- United States

- /

- Machinery

- /

- NasdaqGS:CECO

Reassessing CECO Environmental (CECO) Valuation After Its Third-Quarter Earnings and Revenue Beat

Reviewed by Simply Wall St

CECO Environmental (CECO) just delivered a third quarter earnings beat, pairing higher than expected revenue with an all time high share price. That combination has investors paying closer attention.

See our latest analysis for CECO Environmental.

That beat lands on top of a powerful run, with the latest $54.93 share price sitting near record levels after a roughly 75% year to date share price return and a multiyear total shareholder return that shows momentum is still very much intact.

If strong execution at CECO has you rethinking what else could surprise to the upside, this is a good moment to explore fast growing stocks with high insider ownership.

But with the stock hovering just below analyst targets and trading well above its recent ranges, is CECO Environmental still undervalued on its fundamentals, or is the market already baking in years of future growth?

Most Popular Narrative: 6.6% Undervalued

With the narrative fair value sitting above CECO Environmental's last close, the story being told leans toward further upside if the growth path holds.

Record-high backlog and robust pipeline growth, especially in power generation, industrial water, and natural gas infrastructure, suggest that increasing global enforcement of environmental regulations is translating into sustained demand and forward visibility for CECO's solutions, supporting topline revenue growth over the next 18 to 24 months.

Curious how steady revenue expansion, shifting profit margins, and a richer future earnings multiple can still combine into an upside case? The narrative spells out the math.

Result: Fair Value of $58.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, elevated debt-funded growth and potential delays or missteps in new international markets could quickly pressure margins and challenge today’s upbeat outlook.

Find out about the key risks to this CECO Environmental narrative.

Another View: Rich Multiples Signal Less Obvious Value

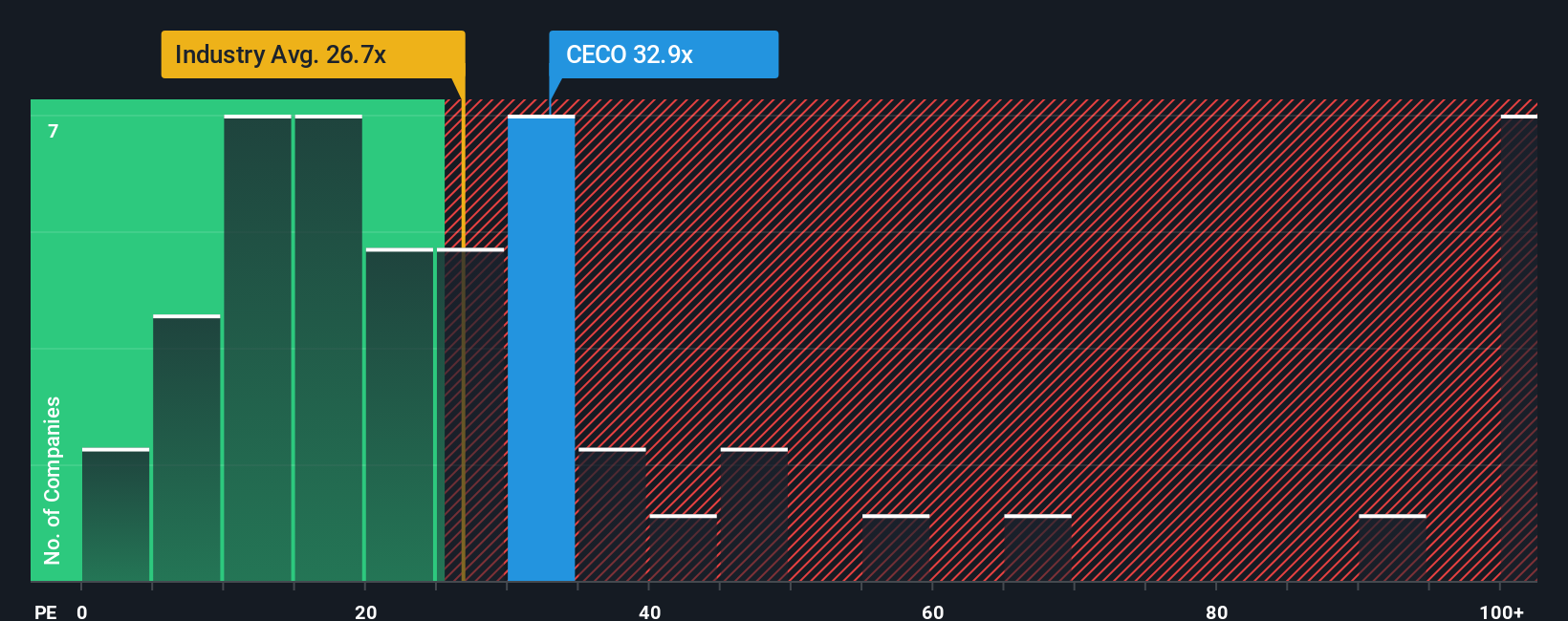

On traditional valuation, CECO looks pricey. Its current P E of 37.7 times sits above both the US Machinery industry at 25.5 times and peers at 35.6 times. It is also roughly double the 18.8 times fair ratio the market could eventually gravitate toward. That gap hints at limited margin for error if growth cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CECO Environmental Narrative

If you see the story differently or like to dig into the numbers yourself, it only takes a few minutes to build your own, Do it your way.

A great starting point for your CECO Environmental research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for your next move?

Before you wrap up on CECO Environmental, put the momentum to work by hunting for your next opportunity with a focused, data driven stock search.

- Capture potential bargains early by scanning these 908 undervalued stocks based on cash flows that may be trading well below what their cash flows suggest they are worth.

- Position yourself for the next wave of innovation by targeting these 26 AI penny stocks that are pushing the boundaries of intelligent automation and data centric business models.

- Lock in reliable income streams by filtering for these 15 dividend stocks with yields > 3% that combine meaningful yields with underlying business strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CECO

CECO Environmental

Provides critical solutions in industrial air quality, industrial water treatment, and energy transition solutions in the United States, the United Kingdom, the Netherlands, China, and internationally.

Proven track record and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026