- United States

- /

- Construction

- /

- NasdaqCM:BBCP

Why Investors Shouldn't Be Surprised By Concrete Pumping Holdings, Inc.'s (NASDAQ:BBCP) 26% Share Price Surge

Those holding Concrete Pumping Holdings, Inc. (NASDAQ:BBCP) shares would be relieved that the share price has rebounded 26% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 4.5% over the last year.

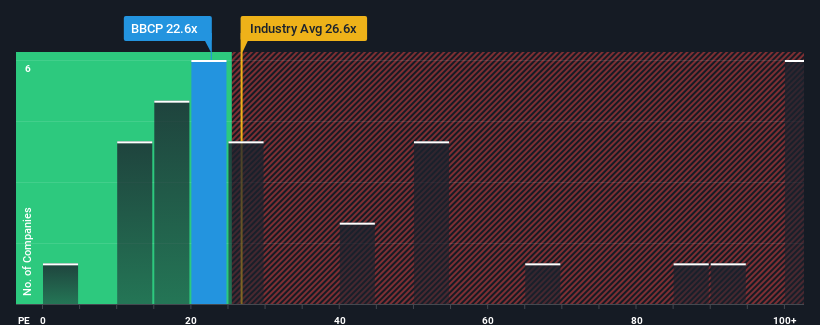

Since its price has surged higher, given around half the companies in the United States have price-to-earnings ratios (or "P/E's") below 17x, you may consider Concrete Pumping Holdings as a stock to potentially avoid with its 22.6x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

We've discovered 1 warning sign about Concrete Pumping Holdings. View them for free.While the market has experienced earnings growth lately, Concrete Pumping Holdings' earnings have gone into reverse gear, which is not great. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

See our latest analysis for Concrete Pumping Holdings

Does Growth Match The High P/E?

There's an inherent assumption that a company should outperform the market for P/E ratios like Concrete Pumping Holdings' to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 19%. At least EPS has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Turning to the outlook, the next three years should generate growth of 26% per annum as estimated by the four analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 10% each year, which is noticeably less attractive.

With this information, we can see why Concrete Pumping Holdings is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Concrete Pumping Holdings' P/E is getting right up there since its shares have risen strongly. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Concrete Pumping Holdings' analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Concrete Pumping Holdings, and understanding should be part of your investment process.

Of course, you might also be able to find a better stock than Concrete Pumping Holdings. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:BBCP

Concrete Pumping Holdings

Provides concrete pumping and waste management services in the United States and the United Kingdom.

Moderate growth potential with questionable track record.

Market Insights

Community Narratives