- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:AVAV

AeroVironment (AVAV): Assessing Valuation After New AV_Halo Upgrades and Puma LE Navigation Enhancements

Reviewed by Simply Wall St

AeroVironment (AVAV) has been on a busy product streak, rolling out AV_Halo CORTEX and MENTOR while upgrading Puma LE with GNSS denied navigation, a cluster of moves that sharpens its multi domain autonomy story.

See our latest analysis for AeroVironment.

Despite the recent product and leadership news, AeroVironment’s $278.39 share price has pulled back, with a 1 month share price return of minus 15.55 percent. However, momentum still looks intact given the 90 day share price return of 17.51 percent and a standout 3 year total shareholder return of 238.96 percent. This suggests investors are treating the latest volatility as a pause in a longer uptrend rather than a change in the story.

If this kind of defense tech momentum has your attention, it is worth exploring other opportunities in aerospace and defense stocks for potential names riding similar multi domain trends.

With earnings and revenue growth surging while the stock still trades at a steep discount to analyst targets, investors face a key question: is AeroVironment quietly undervalued here or already pricing in its next leg of growth?

Most Popular Narrative Narrative: 31.1% Undervalued

With AeroVironment last closing at $278.39 against a narrative fair value of about $404, the valuation story leans heavily toward upside and ambitious growth assumptions.

The analysts have a consensus price target of $298.727 for AeroVironment based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $335.0, and the most bearish reporting a price target of $225.0.

Want to see what kind of revenue surge, margin lift, and future earnings power has to materialize to back that premium valuation curve? The narrative spells out aggressive growth targets, expanding profitability, and a lofty future earnings multiple that would usually be reserved for elite growth names. Curious which assumptions really carry the weight in that fair value math, and how far expectations stretch beyond today’s losses? Dive in to unpack the full story behind those numbers.

Result: Fair Value of $404.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution missteps on the BlueHalo integration, or a surprise reset in U.S. defense funding, could quickly puncture the current growth narrative.

Find out about the key risks to this AeroVironment narrative.

Another Way To Look At Value

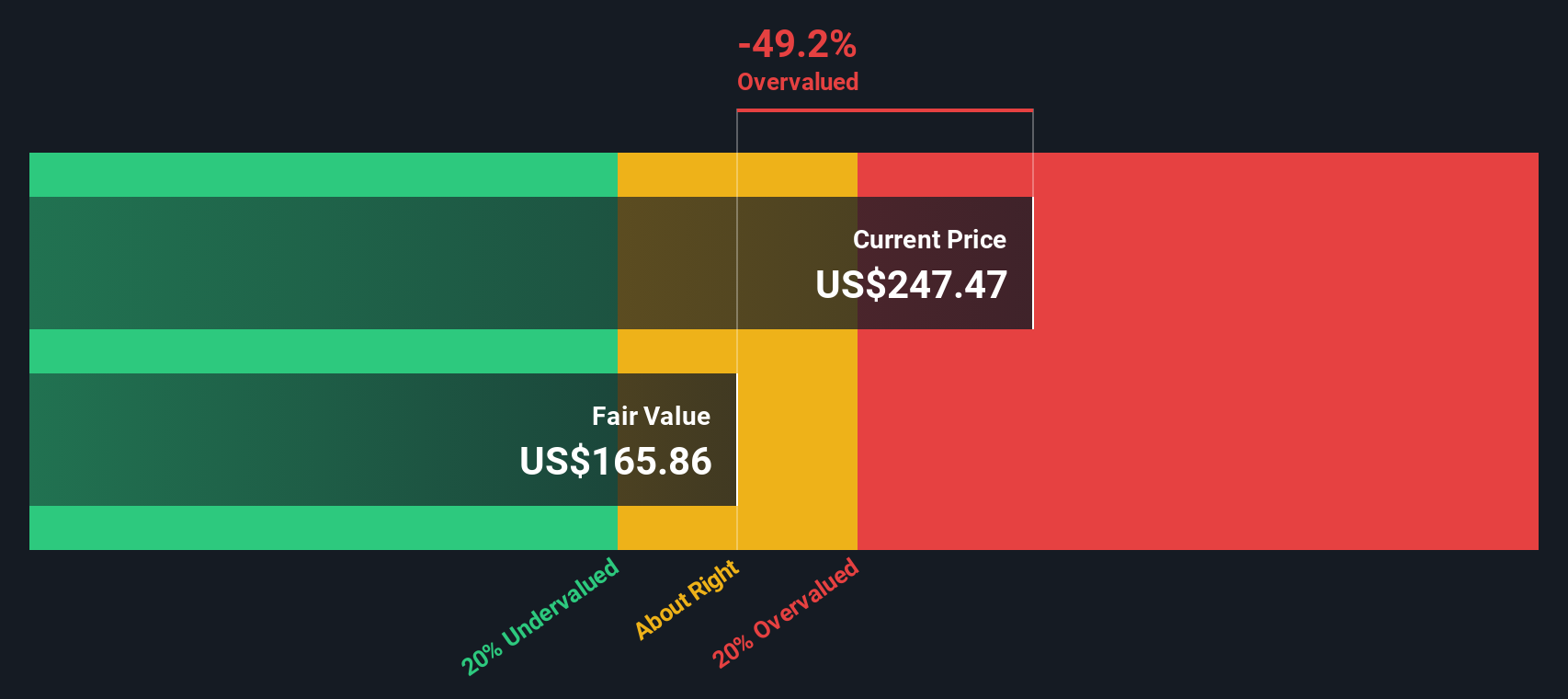

Our DCF model paints a cooler picture than the bullish narrative, suggesting AVAV is trading above an intrinsic value of about $191. That implies downside rather than upside if cash flows fall short. Are investors paying today for growth that may take longer to arrive?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own AeroVironment Narrative

If you are skeptical of this view or simply want to dig into the numbers yourself, you can build a personalized narrative in just a few minutes: Do it your way.

A great starting point for your AeroVironment research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next moves with focused stock ideas from the Simply Wall St screener, built to uncover opportunities you will not want to overlook.

- Target resilient cash generators with these 15 dividend stocks with yields > 3% that aim to deliver income today while still leaving room for long term growth.

- Ride structural tailwinds by tapping into these 30 healthcare AI stocks, where cutting edge innovation meets durable real world demand.

- Position early in transformative tech with these 81 cryptocurrency and blockchain stocks that could reshape finance, infrastructure and digital asset ecosystems.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AVAV

AeroVironment

Designs, develops, produces, delivers, and supports a portfolio of robotic systems and related services for government agencies and businesses in the United States and internationally.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026