- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:AVAV

AeroVironment (AVAV): Evaluating Valuation Following Major AV_Halo Software Integration with OpenJAUS

Reviewed by Simply Wall St

AeroVironment (AVAV) just announced a fresh collaboration with OpenJAUS, bringing the JAUS standard to its AV_Halo Command software for uncrewed systems. This integration is expected to boost flexibility and streamline OEM deployment in a fast-evolving market.

See our latest analysis for AeroVironment.

AeroVironment’s integration of the JAUS standard arrives after a run of headline-making advances, yet the stock’s momentum has shifted lately. While a stellar year-to-date share price return of 106.66% highlights the big-picture growth story, recent share price pressure, including a sharp 21.11% decline in the last month, shows investors are reassessing short-term risks and expectations. Even so, AeroVironment’s 1-year total shareholder return of 48.61% and a remarkable 290% total return over five years show its longer-term trajectory remains impressive.

If you’re interested in uncovering more opportunities among defense and aerospace innovators, check out the full lineup with our See the full list for free..

Given this leap in product innovation and a hefty long-term return, the real question is whether AeroVironment is now undervalued or if the market is simply reflecting years of anticipated growth. Is this a true buying opportunity, or are future gains already priced in?

Most Popular Narrative: 20.9% Undervalued

With AeroVironment’s most followed narrative suggesting a fair value of $409, compared to a last close price of $323.32, the gap between perceived future potential and the current market price is wide. The driving force behind this outlook is a series of aggressive business shifts and high expectations for future performance, making the upcoming years pivotal for investors hoping to benefit from the company’s projected trajectory.

The company's strategic focus on developing modular, interoperable, and software-defined platforms, including the newly launched AV Halo open software ecosystem, directly aligns with the accelerating adoption of AI-powered autonomy and network-centric warfare. This enables future premium pricing, increased service revenues, and gross margin expansion as these high-value platforms are deployed at scale.

What’s driving that high fair value? The narrative is built on ambitious assumptions about next-level revenue acceleration, wider margins, and disruptive platform launches. There is a bold, quantified bet on how AeroVironment rides the defense innovation wave. Uncover exactly what projections are powering such a strong upside case in the full narrative.

Result: Fair Value of $409 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, uncertainty remains if AeroVironment's heavy reliance on U.S. contracts or increasing competition in unmanned systems affects its growth trajectory.

Find out about the key risks to this AeroVironment narrative.

Another View: Looking Through a Market Valuation Lens

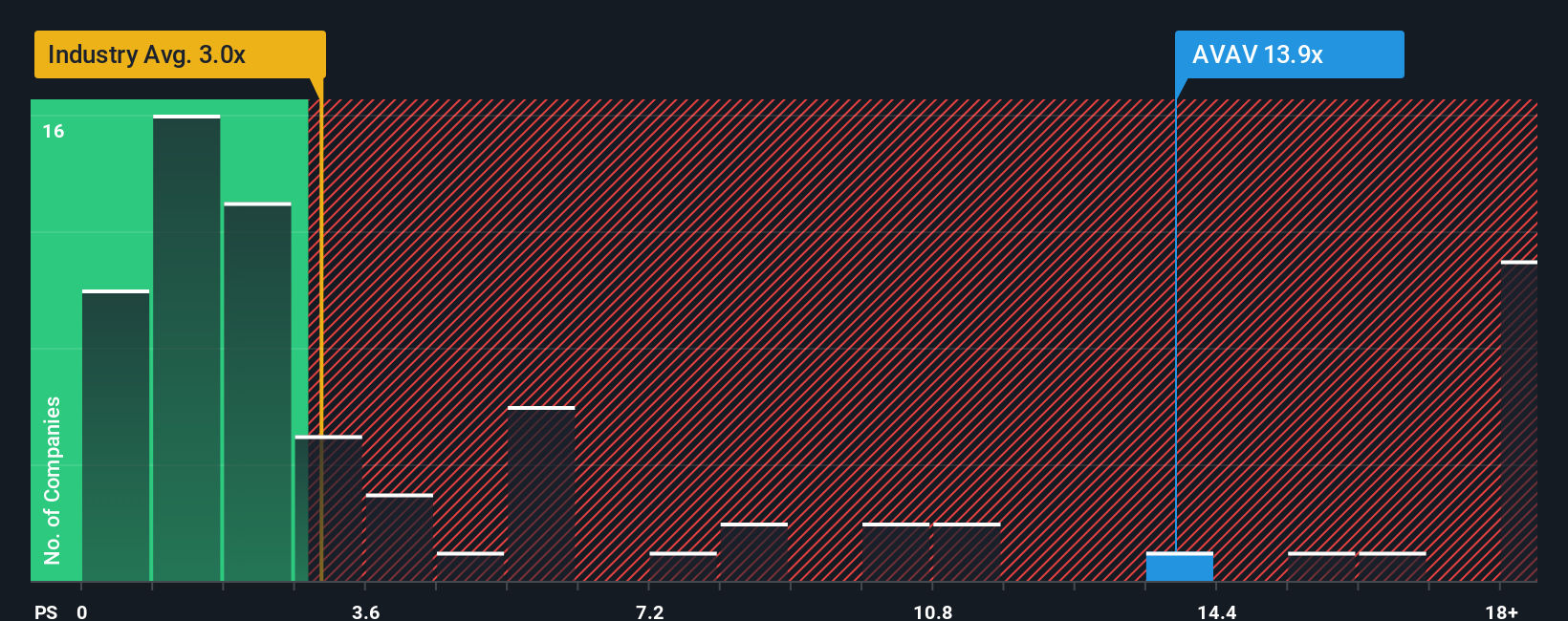

Looking at AeroVironment’s valuation from a market perspective, the company’s price-to-sales ratio stands at 14.8x, which is far higher than the US Aerospace & Defense industry average of 3x and the peer average of 6.6x. Compared to our calculated fair ratio of 5.8x, this premium could signal elevated expectations and the risk that the share price might move closer to broader market levels over time. Is the market overreaching here, or is this just the new normal for a high-growth defense company?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own AeroVironment Narrative

If these narratives don't quite fit your view or you want to dive into the numbers yourself, it's easy to spin up your own AeroVironment story in just a few minutes. Do it your way.

A great starting point for your AeroVironment research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Go further with your portfolio by finding standout opportunities beyond AeroVironment. Don’t risk missing out on powerful trends that could shape tomorrow’s markets.

- Unlock income potential as you find stable earnings and attractive yields with these 14 dividend stocks with yields > 3% for your next winning pick.

- Advance your growth strategy by focusing on underappreciated companies trading below intrinsic value with these 865 undervalued stocks based on cash flows.

- Capture the disruptive upside of artificial intelligence when you target innovative leaders powering the AI revolution through these 25 AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AVAV

AeroVironment

Designs, develops, produces, delivers, and supports a portfolio of robotic systems and related services for government agencies and businesses in the United States and internationally.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives