- United States

- /

- Aerospace & Defense

- /

- NasdaqGM:EH

Evaluating EHang (NasdaqGM:EH) After Bangkok eVTOL Breakthrough and Reaffirmed 2025 Revenue Guidance

Reviewed by Simply Wall St

EHang Holdings (NasdaqGM:EH) just checked two big boxes for investors, showcasing a successful pilotless EH216-S passenger flight in Bangkok while reaffirming its 2025 revenue outlook. This tightened the link between technology milestones and future cash flows.

See our latest analysis for EHang Holdings.

The Bangkok milestone lands after a tougher stretch for the stock, with a 30 day share price return of minus 13.17 percent and year to date share price return of minus 8.30 percent. At the same time, the three year total shareholder return of 94.98 percent shows that longer term momentum is still very much alive.

If this kind of early stage aerospace innovation has your attention, it could be worth seeing what else is taking off via aerospace and defense stocks.

With losses widening even as management holds firm on its 2025 revenue guidance, and the stock trading well below analyst targets, the real tension now is simple: is EHang a mispriced growth story, or is the market already discounting its future upside?

Most Popular Narrative Narrative: 36% Undervalued

With the narrative fair value at $22.33 versus a last close of $14.37, the gap hinges on aggressive growth, rising margins, and regulatory follow through.

The company's deepening partnerships with municipal governments (such as Hefei's RMB 500 million support for the VT35 hub) and involvement in setting regulatory and safety standards enhances regulatory acceptance and ecosystem integration, supporting wider market entry, improved top line growth, and improved long term earnings visibility.

Want to see what kind of revenue surge and margin turnaround this narrative is baking in? The projections lean on bold scale up math and a premium future earnings multiple. Curious how fast profits would need to inflect for that to hold?

Result: Fair Value of $22.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower regulatory approvals and EHang's decision to prioritize operational readiness over rapid deliveries could delay scaling and undermine the growth embedded in this valuation.

Find out about the key risks to this EHang Holdings narrative.

Another Lens on Valuation

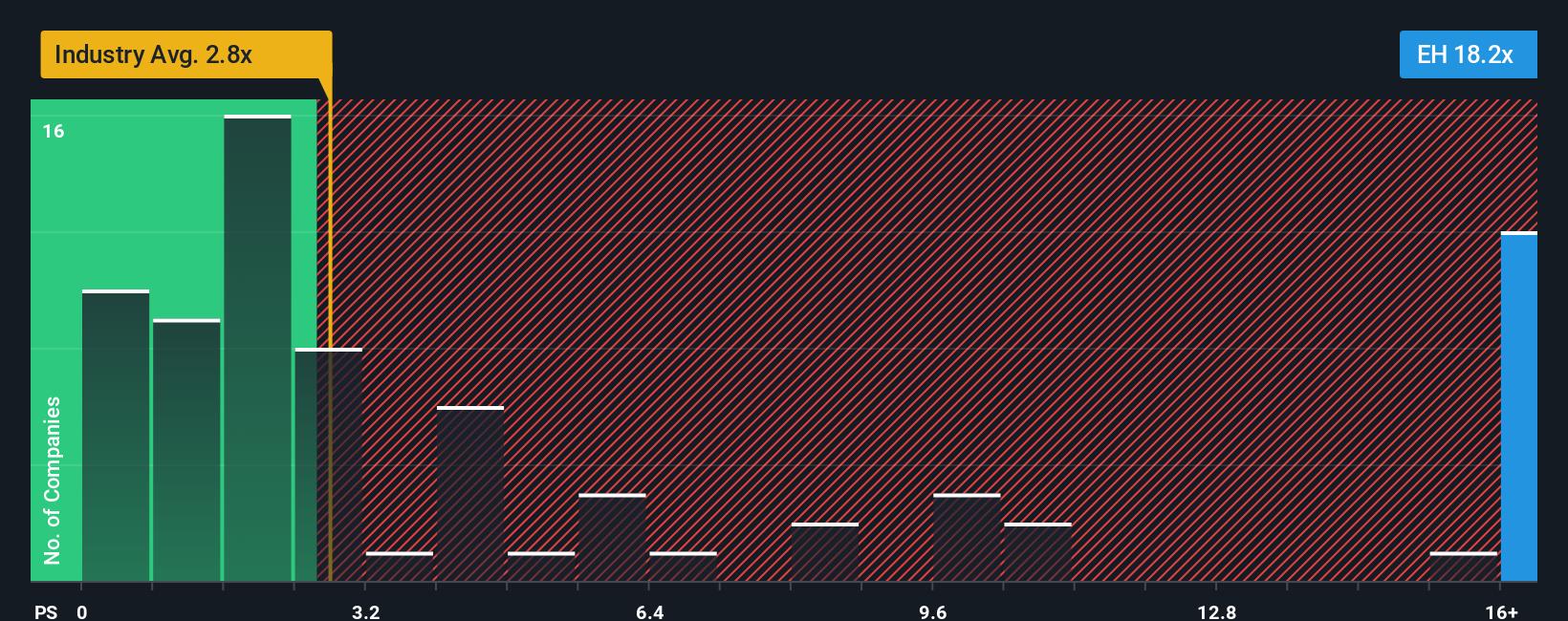

While the narrative fair value points to upside, the current price to sales ratio of 16.9 times looks stretched next to the US Aerospace and Defense average of 3 times and a fair ratio of 10.1 times. That richer multiple signals real downside risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own EHang Holdings Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in just minutes: Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding EHang Holdings.

Looking for more investment ideas?

Before you move on, line up your next opportunities with a few targeted stock ideas so you are not watching the market from the sidelines.

- Capture potential multi baggers early by scanning these 3577 penny stocks with strong financials that already show robust balance sheets and improving fundamentals.

- Ride structural growth trends by focusing on these 30 healthcare AI stocks bringing data driven breakthroughs to diagnostics, treatments, and hospital efficiency.

- Turn volatility into income potential by reviewing these 15 dividend stocks with yields > 3% that combine reliable payouts with room for capital appreciation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EHang Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:EH

EHang Holdings

Operates as an urban air mobility (UAM) technology platform company in the People’s Republic of China, East Asia, West Asia, North America, South America, West Africa, and Europe.

High growth potential with mediocre balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026