- United States

- /

- Machinery

- /

- NasdaqCM:GTEC

Greenland Technologies Holding Corporation (NASDAQ:GTEC) Held Back By Insufficient Growth Even After Shares Climb 34%

Those holding Greenland Technologies Holding Corporation (NASDAQ:GTEC) shares would be relieved that the share price has rebounded 34% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 21% over that time.

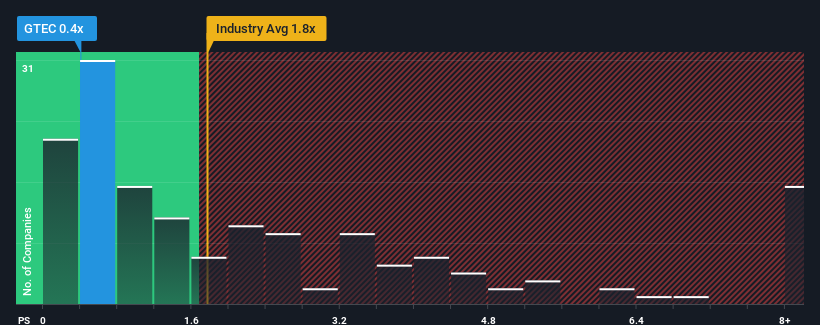

Even after such a large jump in price, Greenland Technologies Holding may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.4x, since almost half of all companies in the Machinery industry in the United States have P/S ratios greater than 1.8x and even P/S higher than 4x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Greenland Technologies Holding

What Does Greenland Technologies Holding's P/S Mean For Shareholders?

Greenland Technologies Holding certainly has been doing a good job lately as its revenue growth has been positive while most other companies have been seeing their revenue go backwards. Perhaps the market is expecting future revenue performance to follow the rest of the industry downwards, which has kept the P/S suppressed. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Greenland Technologies Holding will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Greenland Technologies Holding?

Greenland Technologies Holding's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. This isn't what shareholders were looking for as it means they've been left with a 12% decline in revenue over the last three years in total. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next year should bring plunging returns, with revenue decreasing 3.1% as estimated by the one analyst watching the company. Meanwhile, the broader industry is forecast to moderate by 0.4%, which indicates the company should perform poorly indeed.

With this information, it's not too hard to see why Greenland Technologies Holding is trading at a lower P/S in comparison. Nonetheless, with revenue going quickly in reverse, it's not guaranteed that the P/S has found a floor yet. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What We Can Learn From Greenland Technologies Holding's P/S?

Greenland Technologies Holding's stock price has surged recently, but its but its P/S still remains modest. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Greenland Technologies Holding's analyst forecasts revealed that its even shakier outlook against the industry is contributing factor to why its P/S is so low. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Although, we would be concerned whether the company can even maintain this level of performance under these tough industry conditions. For now though, it's hard to see the share price rising strongly in the near future under these circumstances.

It is also worth noting that we have found 1 warning sign for Greenland Technologies Holding that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:GTEC

Greenland Technologies Holding

Designs, develops, manufactures, and sells components and products for material handling industries worldwide.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives