- United States

- /

- Machinery

- /

- NasdaqGS:CMCO

Columbus McKinnon (CMCO): Revenue Growth Lags Market as Valuation Shows Discount Heading Into Earnings

Reviewed by Simply Wall St

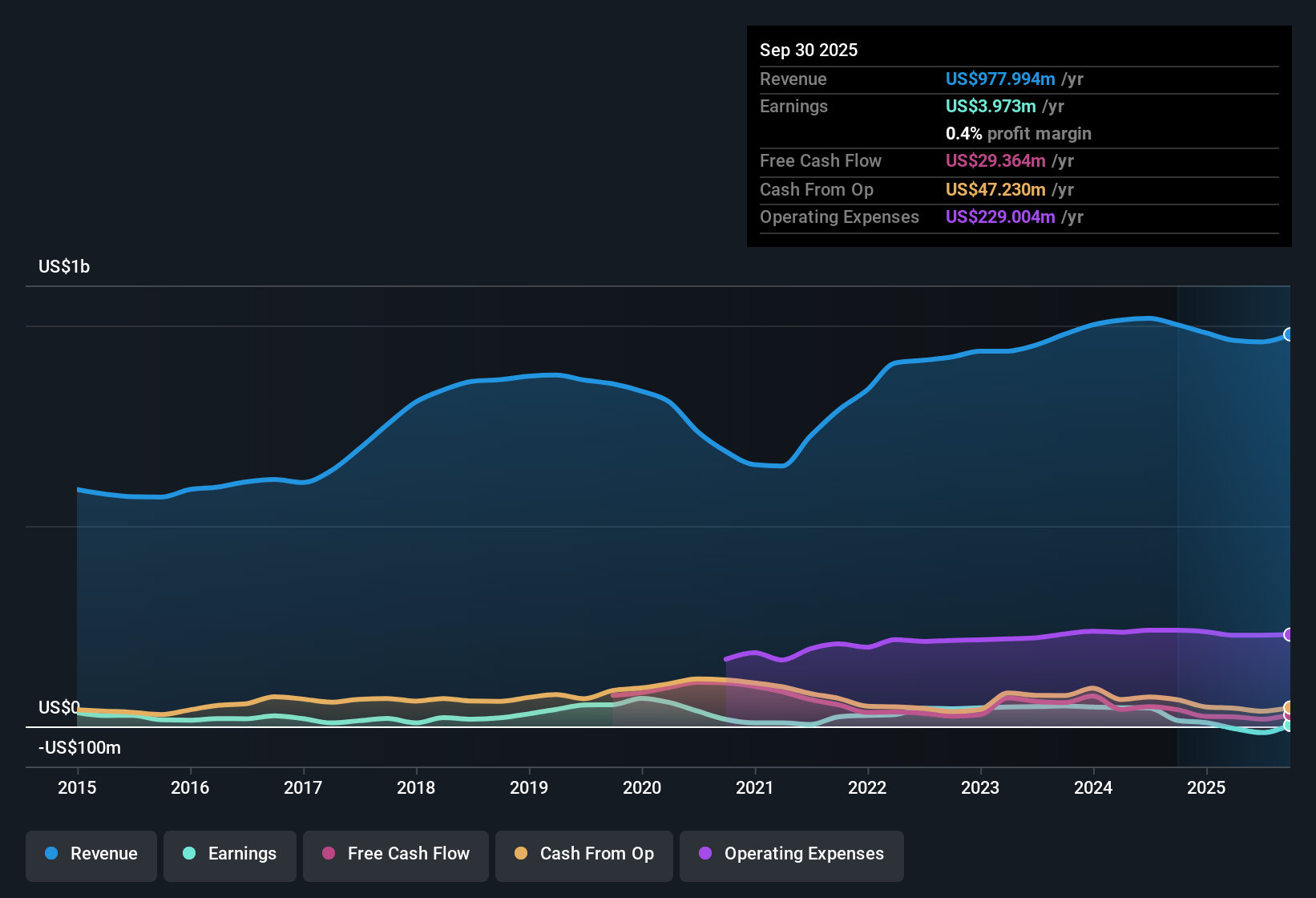

Columbus McKinnon (CMCO) is currently operating at a loss, with losses having grown at an annualized rate of 3% over the past five years. Forecasts call for an impressive turnaround, projecting earnings to grow by 118.25% per year. The company is expected to achieve profitability within three years, even though revenue is anticipated to rise just 3.7% per year, a slower pace than the US market’s 10.3% average. For investors, the flat net profit margins and lack of margin improvement point to ongoing challenges. However, the outlook for a sharp rebound in profitability highlights the company’s potential for a comeback.

See our full analysis for Columbus McKinnon.Next, we will see how these headline numbers stack up against market expectations and the narratives that shape investor sentiment.

See what the community is saying about Columbus McKinnon

Cost Synergies Projected at $70 Million

- The transformational acquisition of Kito Crosby is expected to deliver approximately $70 million in net cost synergies by the end of year three, supporting a significant margin uplift.

- Analysts' consensus view highlights three main impacts of these synergies:

- Cost reductions are modeled to propel Columbus McKinnon’s adjusted EBITDA margin up to 23%, well above recent levels. This supports expectations for improved net profitability even as revenue growth remains modest at 2.1% per year.

- Greater cash flow from these efficiencies is forecasted to facilitate sizable debt reduction, strengthening the company’s balance sheet position and providing more financial flexibility to reinvest for long-term growth.

- To see if these projected improvements match up with broader consensus expectations, check out the full range of analyst takes on Columbus McKinnon. 📊 Read the full Columbus McKinnon Consensus Narrative.

High Leverage Poses Earnings Strain

- The Kito Crosby acquisition has lifted Columbus McKinnon's leverage, exposing it to higher interest expenses and financial pressure as it works through debt reduction.

- Consensus narrative spotlights several risks from this increased leverage:

- Bears argue that substantial debt from the deal could strain cash flows, especially if forecasted synergy benefits are delayed or muted. This may reduce earnings upside in the near term.

- Critics highlight that unexpected expenses, including those related to factory closures or new tariffs, could further erode net margins and threaten the company’s timeline to sustainable profitability, particularly if weak end-market demand continues in Europe and the U.S.

Valuation Looks Attractive Versus Peers

- Columbus McKinnon is currently trading at a Price-to-Sales ratio of 0.5x, well below industry (1.9x) and peer (1.0x) averages. Its $17.35 share price is also well below both the analyst consensus price target of $28.00 and DCF fair value of $28.62.

- Analysts' consensus view sees this valuation gap as a material opportunity:

- The steep discount relative to sector norms supports the bullish case that the market may be underestimating the company’s ability to rebound as cost synergies are realized and leverage is reduced.

- Despite slow revenue forecasts, even modest execution of margin expansion or debt reduction could move the shares closer to fair value. This justifies a potential 61% upside if the company meets consensus targets.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Columbus McKinnon on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at the data from a different angle? Take just a few minutes to craft and share your own take on Columbus McKinnon’s outlook. Do it your way.

A great starting point for your Columbus McKinnon research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

While Columbus McKinnon’s improving outlook is promising, its high debt load and margin pressures mean financial stability remains a key concern.

If you want to sidestep these balance sheet challenges, check out solid balance sheet and fundamentals stocks screener (1986 results) for companies with stronger financial foundations and lower debt burdens.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CMCO

Columbus McKinnon

Designs, manufactures, and markets motion solutions for moving, lifting, positioning, and securing materials worldwide.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives