- United States

- /

- Electrical

- /

- NasdaqGS:ENVX

Fiduciary Duty Probe Could Be a Game Changer for Enovix (ENVX)

Reviewed by Sasha Jovanovic

- In late November 2025, Halper Sadeh LLC, an investor rights law firm, announced an investigation into whether certain officers and directors of Enovix Corp. breached fiduciary duties to shareholders, urging shareholder involvement due to possible limited time to take action.

- This situation highlights possible ramifications for Enovix’s corporate governance, as shareholder engagement could drive reforms in company oversight or policies.

- We’ll examine how the ongoing fiduciary duty investigation may impact Enovix’s outlook and assessment of management quality.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Enovix Investment Narrative Recap

To be an Enovix shareholder, you need to believe in the company’s ability to achieve mass production of advanced batteries for smartphones and overcome its current unprofitability. The ongoing fiduciary duty investigation by Halper Sadeh LLC does not appear to materially influence near-term production milestones, a central short-term catalyst, but could raise questions about management oversight, which is the company’s biggest current risk.

The most relevant recent announcement is the expansion of the board of directors in August 2025, increasing independent oversight. This is timely, as the current investigation into board conduct could make governance strength a more prominent consideration for investors, especially with customer qualification for mass production approaching as a key catalyst.

But, in contrast, investors should be aware that the largest immediate risk remains the potential for further delays in customer qualification or...

Read the full narrative on Enovix (it's free!)

Enovix's narrative projects $460.3 million in revenue and $48.3 million in earnings by 2028. This requires 171.2% yearly revenue growth and a $270.5 million increase in earnings from the current -$222.2 million.

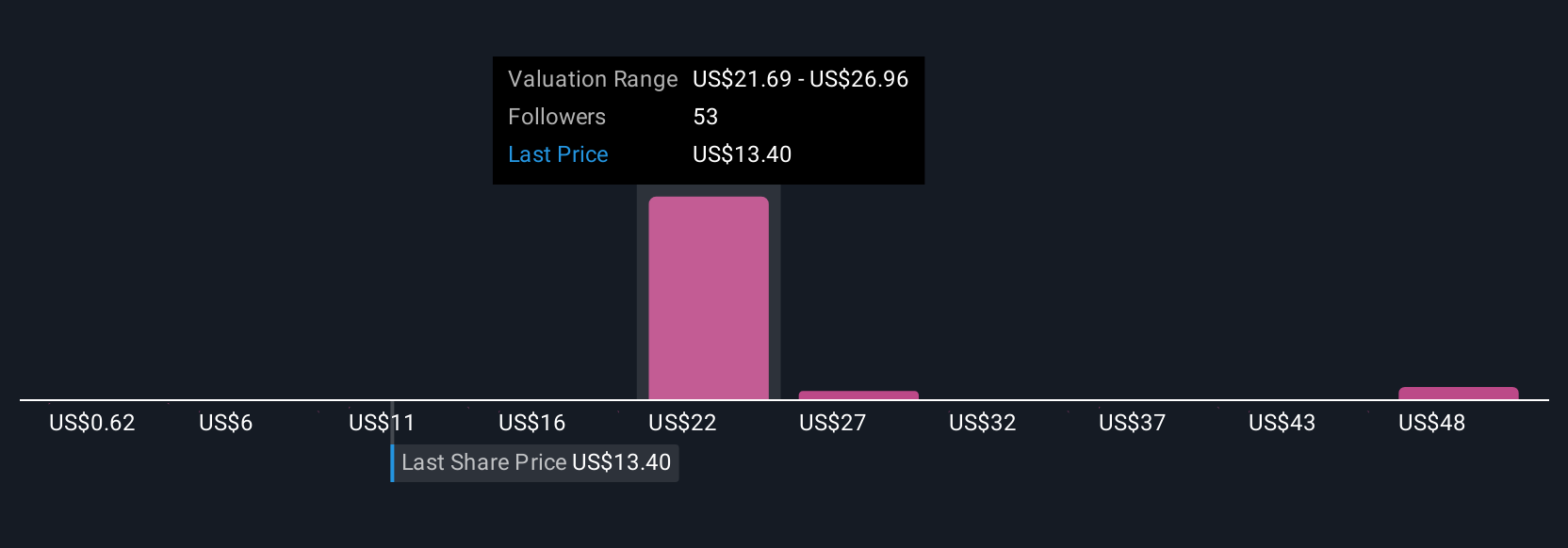

Uncover how Enovix's forecasts yield a $26.90 fair value, a 269% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members shared seven fair value opinions for Enovix, from US$0.81 up to US$34.57 per share. Against this broad range, the company’s dependence on successful high-volume production and customer qualification may cause expectations to shift rapidly, prompting you to review the full spectrum of outlooks today.

Explore 7 other fair value estimates on Enovix - why the stock might be worth over 4x more than the current price!

Build Your Own Enovix Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Enovix research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Enovix research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Enovix's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Enovix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ENVX

Enovix

Designs, develops, and manufactures lithium-ion battery cells in the United States and internationally.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026