- United States

- /

- Construction

- /

- NasdaqCM:LMB

Limbach Holdings (LMB): Assessing Valuation After Recent Share Price Weakness and Momentum Shift

Reviewed by Simply Wall St

See our latest analysis for Limbach Holdings.

Limbach’s share price has pulled back sharply in recent weeks, reflecting a shift in sentiment as momentum fades following months of strength. Despite a 1-year total shareholder return of -12%, long-term investors have still seen eye-popping gains of more than 800% over the past three and five years.

If you’re watching how momentum shifts in overlooked stocks, it might be the perfect time to broaden your horizons and discover fast growing stocks with high insider ownership

With shares trading well below analyst targets and growth in both revenue and net income, investors are now left to consider if Limbach is undervalued or if the current price already reflects its future potential.

Most Popular Narrative: 39.9% Undervalued

With Limbach Holdings’ fair value estimated at $137.25 versus a last close of $82.50, some see significant upside from current levels. The most popular narrative points to accelerating business transformation and margin potential as central to the outlook.

The focus on energy efficiency, digital building solutions, and proactive facility management positions Limbach to capture secular demand for retrofitting, upgrading, and integrating smart building technologies. This directly expands its addressable market and supports long-term top-line growth and higher service margins.

Want to know what’s fueling this bullish projection? This narrative leans on bold assumptions about future growth, rising margins, and new recurring revenue streams that could set the company apart. What numbers are behind the headline price target? If you’re curious about the playbook for reaching those heights, don’t miss the full story.

Result: Fair Value of $137.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, integration challenges from recent acquisitions or delays in ramping up the expanded sales force could disrupt Limbach’s earnings momentum and could temper profit growth expectations.

Find out about the key risks to this Limbach Holdings narrative.

Another View: The Earnings Multiple Perspective

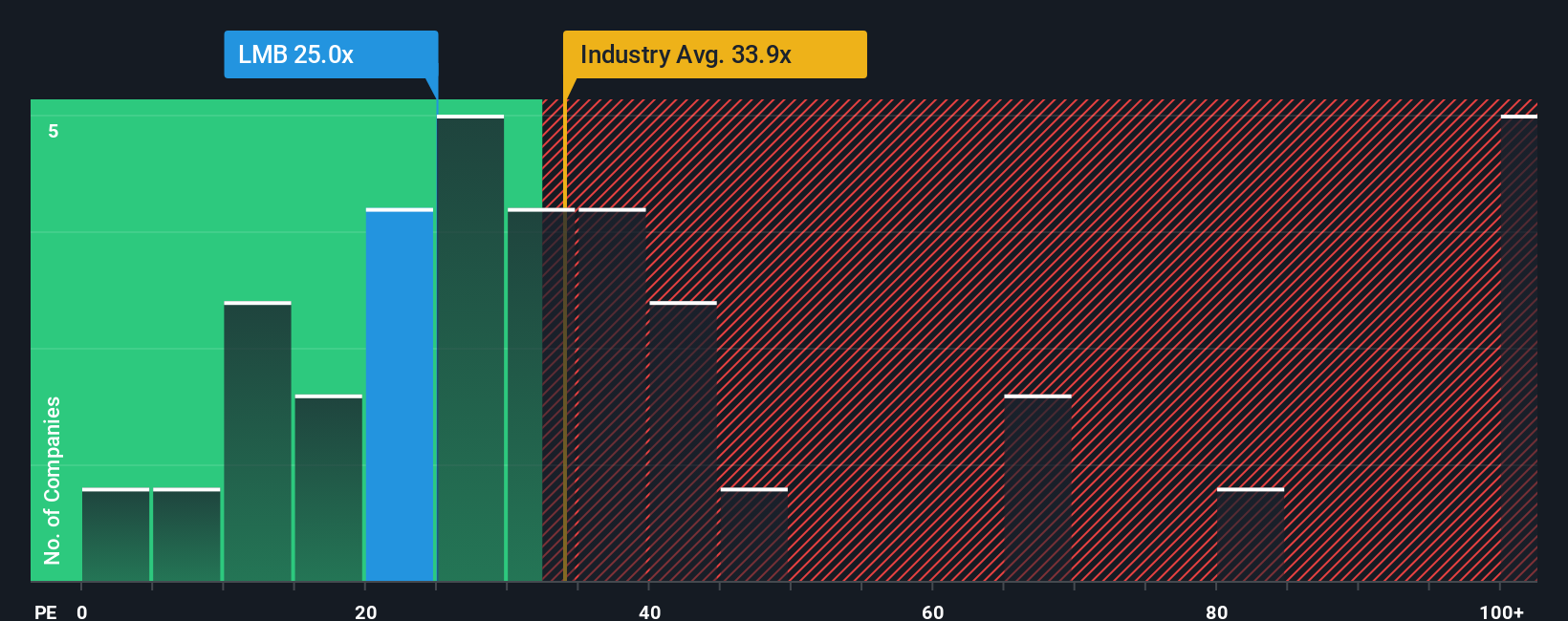

While fair value models point to a big gap between price and potential, Limbach’s actual price-to-earnings ratio is currently 26.2 times. This makes it more expensive than its direct peers at 23.8 times, but cheaper than the industry average of 33.5 times. However, it trades almost exactly at the fair ratio of 26.4 times, which means there might not be much of a margin for error if future results disappoint. Does this signal strong conviction, or room for volatility ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Limbach Holdings Narrative

If you like to dig into the numbers yourself or want a different perspective, there is always the option to build your own take on Limbach’s outlook in under three minutes with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Limbach Holdings.

Looking for more investment ideas?

Don’t let opportunities pass by. Expand your horizons with fresh strategies and sectors. Use these screeners to spot strong contenders other investors may miss:

- Uncover growth early by tracking these 3597 penny stocks with strong financials with solid financial foundations, poised to outperform as the market’s next breakout stars.

- Position yourself ahead of innovation and capitalize on the potential of these 32 healthcare AI stocks tackling tomorrow’s biggest challenges in health and technology.

- Capture steady returns and build wealth by targeting income with these 17 dividend stocks with yields > 3% offering yields above 3% for reliable portfolio support.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:LMB

Limbach Holdings

Operates as a building systems solution company in the United States.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives