- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:AXON

Axon (AXON): Evaluating Current Valuation After Strong Shareholder Returns

Reviewed by Simply Wall St

Axon Enterprise (AXON) has been catching the attention of investors with its recent stock performance and strong year-to-date gains. The company’s steady revenue growth and consistent profitability trends are fueling plenty of valuation discussions at current levels.

See our latest analysis for Axon Enterprise.

Axon’s share price has seen a strong run lately, scoring a 23.87% gain so far this year on the back of robust revenue growth and a surge in investor optimism. Investors have enjoyed a remarkable 74.47% total shareholder return over the past twelve months, indicating that the stock’s momentum is still very much in play, both in the short term and the long term.

If Axon's recent rally has you thinking bigger, this could be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With such impressive gains and strong fundamentals, the question now is whether Axon remains undervalued or if its current success is already fully reflected in the share price. This could leave little room for significant upside from here.

Most Popular Narrative: 16.5% Undervalued

Axon's prevailing narrative points to a potential upside, as its fair value estimate stands well above the last closing price of $738.88. This has investors debating whether the momentum can continue as expectations for rapid expansion meet a high bar for future performance.

Accelerating demand for next-generation technologies, including AI, drones, robotics, body cameras, and digital evidence management, demonstrates a rapid shift by public safety agencies toward modern, cloud-based, and connected solutions. This supports sustained revenue growth as agencies upgrade from legacy systems and adopt more comprehensive SaaS offerings. Fast-track adoption of new Axon products such as Draft One (AI), TASER 10, Axon Body 4, and Dedrone (counter-drone) is driving up average deal values and product bundles per customer, raising net revenue per user and supporting higher long-term margins as the ecosystem deepens.

Want an inside look at just how bullish these projections are? The narrative hinges on growth rates and margin assumptions that rival industry heavyweights. Hungry to find out what pushes Axon's potential sky-high? Dive in to uncover the numbers fueling that bold fair value.

Result: Fair Value of $884.69 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering risks remain, including heavy dependence on government budgets and growing competition. Both of these factors could challenge Axon's growth trajectory ahead.

Find out about the key risks to this Axon Enterprise narrative.

Another View: Price-to-Sales Raises Caution

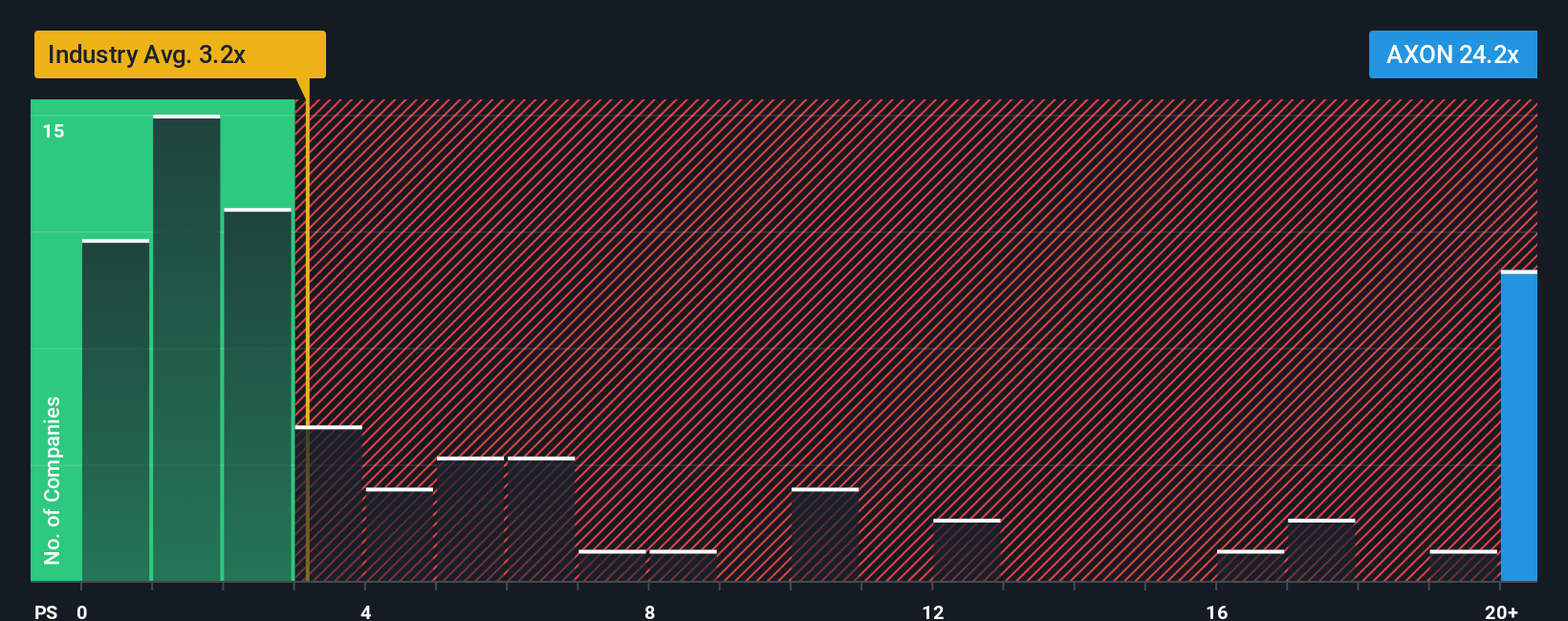

While fair value estimates paint Axon as undervalued, a look at its price-to-sales ratio tells a different story. At 24.3x, Axon's ratio is much higher than both the peer average of 7.9x and the industry average of 3x. This kind of premium signals heightened valuation risk if growth expectations do not materialize. Could current optimism be overstated?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Axon Enterprise Narrative

If you have a different perspective or want to reach your own conclusions, you can dive into the data and craft a personalized narrative in just a few minutes: Do it your way

A great starting point for your Axon Enterprise research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Take control of your investment journey with ideas designed to help you build a smarter, more resilient portfolio. Don’t let the next big opportunity pass you by.

- Capture the strongest yields by tapping into these 24 dividend stocks with yields > 3%, which boasts payouts over 3% for powerful income potential.

- Supercharge your portfolio by seizing opportunities among these 843 undervalued stocks based on cash flows, which are primed for future growth and currently trading below their fair value.

- Capitalize on rapid healthcare trends by browsing these 34 healthcare AI stocks, featuring breakthrough companies at the intersection of AI and medical innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AXON

Axon Enterprise

Develops, manufactures, and sells conducted energy devices (CEDs) under the TASER brand in the United States and internationally.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives