- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:KTOS

Kratos Defense & Security Solutions (NasdaqGS:KTOS) Expands With New Oklahoma Facility

Reviewed by Simply Wall St

Kratos Defense & Security Solutions (NasdaqGS:KTOS) recently saw pivotal changes as it was dropped from several indexes in June 2025 and completed a $500 million follow-on equity offering. The establishment of a new manufacturing facility in Oklahoma is set to enhance production capacity and create new jobs. During the past quarter, the stock price moved up 56%, standing out against a year-long market rise of 13%. The company's business expansion, particularly in the turbojet segment, and notable contracts with entities like the U.S. Space Force, collectively contributed positively amidst a generally flat market trend.

Be aware that Kratos Defense & Security Solutions is showing 1 weakness in our investment analysis.

The recent developments at Kratos Defense & Security Solutions could significantly influence the company's trajectory. The establishment of a new facility in Oklahoma aims to expand production capacity for the company's turbojet segment and secure new industry contracts, which may boost revenue streams in the long term. Although the company's stock was dropped from several indexes, completing a US$500 million follow-on equity offering provides newfound capital that could be channeled into strategic projects. This aligns with existing catalysts, such as defense budget increases and strategic contracts, which already position Kratos for potential growth in earnings and revenue.

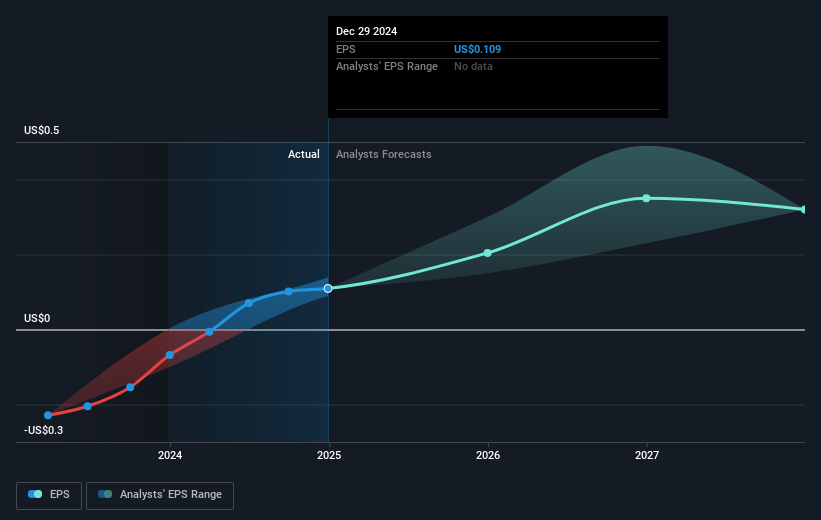

Over a three-year period, Kratos shares achieved a total return of 296.25%. In the last year alone, the shares outperformed the US Aerospace & Defense industry, which returned 40.8%. The company's recent 56% share price uptick contrasts with the consensus price target of US$34.82, which is slightly lower than the current share price of US$36.23. Analysts forecast a potential revenue rise to US$1.7 billion by 2028, with earnings increasing to US$53.9 million. Although the recent developments are generally positive, industry-specific risks, such as supply chain issues and potential contract delays, could impact these forecasts. Nevertheless, the recent corporate activities, including new contracts and capital investment opportunities, could enhance Kratos' operating leverage and benefit future earnings.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kratos Defense & Security Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KTOS

Kratos Defense & Security Solutions

A technology company, provides technology, products, and system and software for the defense, national security, and commercial markets in the United States, other North America, the Asia Pacific, the Middle East, Europe, and Internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives