- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:KTOS

Kratos Defense & Security Solutions (KTOS) Advances 5G-NTN Capabilities With Successful Satellite Demo

Reviewed by Simply Wall St

Kratos Defense & Security Solutions (KTOS) experienced a significant 78% share price surge over the last quarter, coinciding with its successful demonstration of a 5G Non-Terrestrial Network in collaboration with Intelsat. This milestone, highlighting the company's technological advancement in integrating satellite and terrestrial networks, likely added weight to the broader market rally. Additionally, Kratos' expansion plans for a new manufacturing facility and a $25 million contract from the U.S. Space Force underscored its growth trajectory. These achievements added momentum to the company's performance, which notably outpaced the broader market's moderate movements over the same period.

The recent surge in Kratos Defense & Security Solutions' share price highlights the potential growth prospects tied to its advancements in 5G and strategic collaborations. This aligns well with the company's narrative that anticipates future opportunities stemming from defense budget increases and strategic contracts. Over the past three years, Kratos has delivered a total shareholder return of 304.05%, exemplifying its robust long-term performance. In comparison, Kratos' one-year return exceeded both the US Aerospace & Defense industry's 43.2% and the broader market's 14.1% rise.

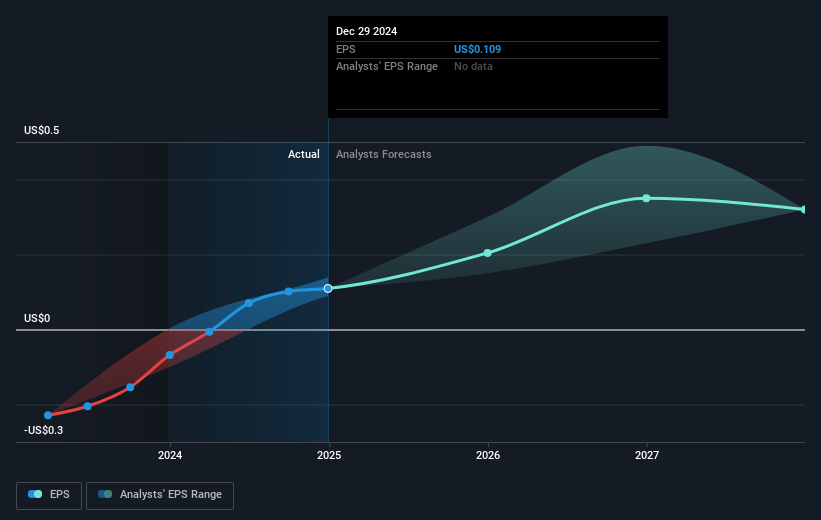

The company's recent achievements could positively influence revenue and earnings forecasts, as analysts foresee annual revenue growth of 13.3% and earnings growth of 32.9% per year over the next few years. The $25 million U.S. Space Force contract and manufacturing facility expansion efforts might support these projections. Despite recent price movements, Kratos' current share price of US$58.91 is higher than the analyst consensus price target of US$50.67, marking a discount of 14%. This suggests that while the market is optimistic, analysts may hold a more cautious stance on its pricing relative to projected future performance.

Our valuation report here indicates Kratos Defense & Security Solutions may be overvalued.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kratos Defense & Security Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KTOS

Kratos Defense & Security Solutions

A technology company, provides technology, products, and system and software for the defense, national security, and commercial markets in the United States, other North America, the Asia Pacific, the Middle East, Europe, and Internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives