- United States

- /

- Banks

- /

- NasdaqGS:BRKL

3 Dividend Stocks In US With Yields Up To 5.7%

Reviewed by Simply Wall St

As the U.S. stock market takes a breather following a post-election rally that pushed major indexes to record highs, investors are increasingly turning their attention to dividend stocks as a source of steady income amidst fluctuating market conditions. In this environment, selecting dividend stocks with attractive yields can be an effective strategy for those looking to balance growth potential with income generation.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.51% | ★★★★★★ |

| Isabella Bank (OTCPK:ISBA) | 4.86% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 4.51% | ★★★★★★ |

| Columbia Banking System (NasdaqGS:COLB) | 4.59% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 5.47% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.37% | ★★★★★★ |

| OTC Markets Group (OTCPK:OTCM) | 4.35% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 5.57% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.36% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.37% | ★★★★★★ |

Click here to see the full list of 136 stocks from our Top US Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

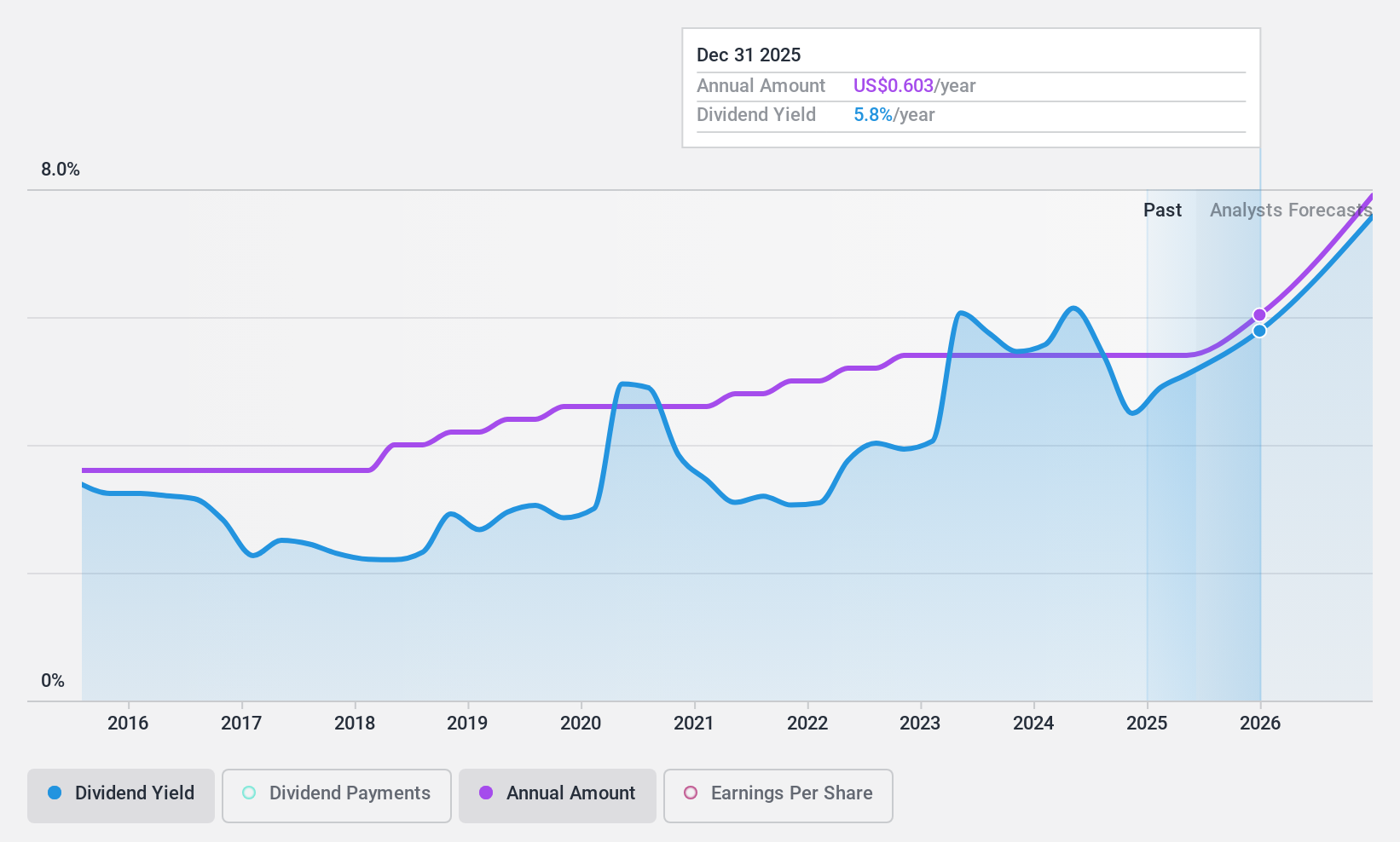

Brookline Bancorp (NasdaqGS:BRKL)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Brookline Bancorp, Inc. is a bank holding company for Brookline Bank, offering commercial, business, and retail banking services to corporate, municipal, and retail customers in the United States with a market cap of $1.14 billion.

Operations: Brookline Bancorp, Inc. generates revenue through its commercial, business, and retail banking services provided to corporate, municipal, and retail clients across the United States.

Dividend Yield: 4.2%

Brookline Bancorp recently affirmed a quarterly dividend of US$0.135 per share, maintaining its history of stable and reliable dividends over the past decade. Despite a slight decrease in net interest income and net income for Q3 2024 compared to the previous year, the company's dividends remain well-covered by earnings with a current payout ratio of 64.8%. The dividend yield stands at 4.23%, slightly below the top tier in the US market, but still attractive for investors seeking consistent returns.

- Click here and access our complete dividend analysis report to understand the dynamics of Brookline Bancorp.

- Our comprehensive valuation report raises the possibility that Brookline Bancorp is priced lower than what may be justified by its financials.

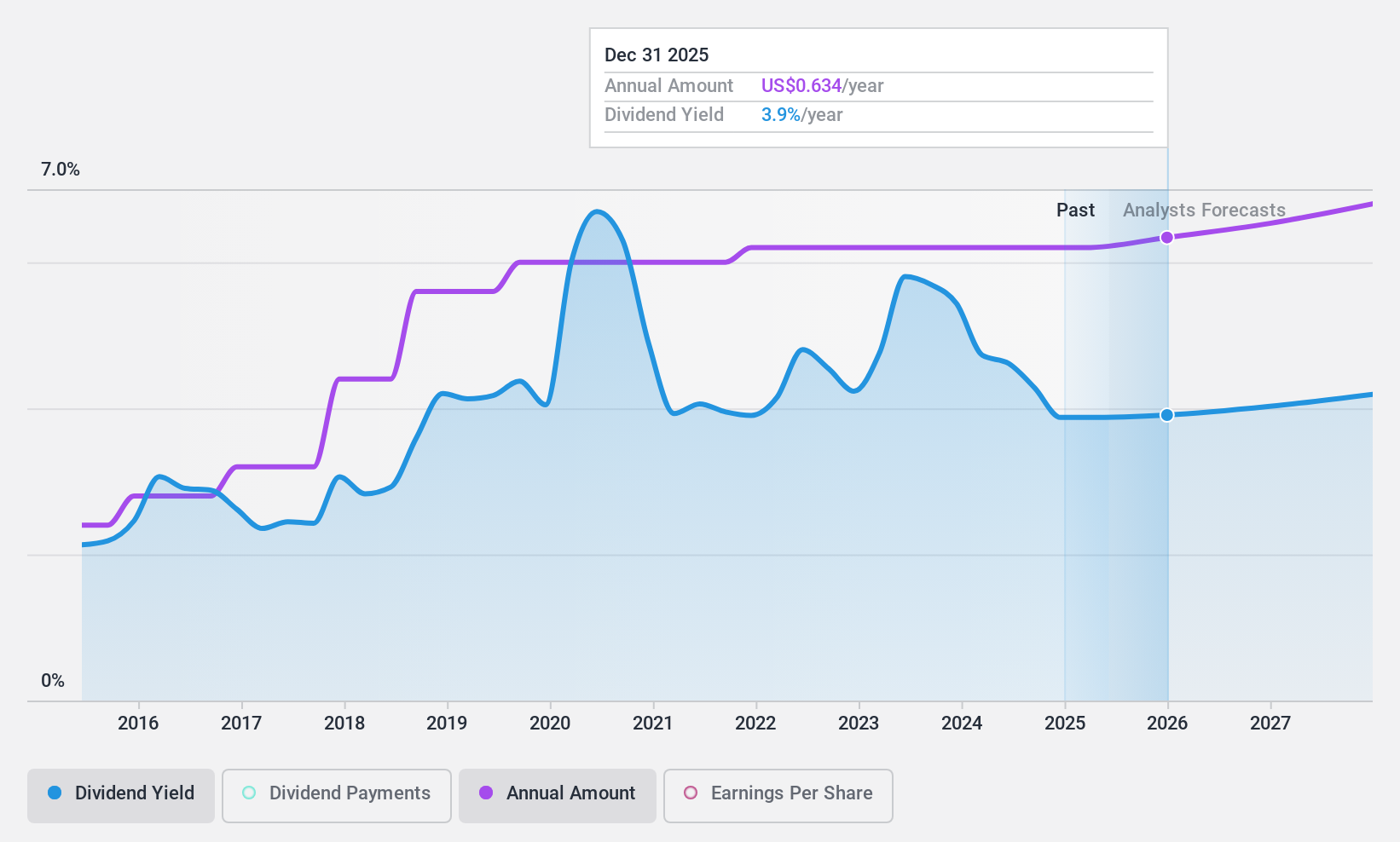

Huntington Bancshares (NasdaqGS:HBAN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Huntington Bancshares Incorporated is a bank holding company for The Huntington National Bank, offering commercial, consumer, and mortgage banking services in the United States with a market cap of $25.79 billion.

Operations: Huntington Bancshares generates its revenue primarily from Consumer & Regional Banking, which accounts for $4.98 billion, and Commercial Banking, contributing $2.60 billion.

Dividend Yield: 3.5%

Huntington Bancshares declared a quarterly dividend of US$0.155 per common share, maintaining stable and reliable dividends over the past decade with growth in payments. Although its 3.51% yield is below the top 25% in the US market, it remains attractive due to consistent coverage by earnings, evidenced by a current payout ratio of 59.2%. Recent earnings showed slight declines year-over-year, but dividends are forecast to remain well-covered in three years with a 44.5% payout ratio.

- Unlock comprehensive insights into our analysis of Huntington Bancshares stock in this dividend report.

- Upon reviewing our latest valuation report, Huntington Bancshares' share price might be too pessimistic.

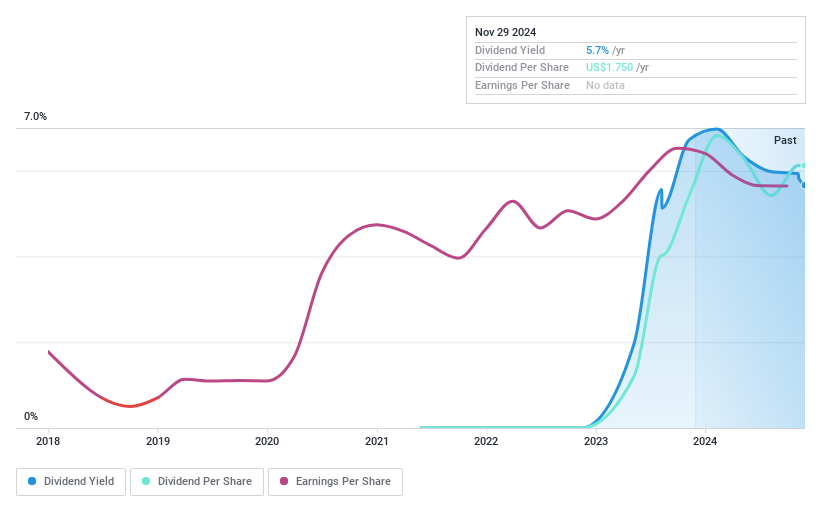

Karat Packaging (NasdaqGS:KRT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Karat Packaging Inc. manufactures and distributes single-use disposable products for restaurant and foodservice settings, with a market cap of approximately $608.13 million.

Operations: Karat Packaging Inc.'s revenue primarily comes from the manufacturing and supply of a diverse range of single-use products, generating $416.57 million.

Dividend Yield: 5.7%

Karat Packaging's dividend yield of 5.7% places it among the top 25% of US dividend payers, although its payments have been volatile over its short history. The company recently increased its quarterly dividend to US$0.40 per share from US$0.35, despite a payout ratio of 84.9% that indicates dividends are covered by earnings and cash flows (76.5%). Recent earnings showed stable sales growth but slight declines in net income year-over-year for nine months ended September 2024.

- Dive into the specifics of Karat Packaging here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that Karat Packaging is trading behind its estimated value.

Turning Ideas Into Actions

- Delve into our full catalog of 136 Top US Dividend Stocks here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brookline Bancorp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BRKL

Brookline Bancorp

Operates as a bank holding company for the Brookline Bank that provide commercial, business, and retail banking services to corporate, municipal, and retail customers in the United States.

Flawless balance sheet 6 star dividend payer.