- United States

- /

- Aerospace & Defense

- /

- NasdaqGM:FLY

Does Firefly Aerospace’s Contract Win Signal a Turnaround for the Stock in 2025?

Reviewed by Bailey Pemberton

- Wondering if Firefly Aerospace is a bargain or overpriced right now? You are not alone, as curiosity around the stock's real value is picking up steam.

- After a rocky start to the year, the stock surged 16.3% in the last week. This comes after a steep 62.0% slide year-to-date and a recent 22.5% drop over the past month.

- This comeback follows reports that Firefly recently secured additional contracts in the commercial launch sector, alongside growing investor attention as the space industry heats up. News of expanded partnerships and technology milestones appear to have reignited interest and pushed the price upward after weeks in the red.

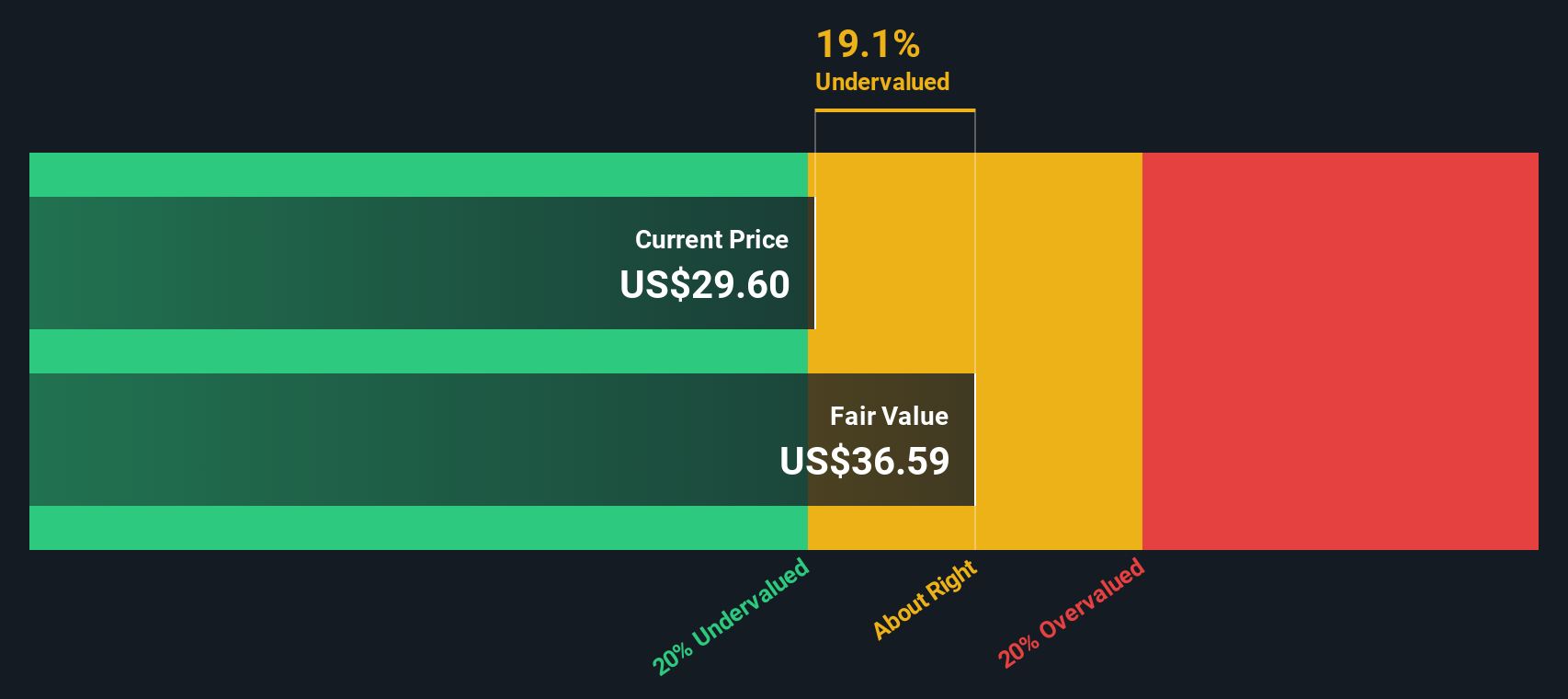

- With a valuation score of 2 out of 6 for being undervalued on key checks, Firefly's price tag raises as many questions as it answers. Next, we will break down different valuation models. Keep reading for a better way to make sense of what the numbers really mean.

Firefly Aerospace scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Firefly Aerospace Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a valuation approach that estimates a company's worth by projecting its future free cash flows and then discounting those values back to today. This method helps investors assess what a business is really worth, based on its potential to generate cash in the future.

For Firefly Aerospace, the most recent reported Free Cash Flow stands at -$177.9 Million. Analysts supply projections for the next five years, forecasting growth, and further years are estimated by Simply Wall St. According to these projections, Firefly's Free Cash Flow could reach around $369 Million by 2035.

These projections are run through a DCF model using the 2 Stage Free Cash Flow to Equity method. The result is an estimated intrinsic value of $38.31 per share. With the current share price about 40.1% below this estimate, the DCF valuation suggests that Firefly Aerospace stock is undervalued.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Firefly Aerospace is undervalued by 40.1%. Track this in your watchlist or portfolio, or discover 879 more undervalued stocks based on cash flows.

Approach 2: Firefly Aerospace Price vs Sales

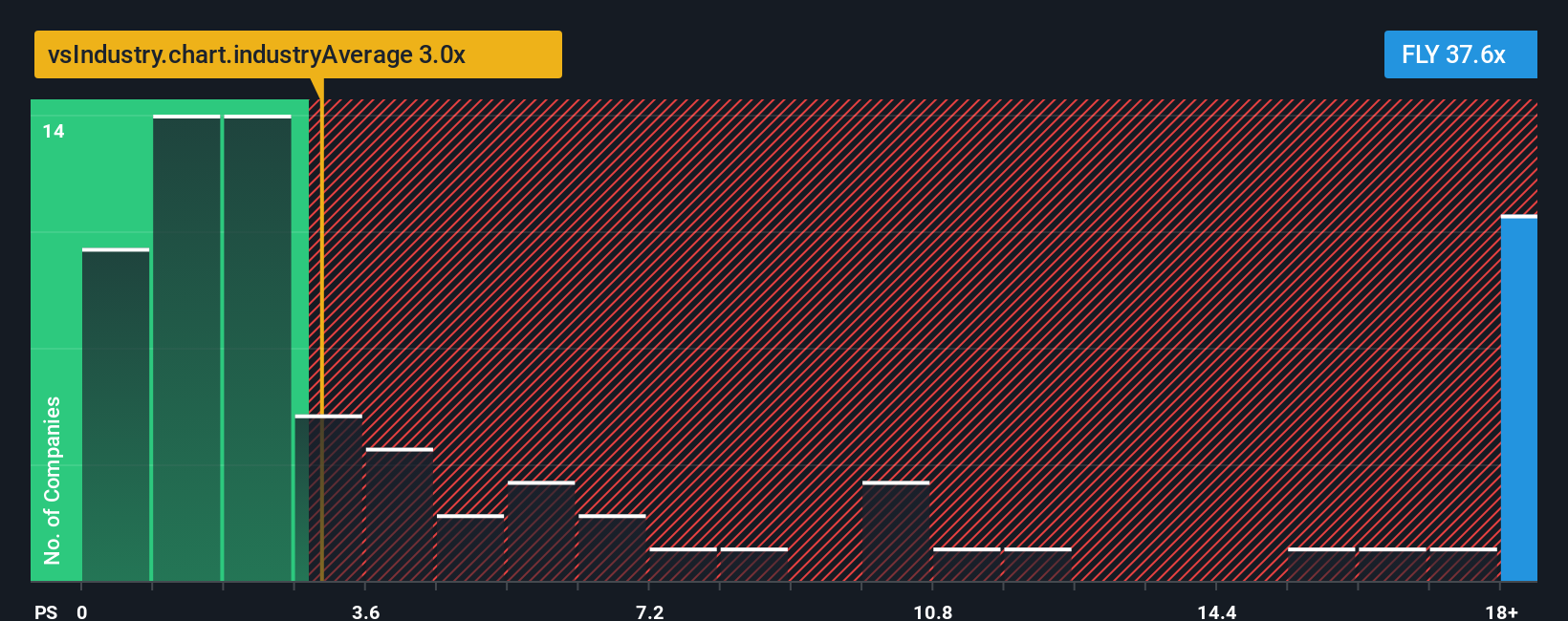

The Price-to-Sales (PS) ratio is a widely used valuation metric, especially for high-growth or early-stage companies that may not yet be profitable. It allows investors to compare how much they are paying for each dollar of a company's sales, making it useful when earnings are negative or volatile, as is the case with many innovative aerospace firms.

A company's growth outlook and risk profile usually influence what is considered a "normal" PS ratio. Higher growth prospects and lower risks typically justify a higher multiple, while uncertain growth or elevated risks warrant a lower one.

Currently, Firefly Aerospace trades at a PS ratio of 30.2x, which stands significantly above the Aerospace & Defense industry average of 2.9x and also far outpaces peer companies at 1.2x. This premium suggests that the market is pricing in substantial future sales growth or sees a unique advantage in the business model.

To determine if this premium is justified, Simply Wall St calculates a "Fair Ratio" for Firefly, custom tailored to the company’s own profile by considering not just industry averages or peer comparisons, but also factors like projected sales growth, risk level, market cap, and profit margins. This methodology provides a more holistic and relevant benchmark for valuation.

In Firefly’s case, the Fair Ratio analysis shows its PS multiple is dramatically higher than what’s merited by its fundamentals. This suggests the stock is likely overvalued when using this approach, as future sales growth would need to be exceptionally strong to justify the current valuation.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1406 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Firefly Aerospace Narrative

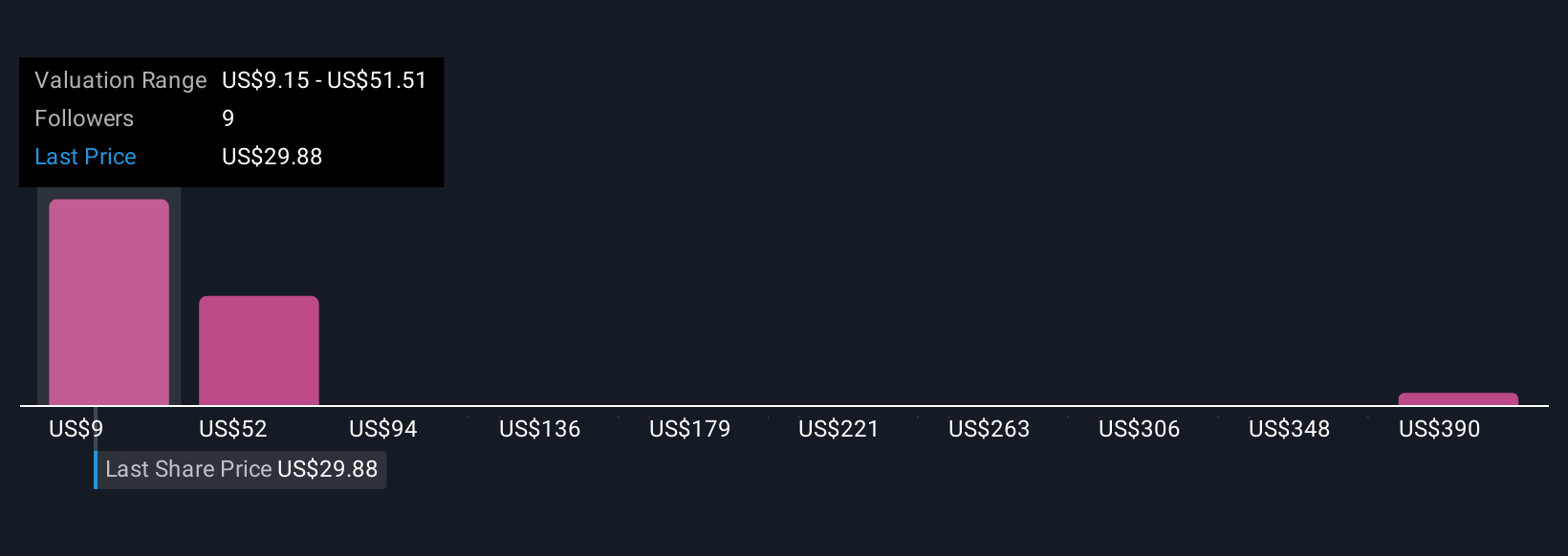

Earlier we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your personal investment thesis, combining your views on a company’s story with your own expectations for future revenue, earnings, and margins. Instead of just relying on raw numbers, Narratives connect Firefly Aerospace’s potential business story to your forecast, then translate that into a specific fair value.

This approach is available on Simply Wall St’s Community page, used by millions of investors, making it easy for you to create or review Narratives designed by others. Narratives empower you to see at a glance whether the current price justifies your outlook, helping inform your buy or sell decisions. Best of all, they update automatically as news or earnings reports become available, keeping your perspective fresh.

For example, one investor’s Narrative might foresee extraordinary contract wins and a fair value well above today’s price. Another might be more cautious, expecting significant delays and a lower fair value.

Do you think there's more to the story for Firefly Aerospace? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:FLY

Firefly Aerospace

Operates as a space and defense technology company and provides mission solutions for national security, government, and commercial customers.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives