- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:ATRO

Astronics (ATRO) Is Down 6.3% After Airbus Cuts A320 Delivery Targets Over Panel Issues

Reviewed by Sasha Jovanovic

- Astronics Corporation recently came under pressure after Airbus cut its 2025 A320-family delivery target due to fuselage panel quality issues, raising questions about future demand visibility for key aerospace suppliers.

- At the same time, fresh Buy ratings from Craig-Hallum and TD Cowen highlight how analysts currently view Astronics’ long-term positioning in the aerospace supply chain.

- We’ll now examine how Airbus’ reduced A320-family delivery outlook could influence Astronics’ investment narrative around aircraft production-driven growth.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

Astronics Investment Narrative Recap

To own Astronics, you need to believe in a recovery story tied to rising aircraft production and better execution in its core aerospace and Test businesses. Airbus’ modest A320 delivery cut looks more sentiment driven than a material hit to Astronics’ near term production led growth catalyst, while leaving its biggest current risks around execution missteps, tariff exposure, and heavy commercial aerospace dependence largely intact.

The recent initiation and reaffirmation of Buy ratings from Craig Hallum and TD Cowen, with one target at US$65.00, are particularly relevant here because they reflect how some analysts are weighing temporary aircraft delivery noise against Astronics’ broader role in the supply chain and its ongoing restructuring and Test segment clean up efforts.

Yet beneath the Airbus headlines, investors should be aware that Astronics’ heavy reliance on commercial aerospace cycles means...

Read the full narrative on Astronics (it's free!)

Astronics' narrative projects $956.5 million revenue and $86.1 million earnings by 2028. This requires 5.1% yearly revenue growth and an $89.8 million earnings increase from -$3.7 million today.

Uncover how Astronics' forecasts yield a $62.75 fair value, a 23% upside to its current price.

Exploring Other Perspectives

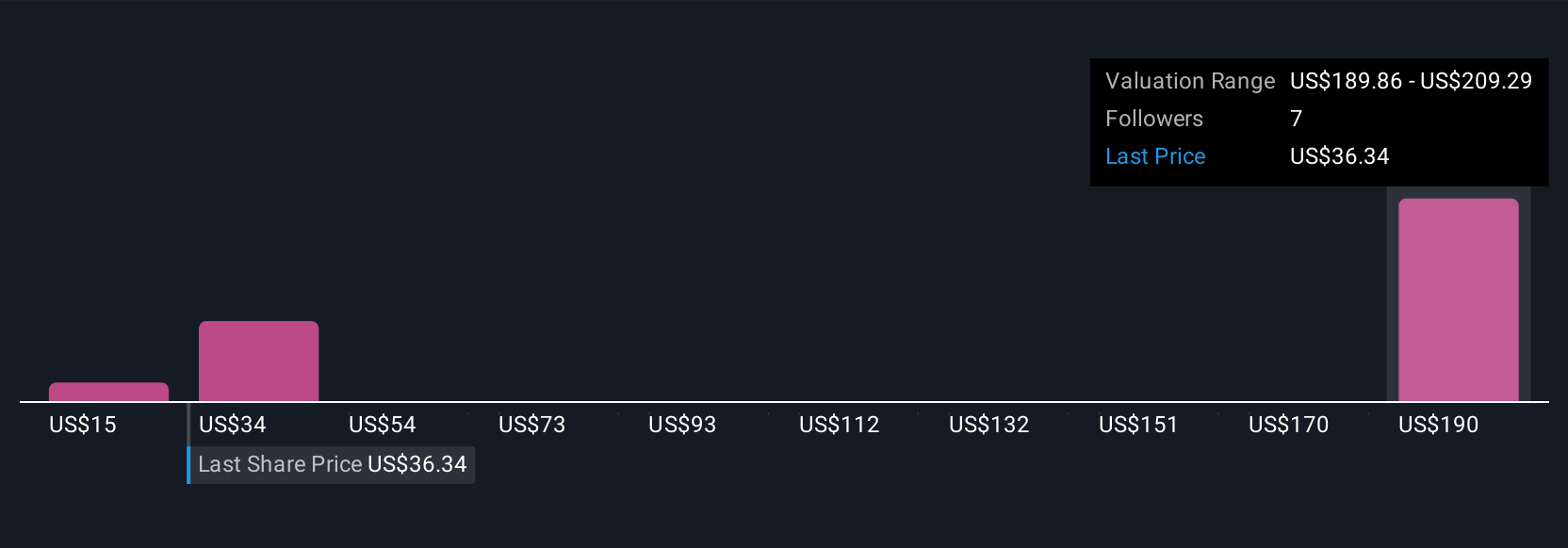

Five Simply Wall St Community members currently value Astronics between US$15 and US$74.37, showing a very wide spread of opinions. As you weigh those views, remember how exposed Astronics remains to commercial aerospace production swings and what that could mean for its earnings resilience.

Explore 5 other fair value estimates on Astronics - why the stock might be worth as much as 45% more than the current price!

Build Your Own Astronics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Astronics research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Astronics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Astronics' overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ATRO

Astronics

Through its subsidiaries, designs and manufactures products for the aerospace, defense, and electronics industries in the United States, rest of North America, Asia, Europe, South America, and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026