- United States

- /

- Trade Distributors

- /

- NasdaqGS:FTAI

FTAI Aviation (FTAI): Valuation in Focus as Analysts Highlight Investor Day, FAA Approval Prospects, and Capital Initiatives

Reviewed by Simply Wall St

FTAI Aviation (FTAI) is attracting investor attention after recent analyst commentary spotlighted several events on the horizon, including an upcoming investor day, FAA approval prospects, and a possible new capital initiative. The company’s strong financial track record adds more interest as investors weigh the outlook and next steps.

See our latest analysis for FTAI Aviation.

FTAI Aviation’s recent momentum stands out, with the stock boasting a 17.1% year-to-date share price return as investors respond to those upcoming catalysts and continued financial strength. While the 1-year total shareholder return is more muted at 2.4%, robust multi-year gains—nearly tenfold over three years—suggest the long-term growth story remains very much alive.

If those moves from FTAI have your interest piqued, you might want to broaden your scope and discover See the full list for free.

But as FTAI Aviation reaches new milestones and analyst optimism grows, the key question remains: are shares still undervalued given its catalysts, or is the market already pricing in all that future growth?

Most Popular Narrative: 25% Undervalued

FTAI Aviation’s most widely followed narrative points to a fair value target comfortably above the recent closing price. The numbers imply a significant gap between what analysts project and where the market is currently pricing the stock, creating a compelling set-up for future upside if expectations are met.

The accelerated adoption of FTAI's Maintenance, Repair and Exchange (MRE) programs by both large and small airlines, as a cost-effective and flexible alternative to traditional shop visits, positions the company to capture additional market share as operators increasingly outsource engine management. This is expected to drive both higher utilization rates and improved net margins as volumes scale.

Want to know what powers this sky-high valuation? Behind the headline price target is a bold profitability forecast and a revenue growth assumption that rivals the fastest-growing sectors. Find out which critical financial lever matters most to the narrative’s bullish view. The details may surprise you.

Result: Fair Value of $227.10 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, setbacks in scaling new partnerships or a sudden shift in engine technology could quickly challenge the bullish growth assumptions for FTAI Aviation.

Find out about the key risks to this FTAI Aviation narrative.

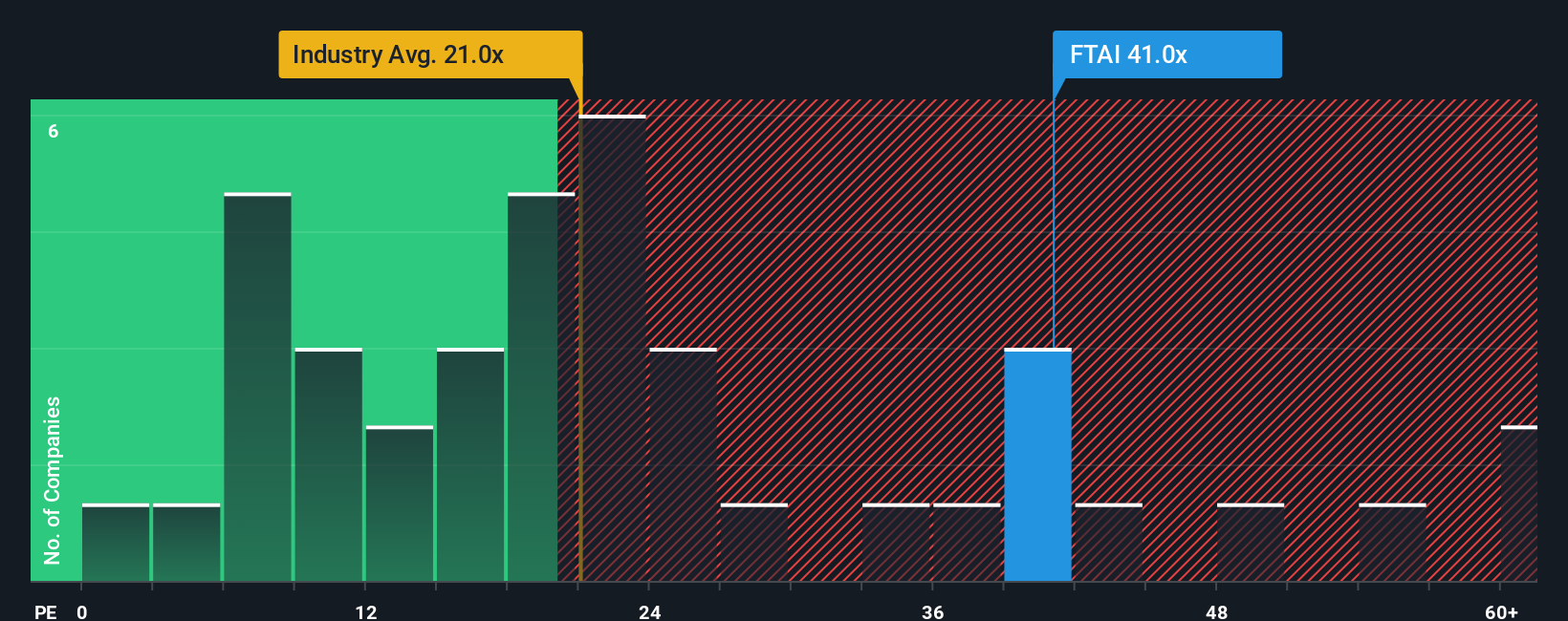

Another View: Multiples Tell a Different Story

When we look at FTAI Aviation’s valuation through the lens of its price-to-earnings ratio, things appear less optimistic. The company trades at 38.4 times earnings, which is nearly double the US Trade Distributors industry average of 19.5 times and well above peer averages. However, it remains below the fair ratio of 52 that our analysis suggests the market could ultimately move toward. This gap signals both a risk of overvaluation and the potential for further upside if growth persists. Are investors being too bold, or is the best still to come?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own FTAI Aviation Narrative

If you have a different take or want to investigate the story firsthand, you can craft your own FTAI Aviation narrative in under three minutes. Do it your way

A great starting point for your FTAI Aviation research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for More Smart Investment Ideas?

Unlock new opportunities and stay a step ahead of the market. These investment angles could be the difference between catching the next big trend and missing out.

- Boost your potential returns by seizing these 923 undervalued stocks based on cash flows identified for their strong cash flow fundamentals before the wider market acts.

- Tap into rapid innovation and growth by checking out these 25 AI penny stocks building breakthroughs in artificial intelligence and machine learning.

- Make your portfolio work harder for you with these 14 dividend stocks with yields > 3% offering attractive, reliable yields above 3% for long-term income stability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FTAI

FTAI Aviation

Owns, acquires, and sells aviation equipment for the transportation of goods and people worldwide.

High growth potential and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026