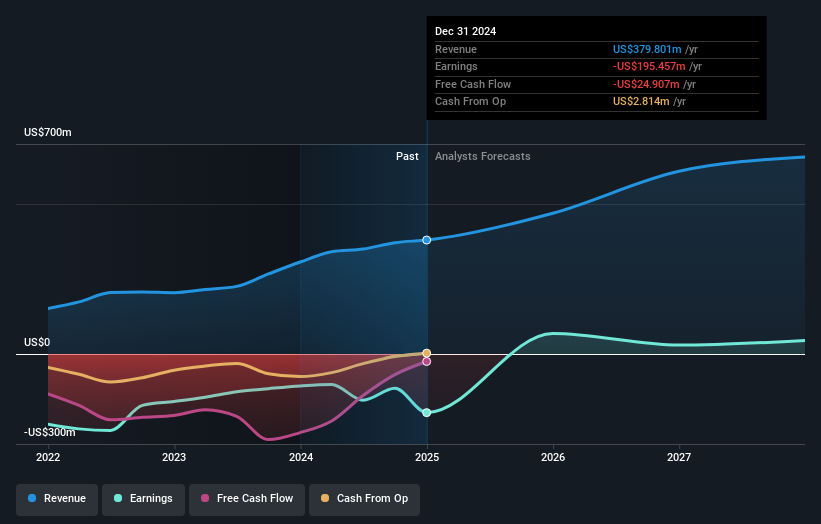

Operations: The company's revenue primarily comes from its Batteries / Battery Systems segment, totaling $444.50 million.

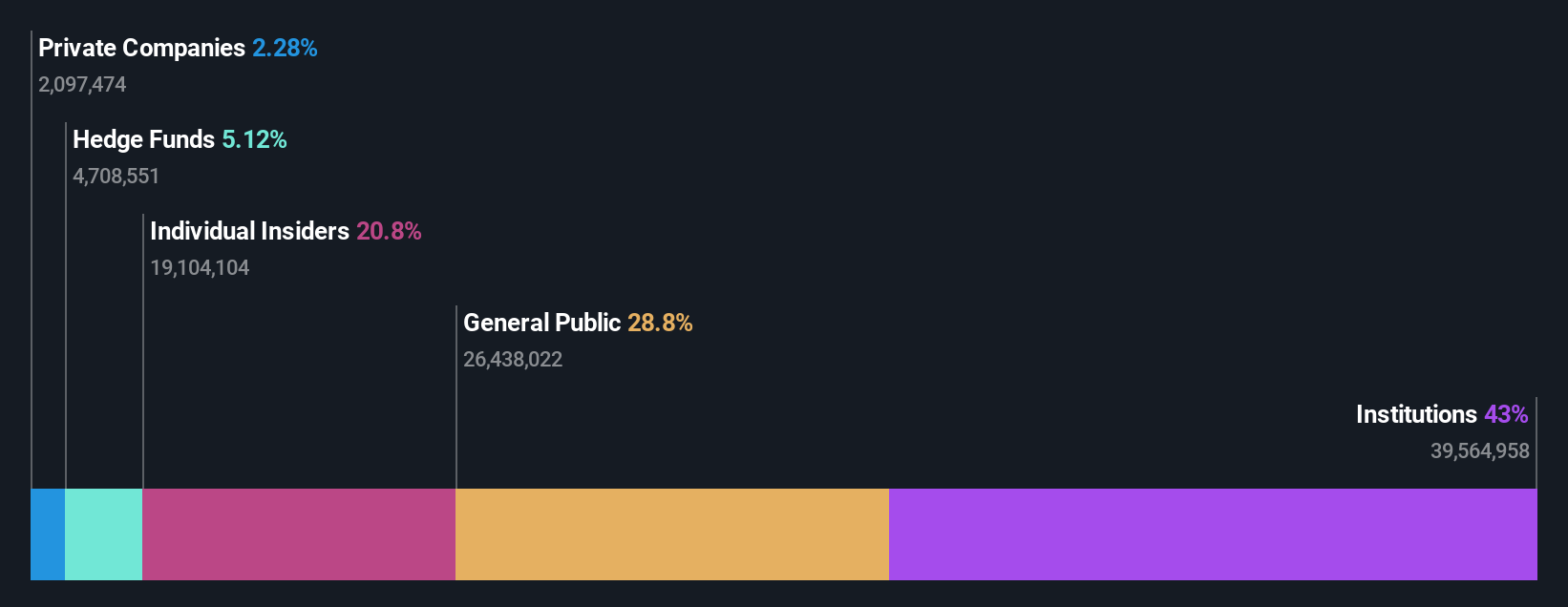

Insider Ownership: 27.5%

Earnings Growth Forecast: 68.1% p.a.

Microvast Holdings, with substantial insider ownership, is experiencing a period of robust growth, maintaining a revenue target of US$450 million to US$475 million for 2025. Despite reporting a Q3 net loss of US$1.49 million and impairment charges, it forecasts significant earnings growth and profitability within three years. Recent initiatives include showcasing advanced battery solutions at international events and filing for a US$137.6 million equity offering to strengthen its market presence in high-performance battery technologies.

- Click to explore a detailed breakdown of our findings in Microvast Holdings' earnings growth report.

- Our comprehensive valuation report raises the possibility that Microvast Holdings is priced higher than what may be justified by its financials.

Better Home & Finance Holding (BETR)

Simply Wall St Growth Rating: ★★★★★☆

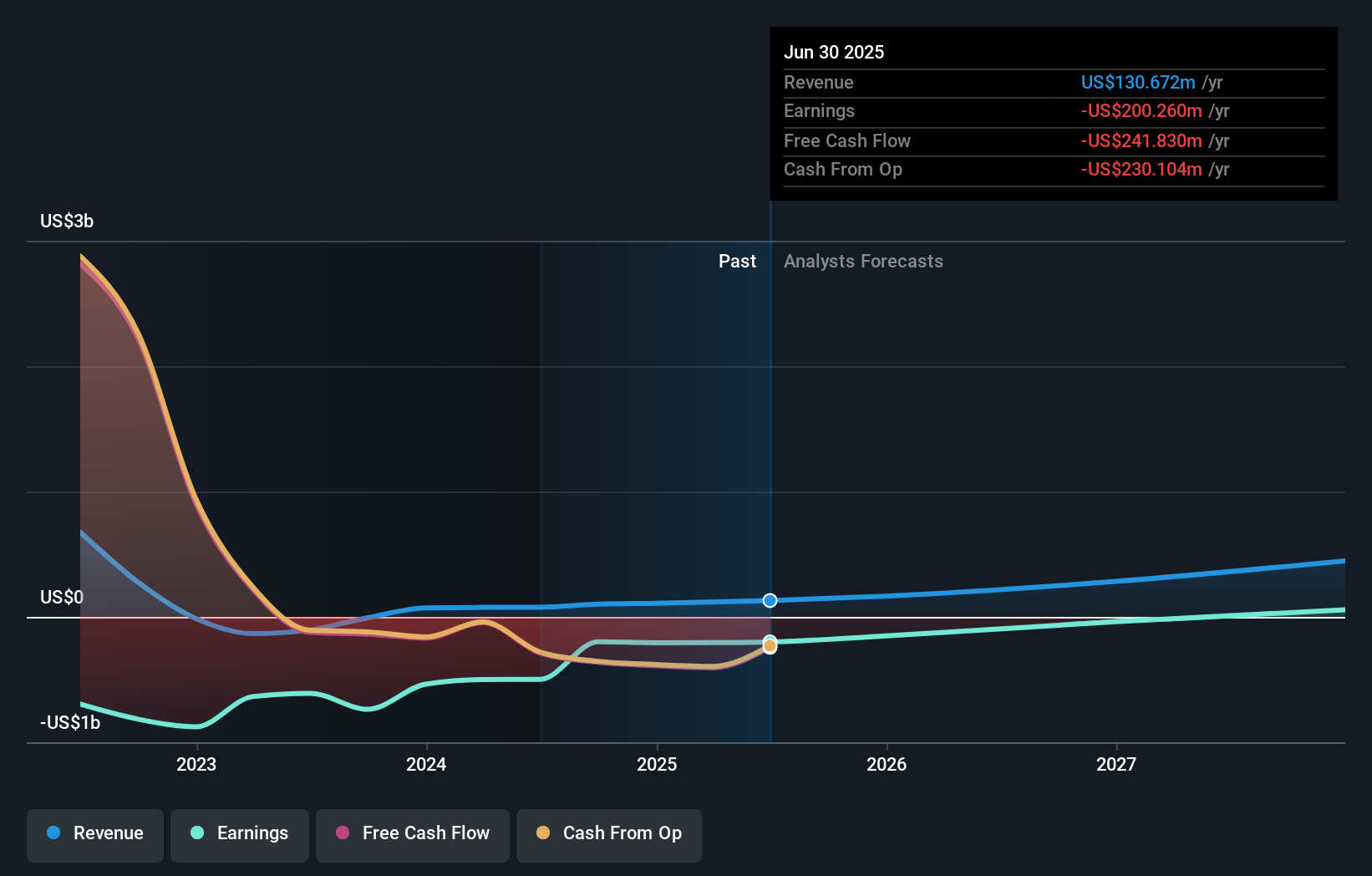

Overview: Better Home & Finance Holding Company operates as a homeownership company in the United States with a market cap of approximately $696.62 million.

Operations: The company generates revenue from its financial services segment, amounting to $145.55 million.

Insider Ownership: 19.4%

Earnings Growth Forecast: 95.3% p.a.

Better Home & Finance Holding, with significant insider ownership, is poised for growth despite recent challenges. The company reported a Q3 net loss of US$39.13 million but has launched innovative products like the Wholesale HELOC and CES Platform powered by Tinman AI, aiming to streamline loan processes. Revenue is forecast to grow 50.9% annually, outpacing the market average. Strategic partnerships and leadership changes further support its expansion in digital mortgage solutions.

- Navigate through the intricacies of Better Home & Finance Holding with our comprehensive analyst estimates report here.

- Our valuation report unveils the possibility Better Home & Finance Holding's shares may be trading at a premium.

Where To Now?

- Gain an insight into the universe of 201 Fast Growing US Companies With High Insider Ownership by clicking here.

- Searching for a Fresh Perspective? We've found 15 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:MVST

Microvast Holdings

Provides battery technologies for electric vehicles and energy storage solutions.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026