- United States

- /

- Industrials

- /

- NasdaqGS:IEP

Assessing Icahn Enterprises (IEP) Valuation Following Strong Net Income Growth in Recent Results

Reviewed by Simply Wall St

Icahn Enterprises (IEP) just released third quarter results, drawing attention for a surge in net income compared to last year, even as sales and revenue held steady. Investors are parsing what this means for future performance.

See our latest analysis for Icahn Enterprises.

Icahn Enterprises has seen a burst of momentum lately, with its share price climbing 8.9% in the past week and 7.0% over the last month. Still, when you zoom out, the one-year total shareholder return is down a steep 18.3%. Long-term holders have faced even greater declines, which highlights how recent optimism follows a years-long stretch of lackluster results.

If sharp turnarounds and market shifts interest you, this is a perfect moment to see what’s out there and discover fast growing stocks with high insider ownership

The real question, then, is whether Icahn Enterprises is trading at a bargain based on its latest turnaround, or if the market is already factoring in the potential for further growth from here.

Price-to-Sales Ratio of 0.5x: Is it justified?

Ieahn Enterprises is trading at a price-to-sales ratio of 0.5x, which stands out as attractively low compared to peer and industry averages. With recent share price volatility and ongoing profitability challenges, this multiple puts the market’s view of IEP’s future potential in the spotlight.

The price-to-sales ratio measures investors’ willingness to pay for each dollar of company sales. In sectors where profits are unpredictable, like diversified industrials, this multiple helps investors weigh valuation more objectively than earnings-based measures. A low ratio can signal undervaluation or reflect market doubts about future growth and profitability.

IEP’s price-to-sales ratio of 0.5x is less than half the global industrials industry average of 0.9x and is well behind the average of its direct peers (1.1x). The fair price-to-sales ratio, estimated to be 0.5x, matches exactly with the current market figure. This suggests there is little disconnect between how the market values IEP’s revenue versus modeled fair value. If sentiment or fundamentals shift, this level could represent either a floor or a ceiling for the multiple moving forward.

Explore the SWS fair ratio for Icahn Enterprises

Result: Price-to-Sales Ratio of 0.5x (ABOUT RIGHT)

However, persistent annual revenue declines and ongoing net losses could challenge the turnaround story if these issues are not addressed promptly.

Find out about the key risks to this Icahn Enterprises narrative.

Another View: Our DCF Model Offers a Different Perspective

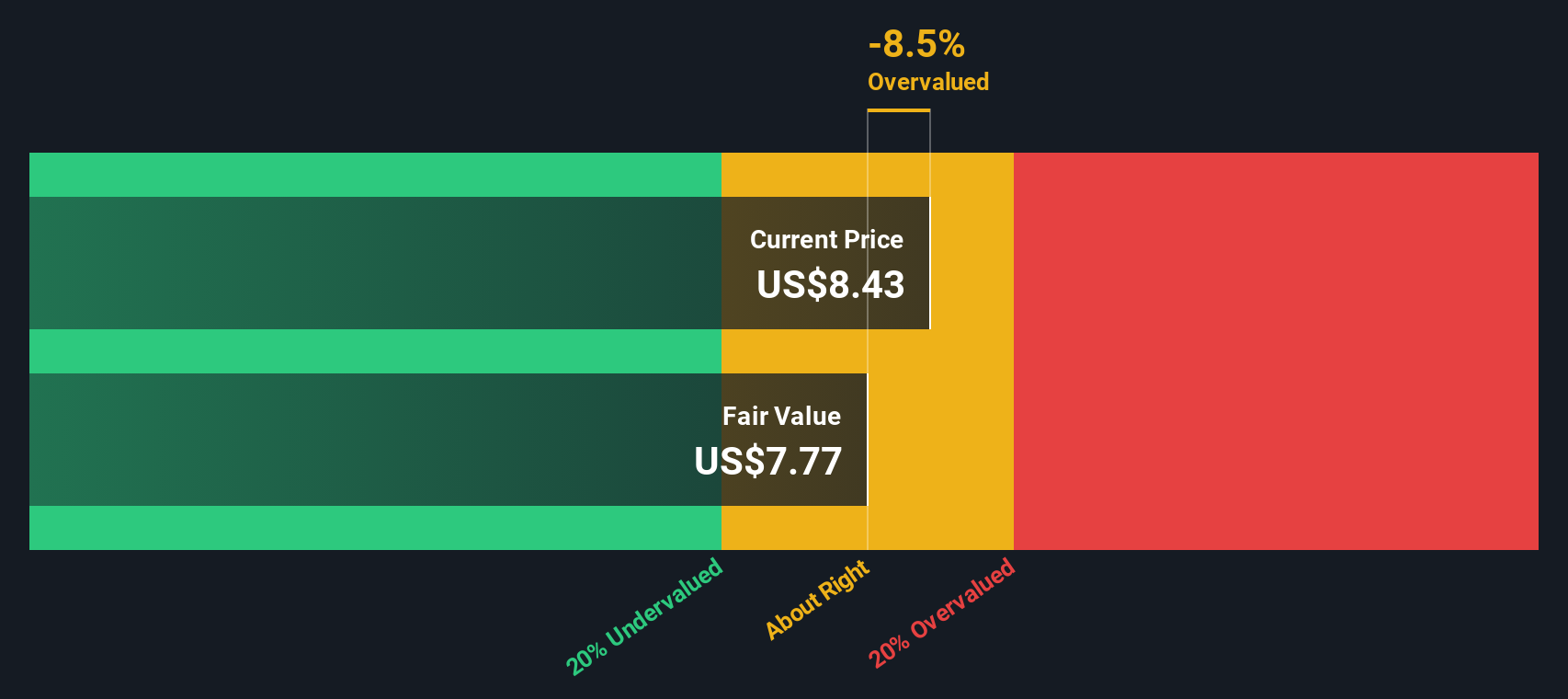

While Icahn Enterprises appears attractively valued on sales multiples, our SWS DCF model suggests a different narrative. At $8.83 per share, IEP is actually trading above our estimated fair value of $7.82. This means that, despite the seemingly low multiple, the market might already be pricing in optimistic assumptions. Could this signal caution rather than opportunity?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Icahn Enterprises for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 836 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Icahn Enterprises Narrative

If you see things differently or want to dig deeper into the numbers, it’s quick and easy to build your own take on Icahn Enterprises in just a few minutes. Do it your way

A great starting point for your Icahn Enterprises research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for More Investment Opportunities?

Smart investors stay ahead by acting on fresh ideas before the crowd does. Expand your watchlist with proven approaches and learn what’s really moving markets right now.

- Capture the potential in digital currencies and blockchain by checking out these 81 cryptocurrency and blockchain stocks, which spotlights companies at the forefront of this fast-growing sector.

- Secure income opportunities with these 20 dividend stocks with yields > 3%, offering consistently high yields for those who value steady portfolio growth and resilience.

- Tap into breakthrough innovation from the healthcare sector and analyze these 33 healthcare AI stocks, which highlights companies pioneering medical advances using artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IEP

Icahn Enterprises

Through its subsidiaries engages in the investment, energy, automotive, food packaging, real estate, home fashion and pharma in the United States and internationally.

Adequate balance sheet and fair value.

Market Insights

Community Narratives