- United States

- /

- Trade Distributors

- /

- NasdaqGS:DXPE

Is There Still Upside in DXP Enterprises After Its Strong Multi Year Share Price Surge?

Reviewed by Bailey Pemberton

- If you are wondering whether DXP Enterprises at around $95.74 is still a smart buy or if the big gains are mostly behind it, you are in the right place.

- The stock is up 24.4% over the last year and 13.4% year to date, even after a recent 5.2% pullback over the past month and a modest 1.9% rise in the last week.

- Recent headlines have focused on DXP's ongoing expansion in industrial distribution and services, as the company continues to bolt on niche businesses that deepen its presence in energy, industrial, and MRO markets. Those strategic moves help explain why the share price has surged 280.2% over 3 years and 322.1% over 5 years, even if shorter term swings look choppy.

- Right now, DXP scores a 4/6 valuation check, suggesting it looks undervalued on several, but not all, metrics. Next, we will walk through the main valuation approaches and finish by looking at a more rounded way to judge what the stock is really worth.

Approach 1: DXP Enterprises Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth today by projecting the cash it can generate in the future and then discounting those cash flows back to their value in today’s dollars.

For DXP Enterprises, the latest twelve month Free Cash Flow is about $61.0 million. Analysts and internal estimates see this rising steadily, with free cash flow expected to reach roughly $206.8 million in 2035. That path includes specific analyst forecasts through 2029, after which Simply Wall St extrapolates growth to extend the projection out to ten years.

Using a 2 Stage Free Cash Flow to Equity approach, these future cash flows imply an estimated intrinsic value of about $166.06 per share. Compared with the recent share price around $95.74, the model suggests the stock is trading at roughly a 42.3% discount to its calculated fair value, indicating potential upside if the cash flow assumptions prove accurate.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests DXP Enterprises is undervalued by 42.3%. Track this in your watchlist or portfolio, or discover 908 more undervalued stocks based on cash flows.

Approach 2: DXP Enterprises Price vs Earnings

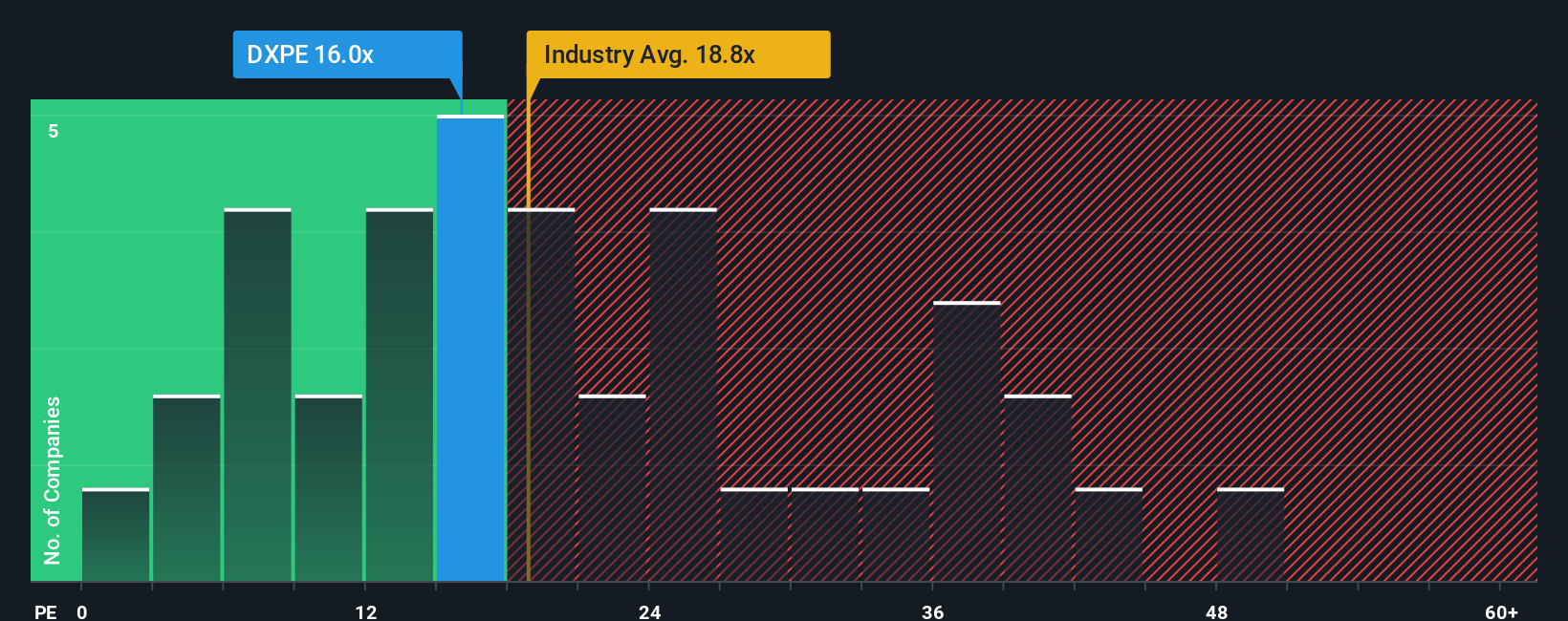

For a profitable company like DXP Enterprises, the price to earnings (PE) ratio is a useful way to gauge whether investors are paying a reasonable price for each dollar of current earnings. What counts as a normal or fair PE depends on how fast earnings are expected to grow and how risky those earnings are, with higher growth and lower risk usually justifying a higher multiple.

DXP currently trades on a PE of about 17.2x, which is below both the Trade Distributors industry average of roughly 19.7x and the selected peer group average of about 14.2x. Simply Wall St also calculates a proprietary Fair Ratio of 25.8x for DXP, which reflects what its PE might reasonably be given its earnings growth outlook, margins, industry, size and risk profile. This Fair Ratio can be more informative than a simple peer or industry comparison because it explicitly adjusts for those company specific factors rather than assuming all businesses in the group deserve similar valuations.

Comparing DXP’s current 17.2x PE with the 25.8x Fair Ratio suggests the market is pricing the stock below what its fundamentals might justify, pointing to potential upside.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1452 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your DXP Enterprises Narrative

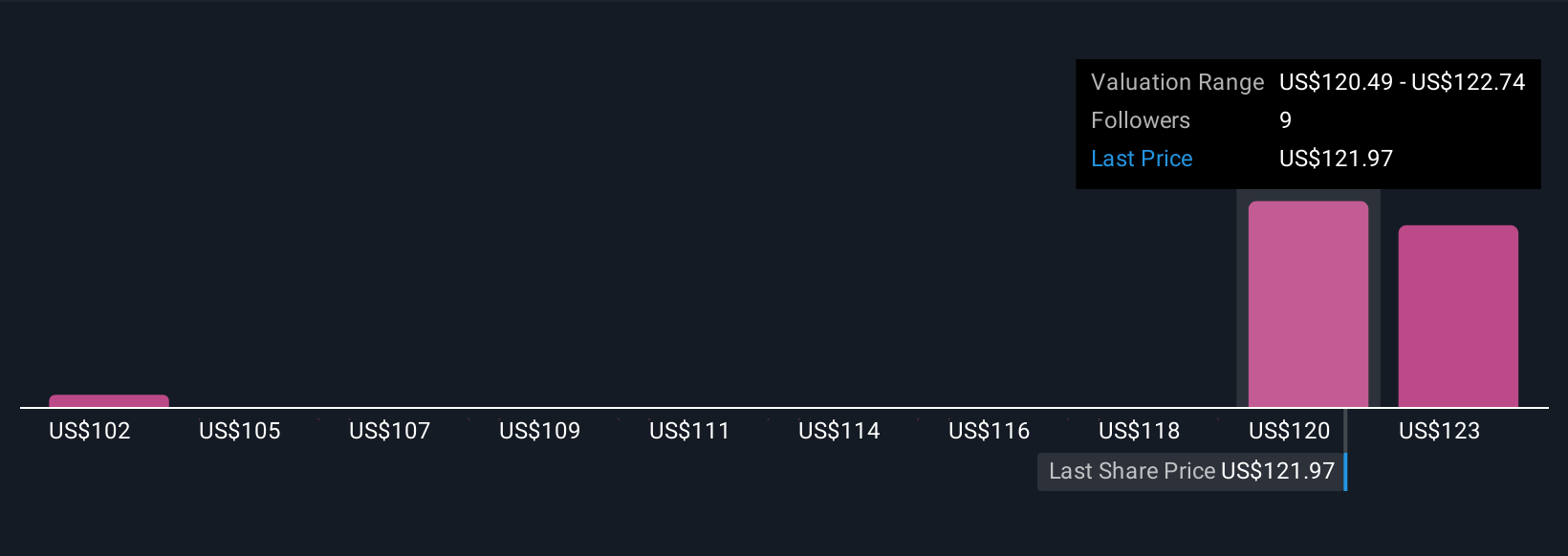

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives, a simple framework on Simply Wall St’s Community page where you connect your view of a company’s story to a set of numbers such as future revenue, earnings, margins and a fair value estimate. You can then compare that fair value with today’s share price to decide whether to buy, hold or sell, with the Narrative updating dynamically as new news and earnings arrive. For DXP Enterprises, for example, one investor might build a bullish Narrative around accelerating digital sales, rising margins and industry consolidation that supports a fair value near $136.50 per share. Another investor might focus on energy exposure, integration risks and margin pressure to justify a more cautious fair value closer to perhaps $90. Both perspectives can coexist and evolve over time as data changes.

Do you think there's more to the story for DXP Enterprises? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DXPE

DXP Enterprises

Engages in distributing maintenance, repair, and operating (MRO) products, equipment, and services in the United States, Canada, and internationally.

Good value with proven track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026