- United States

- /

- Trade Distributors

- /

- NasdaqGS:FTAI

FTAI Aviation (FTAI): Exploring Valuation After Strong Revenue Growth, Dividend Hike, and Raised Guidance

Reviewed by Simply Wall St

FTAI Aviation reported third-quarter results that caught investors’ attention. The company posted 43% revenue growth from last year and raised its full-year adjusted EBITDA outlook, even though profit per share came in below analyst forecasts.

See our latest analysis for FTAI Aviation.

FTAI Aviation’s latest results arrive after a period of notably strong momentum for the stock, which has climbed 26% over the last 90 days. With the company announcing substantial capital commitments, raising its dividend, and executing on new joint ventures, investors appear to be focused more on its promising long-term growth story than any single quarter’s profit miss. If you zoom out, FTAI’s total shareholder return stands at a staggering 969% over three years. This puts its recent short-term dip in perspective.

If expanding possibilities in aviation finance and engineering intrigues you, now might be the right time to discover See the full list for free.

With FTAI Aviation posting big revenue gains and raising its outlook, even after an EPS miss, the question now becomes whether investors are undervaluing this transformation or if the market has already priced in the company’s future growth trajectory.

Most Popular Narrative: 18.8% Undervalued

With FTAI Aviation closing at $174 and the most-followed narrative assigning a fair value of $214.20, there is strong belief that market expectations have not fully caught up to projected future performance. This sets up a story of rising analyst confidence amid continued business momentum.

The accelerated adoption of FTAI's Maintenance, Repair and Exchange (MRE) programs by both large and small airlines, as a cost-effective and flexible alternative to traditional shop visits, positions the company to capture additional market share as operators increasingly outsource engine management. This will drive both higher utilization rates and improved net margins as volumes scale.

Want to know the key assumption behind that higher fair value? It is not just revenue that is set to accelerate. Hidden in this narrative are analyst projections for future earnings and profit margins few would have anticipated. Unpack these bold forecasts for yourself and discover what could set a surprisingly high multiple in motion.

Result: Fair Value of $214.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including the company’s reliance on legacy engine platforms and uncertainties tied to scaling new partnership models. These factors could challenge growth assumptions.

Find out about the key risks to this FTAI Aviation narrative.

Another View: A Different Valuation Lens

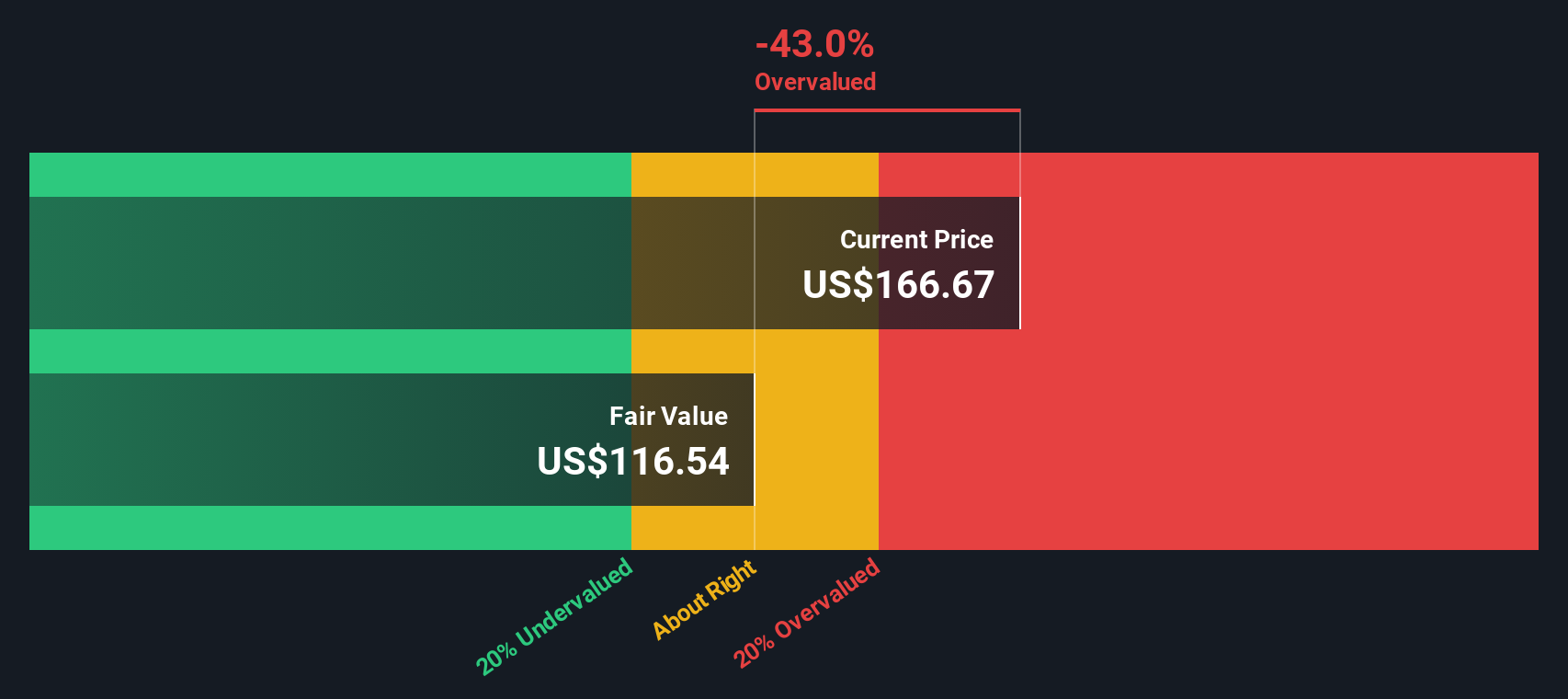

Looking beyond analyst targets, our DCF model offers a more cautious perspective. It suggests FTAI Aviation, at $174, is trading above its estimated fair value of $119.67. This method implies the stock could be overvalued and raises questions about whether current optimism has gone too far.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out FTAI Aviation for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 852 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own FTAI Aviation Narrative

If you see things differently or want to dig deeper into the numbers yourself, you can easily build your own analysis in just a few minutes. Do it your way

A great starting point for your FTAI Aviation research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Expand your horizons and don’t miss out on these high-potential themes. Our screeners can help you act now on key market opportunities others might overlook.

- Secure your portfolio with potential regular returns when you check out these 21 dividend stocks with yields > 3% which offers attractive yields above 3% and stable income streams.

- Fuel your growth strategy by finding these 26 AI penny stocks that are tapping into the hottest advancements in artificial intelligence and disruption.

- Gain an edge in tomorrow’s tech with these 28 quantum computing stocks at the forefront of rapid progress in quantum computing and the evolution of computing power.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FTAI

FTAI Aviation

Owns, acquires, and sells aviation equipment for the transportation of goods and people worldwide.

High growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives