- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:AXON

How Investors Are Reacting to Axon Enterprise (AXON) Expanding Body Cameras Into Commercial Frontline Markets

Reviewed by Sasha Jovanovic

- Axon Enterprise recently unveiled the Axon Body Workforce Mini, a compact and lightweight body camera designed to enhance safety for retail, healthcare, and other frontline workers with advanced communications, extended battery life, and a front-facing LED display.

- This launch highlights Axon's move beyond law enforcement and into new commercial sectors, addressing escalating workplace violence and opening up significant recurring revenue opportunities through early adoption by major industry partners.

- We’ll examine how Axon’s expansion into frontline commercial markets reshapes its investment outlook and long-term growth potential.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Axon Enterprise Investment Narrative Recap

Being an Axon shareholder means believing that demand for public safety and security technology will extend well beyond law enforcement, with the company’s integrated platforms driving future recurring revenue. The Axon Body Workforce Mini launch expands Axon’s reach into frontline commercial markets, but this move does not materially change the company’s short-term business catalyst: sustaining strong adoption of new AI-powered products within public sector contracts. The core risk remains Axon’s deep reliance on government budgets, making revenues sensitive to political cycles and funding priorities.

Among Axon’s recent announcements, the Loomis Body 4 camera deployment in the commercial security sector stands out. This rollout, together with the new ABW Mini, shows Axon is actively diversifying its customer base, a strategy that could offset exposure to volatility in law enforcement budgets if successful.

Yet, for those focused on risks, there’s an important detail that may be easy to overlook: despite strong demand, Axon’s dependency on public sector spending means that even...

Read the full narrative on Axon Enterprise (it's free!)

Axon Enterprise's narrative projects $4.6 billion in revenue and $476.0 million in earnings by 2028. This requires 24.3% annual revenue growth and a $149.7 million earnings increase from $326.3 million today.

Uncover how Axon Enterprise's forecasts yield a $884.69 fair value, a 23% upside to its current price.

Exploring Other Perspectives

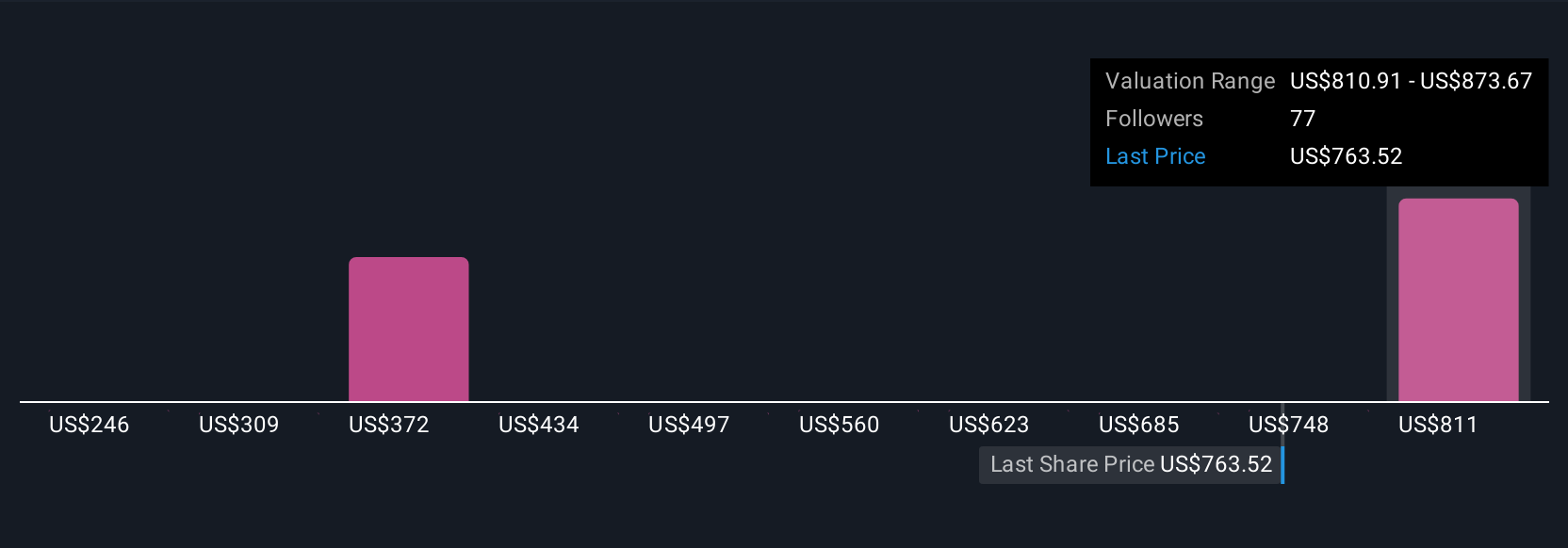

Eight members of the Simply Wall St Community have fair value estimates for Axon ranging widely from US$246 to US$895. With so much variation, it’s clear you’ll find sharply differing views, especially as Axon’s core risk ties back to revenue volatility from changing government budgets.

Explore 8 other fair value estimates on Axon Enterprise - why the stock might be worth as much as 24% more than the current price!

Build Your Own Axon Enterprise Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Axon Enterprise research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Axon Enterprise research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Axon Enterprise's overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AXON

Axon Enterprise

Provides public safety technology solutions in the United States and internationally.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026