- United States

- /

- Machinery

- /

- NasdaqGM:BLBD

How Investors Are Reacting To Blue Bird (BLBD) Record Earnings and Reaffirmed 2026 Guidance

Reviewed by Sasha Jovanovic

- Blue Bird Corporation recently announced its earnings results for the fourth quarter and full year ended September 27, 2025, reporting quarterly sales of US$409.37 million and net income of US$36.5 million, both higher than the same period last year.

- A unique aspect of this update is the company’s record performance across multiple metrics and its reaffirmed guidance for 2026, reflecting confidence in its operational outlook and demand trends for its electric and alternative-fuel buses.

- We'll examine how Blue Bird's record quarterly results and strong guidance influence its investment narrative moving forward.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Blue Bird Investment Narrative Recap

To own shares in Blue Bird, an investor must believe in the company’s ability to grow its electric and alternative-fuel bus business, supported by ongoing policy incentives and a stable school bus replacement cycle. The strong quarterly and full-year earnings, combined with reaffirmed 2026 revenue guidance, reinforce the company’s current operational strength, but do not eliminate underlying risks in tariff and funding policy uncertainty which remain the most significant factors for near-term performance.

Among recent developments, the company’s reaffirmation of its full-year 2026 revenue guidance at approximately US$1.5 billion stands out. This announcement signals management’s confidence in both demand and operational execution, especially as electric vehicle sales represent a growing share of total deliveries and depend on sustained government funding, one of the primary catalysts for future performance.

However, it’s important to remember that persistent tariff volatility could still disrupt the order backlog and impact revenue visibility if…

Read the full narrative on Blue Bird (it's free!)

Blue Bird's narrative projects $1.6 billion in revenue and $152.3 million in earnings by 2028. This requires 4.0% yearly revenue growth and a $36.4 million earnings increase from $115.9 million.

Uncover how Blue Bird's forecasts yield a $62.38 fair value, a 19% upside to its current price.

Exploring Other Perspectives

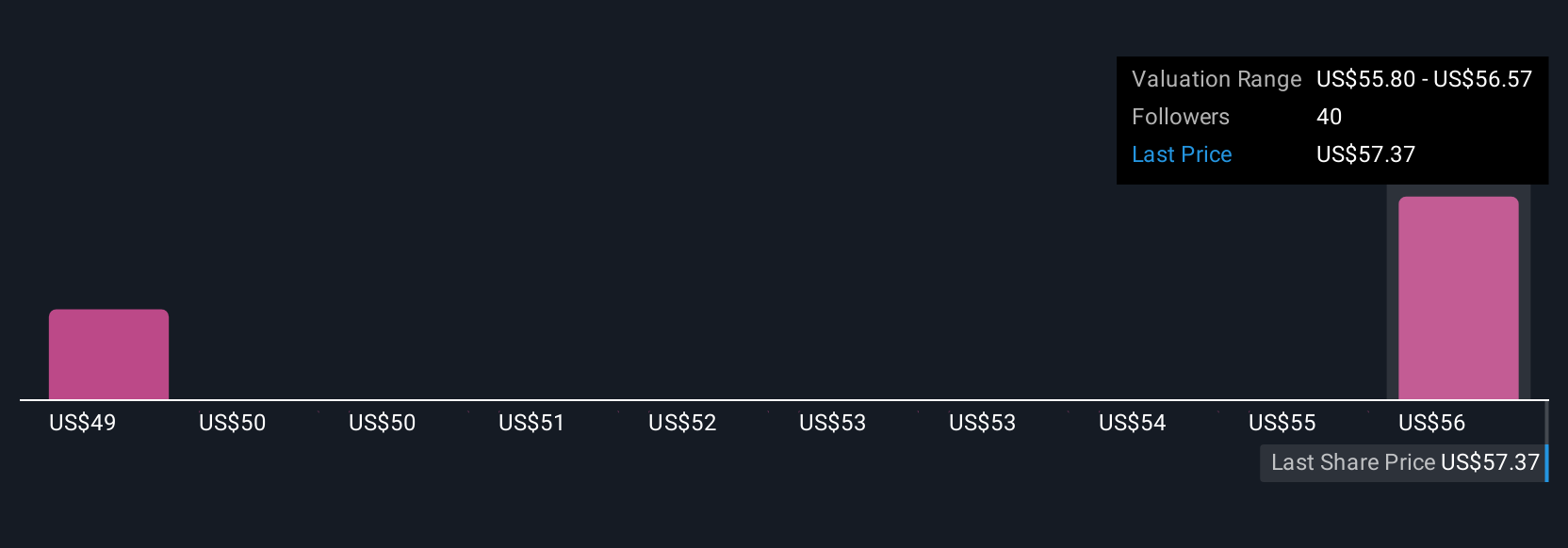

Simply Wall St Community fair value estimates for Blue Bird range from US$62.38 to US$93.86 across three viewpoints. While many see upside, ongoing reliance on government incentives for electric vehicle sales introduces ongoing uncertainty for both growth and profitability, compare estimates and consider how differing assumptions about future funding shape the investment debate.

Explore 3 other fair value estimates on Blue Bird - why the stock might be worth just $62.38!

Build Your Own Blue Bird Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Blue Bird research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Blue Bird research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Blue Bird's overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Blue Bird might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:BLBD

Blue Bird

Designs, engineers, manufactures, and sells school buses in the United States, Canada, and internationally.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.