- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:MRCY

How Falling Short Interest and AI Trends at Mercury Systems (MRCY) Are Reshaping Its Investment Story

Reviewed by Sasha Jovanovic

- In recent weeks, Mercury Systems experienced significant changes in investor sentiment, with a marked decline in short interest and renewed optimism regarding its role in the defense sector's digitization and adoption of AI and machine learning technologies.

- This shift suggests that investors are reassessing the company's risk profile, potentially influenced by broader industry trends and the company's positioning to secure higher-margin, technology-driven contracts.

- We'll take a look at how falling short interest could influence Mercury Systems' investment narrative and future margin expectations.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Mercury Systems Investment Narrative Recap

To own Mercury Systems shares, you have to believe in the company's ability to capture higher-margin opportunities as the defense sector expands digitalization and increases its adoption of AI and machine learning. The latest decline in short interest marks a sentiment shift, but this may only have a modest short-term impact, with the more pressing risk still tied to Mercury's reliance on executing low-margin legacy contracts that could hinder near-term margin progress. Among recent company developments, the approval of an up to US$200 million share repurchase program stands out, especially as it comes alongside efforts to control expenses and improve earnings. While this could create incremental value for shareholders and indicate financial stability, the main operational catalysts remain new contract wins and margin expansion from technology-focused deals. However, risks surrounding the execution of older, low-margin backlog contracts mean that investors should also be mindful of...

Read the full narrative on Mercury Systems (it's free!)

Mercury Systems' projections indicate $1.1 billion in revenue and $44.5 million in earnings by 2028. This is based on an anticipated 6.1% annual revenue growth rate and a $82.4 million increase in earnings from the current level of -$37.9 million.

Uncover how Mercury Systems' forecasts yield a $86.00 fair value, a 23% upside to its current price.

Exploring Other Perspectives

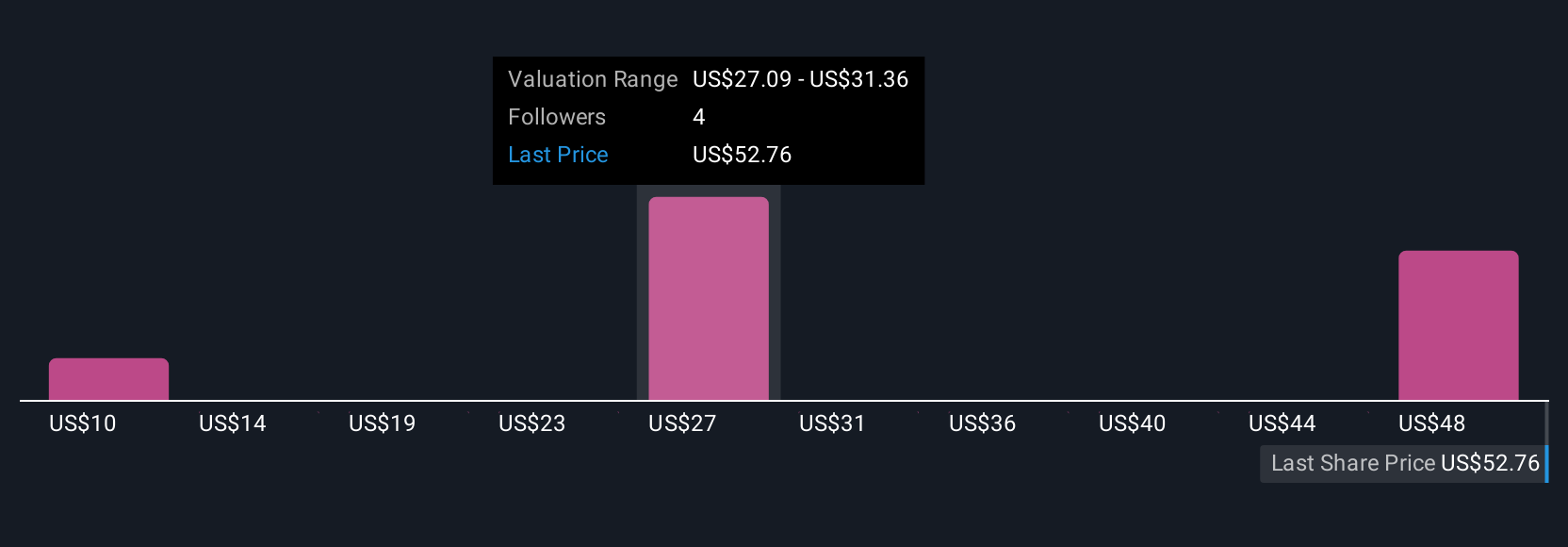

Simply Wall St Community members have published fair value estimates for Mercury Systems ranging from US$39.57 to US$86, reflecting broad differences in opinion across three contributors. Even with such a spread, ongoing exposure to legacy contract risks remains a point you should carefully consider as you weigh these views.

Explore 3 other fair value estimates on Mercury Systems - why the stock might be worth as much as 23% more than the current price!

Build Your Own Mercury Systems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mercury Systems research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Mercury Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mercury Systems' overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MRCY

Mercury Systems

A technology company, manufactures and sells components, products, modules, and subsystems for defense prime contractors, original equipment manufacturers, government, and commercial aerospace companies.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026