- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:KTOS

Kratos Defense & Security Solutions (KTOS): Assessing Valuation Following Earnings Beat and Unmanned Systems Breakthroughs

Reviewed by Simply Wall St

Kratos Defense & Security Solutions (KTOS) has been making headlines after a series of milestones, including strong third-quarter earnings, an increase in its revenue growth outlook, and completion of advanced engine testing with GE Aerospace.

See our latest analysis for Kratos Defense & Security Solutions.

Kratos’ expanding leadership in unmanned aerial technology has kept the spotlight on its stock, and the market has responded with plenty of excitement and volatility. The 1-year total shareholder return stands at an impressive 199.9%, fuelled by robust earnings, strategic acquisitions, and new technical milestones. Recent setbacks after cautious guidance have led to pullbacks, even amid longer-term momentum.

If Kratos’ pace of innovation has you eyeing the broader defense sector, now is a great moment to discover new opportunities with our curated list of aerospace and defense stocks: See the full list for free.

With shares up nearly 200% in the past year and future growth already flagged by management, the key debate is whether Kratos remains undervalued or if the market has already priced in years of expansion. The question remains: does a true buying opportunity still exist?

Most Popular Narrative: 22.1% Undervalued

With Kratos Defense & Security Solutions closing at $77.88, the most widely followed narrative calculates a fair value of $100, suggesting significant upside if its ambitious financial forecasts are realized. This positions the stock well above current levels and sets high expectations for continued performance.

Kratos is well positioned to benefit from a historic surge in global defense spending and modernization initiatives by the U.S., NATO, and Pacific allies, as ongoing geopolitical tensions drive a multi-year expansion in defense budgets. This widespread increase in procurement is creating robust demand for Kratos' technologies and supporting high contract win rates. These factors are expected to contribute to ongoing revenue growth and sustained backlog momentum.

Want to know exactly what’s fueling this lofty valuation? The narrative hinges on bold growth assumptions and breakthroughs in defense innovation. Discover which powerful financial projections and strategic advantages back up this market-shaking target and see the driving forces behind the fair value for yourself.

Result: Fair Value of $100 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, delays in government contract awards or supply chain disruptions could quickly challenge the current bullish outlook and put near-term earnings growth at risk.

Find out about the key risks to this Kratos Defense & Security Solutions narrative.

Another View: A Look Through the Price-to-Sales Lens

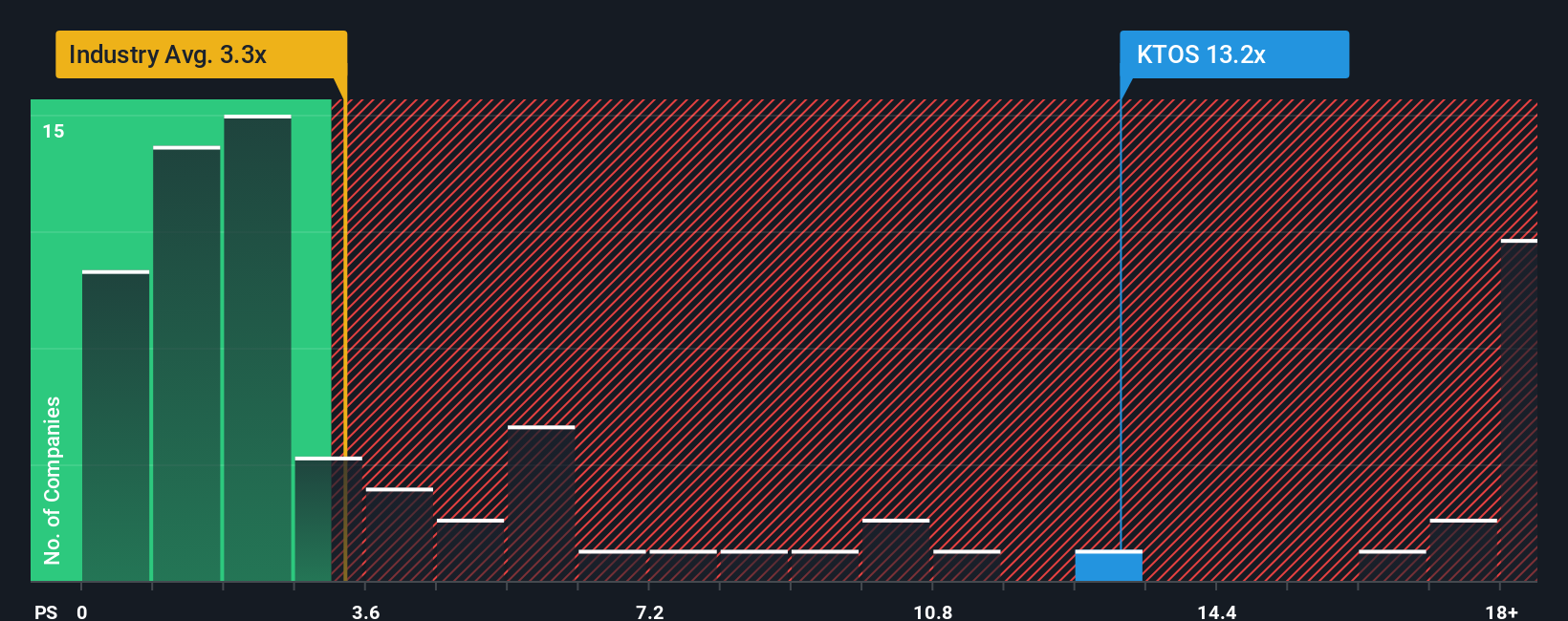

While the fair value narrative points to upside, the market’s chosen price-to-sales ratio tells a more cautious story. Kratos currently trades at 10.2 times sales, which is well above its industry average of 3 times and further from a fair ratio of 2.8 times. This significant premium suggests investors are paying up for future growth, leaving little margin for disappointment if results cool. Are expectations running too far ahead of reality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Kratos Defense & Security Solutions Narrative

If you want to dive deeper or have a different perspective on Kratos, you can shape your own view in just a few minutes by using Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Kratos Defense & Security Solutions.

Looking for More Investment Ideas?

Smart investors rarely stop at just one opportunity. Broaden your horizons and tap into fresh market momentum with ingenious companies in high-potential sectors, all just a click away.

- Supercharge your search for unique opportunities by checking out these 25 AI penny stocks which are already riding the latest wave of artificial intelligence innovation.

- Collect steady returns when you target these 16 dividend stocks with yields > 3% that are known for their attractive yields and strong fundamentals.

- Ride the early trend and amplify your gains by scanning these 82 cryptocurrency and blockchain stocks as they power blockchain breakthroughs and digital finance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kratos Defense & Security Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KTOS

Kratos Defense & Security Solutions

A technology company, provides technology, products, and system and software for the defense, national security, and commercial markets in the United States, other North America, the Asia Pacific, the Middle East, Europe, and Internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives