- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:DRS

Leonardo DRS (DRS): Evaluating Valuation After New AI Defense Collaboration With Axon Vision

Reviewed by Simply Wall St

Leonardo DRS (DRS) just announced a collaboration with Axon Vision, aimed at integrating AI-driven situational awareness and counter-UAS technologies into U.S. defense platforms. This partnership is designed to deliver automated threat detection and real-time response capabilities.

See our latest analysis for Leonardo DRS.

Leonardo DRS’s collaboration with Axon Vision follows a year marked by gains and recent volatility. Despite ongoing momentum in the defense sector, the share price return year-to-date is still positive at 2.66%, even as the last quarter saw a 20% pullback. The company’s three-year total shareholder return of over 212% indicates substantial long-term growth potential.

If defense technology breakthroughs have piqued your interest, take your research a step further and check out the full lineup in our dedicated See the full list for free.

With shares recently experiencing volatility, even as long-term returns outpace the market and the stock trades at a noticeable discount to analyst targets, investors must now ask whether Leonardo DRS is undervalued or if the market already reflects future growth prospects.

Most Popular Narrative: 29.7% Undervalued

With the current share price at $33.24 and the narrative’s fair value set at $47.30, there is a significant gap. This suggests analysts and market watchers believe the stock’s future potential far outpaces today’s price, if their thesis holds up.

The company's strategic alignment with national priorities, including investments in naval modernization, next-generation air and missile defense (such as the Golden Dome initiative), and counter-UAS capabilities, sets the stage for premium contract awards and program expansions, benefiting both revenue and net margins over the next several years.

Want to know what ambitious growth benchmarks underlie this bullish view? The narrative’s case leans on advancing defense tech, projections for stronger profits, and a bold financial runway. Which future figures drive such a high consensus target? Discover the hidden levers reshaping DRS’s value story and see what everyone else is betting on.

Result: Fair Value of $47.30 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing raw material constraints and reliance on major U.S. government contracts could quickly undermine the bullish outlook if conditions worsen.

Find out about the key risks to this Leonardo DRS narrative.

Another View: What Does the SWS DCF Model Suggest?

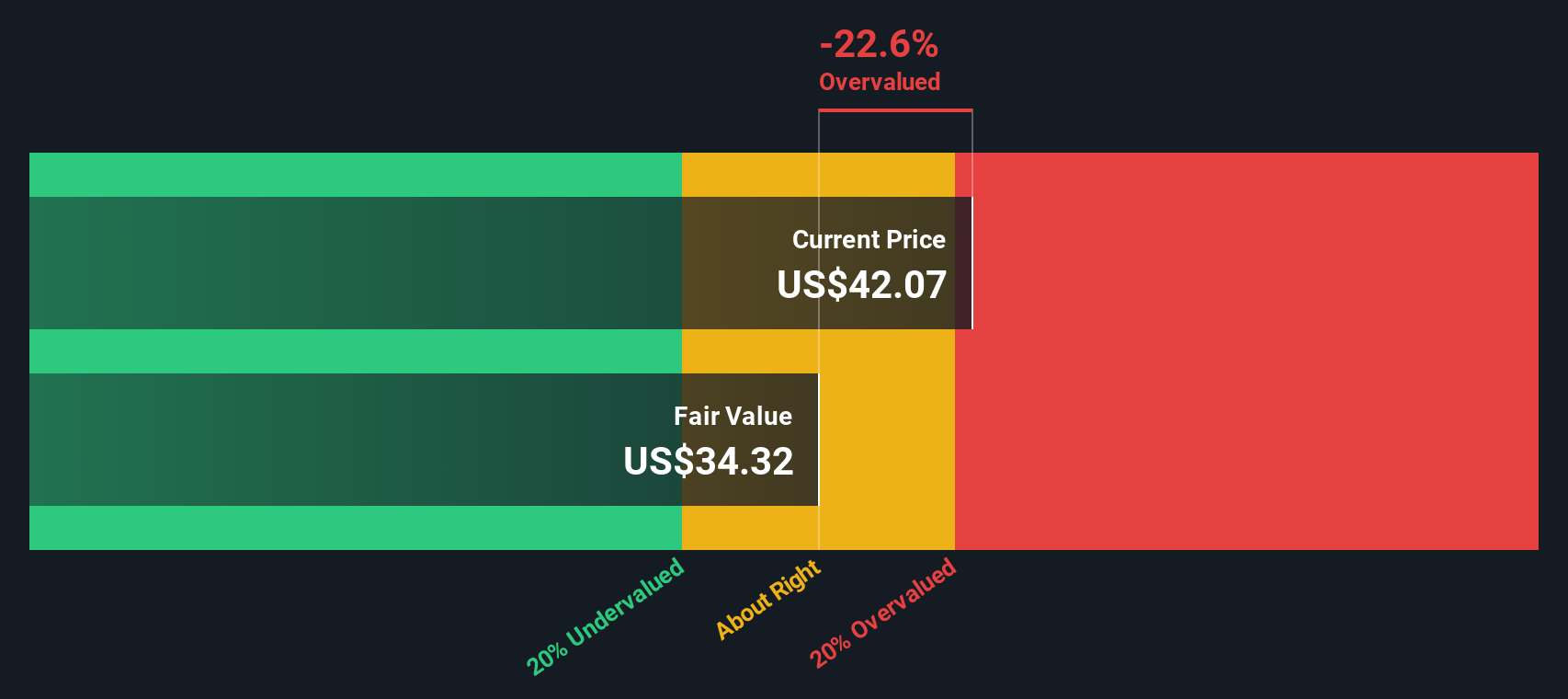

Looking from a different angle, our DCF model estimates that Leonardo DRS is trading above its fair value. The fair value is calculated at $29.92, compared to today’s share price of $33.24. While analysts see notable upside, the DCF result presents a more cautious perspective. Which view deserves more consideration as the market digests recent volatility?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Leonardo DRS for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 928 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Leonardo DRS Narrative

If you think the story could unfold differently, dive into the numbers and craft your own take in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Leonardo DRS.

Looking for More Smart Investment Ideas?

Maximize your strategy and stay ahead by researching stocks built for today’s opportunities. Don’t let the next big winner pass you by!

- Strengthen your portfolio with steady income streams and check out these 14 dividend stocks with yields > 3%, offering high yields above 3% for resilient growth potential.

- Tap into rapid advancements in medical innovation by reviewing these 30 healthcare AI stocks, fueling the next frontier of AI-powered healthcare solutions.

- Catch early trends in the digital economy and examine these 81 cryptocurrency and blockchain stocks, reshaping global finance with blockchain and cryptocurrency breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DRS

Leonardo DRS

Provides defense electronic products and systems, and military support services worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026