- United States

- /

- Electrical

- /

- NasdaqGS:AMSC

American Superconductor (AMSC) Reports Impressive Q1 Sales of US$72 Million

Reviewed by Simply Wall St

American Superconductor (AMSC) recently provided strong corporate guidance, predicting Q2 revenues between $65 million and $70 million, along with a net income exceeding $2 million. This, combined with the company's reported Q1 sales of $72 million—an impressive increase from the previous year's figure—and a net income of $6.7 million, likely influenced its substantial 86% share price growth over the last quarter. This rise was notable given the mixed performance of broader indexes, such as the Nasdaq, which hit record highs during the same period, potentially adding upward momentum to AMSC's significant share appreciation.

We've identified 3 risks for American Superconductor that you should be aware of.

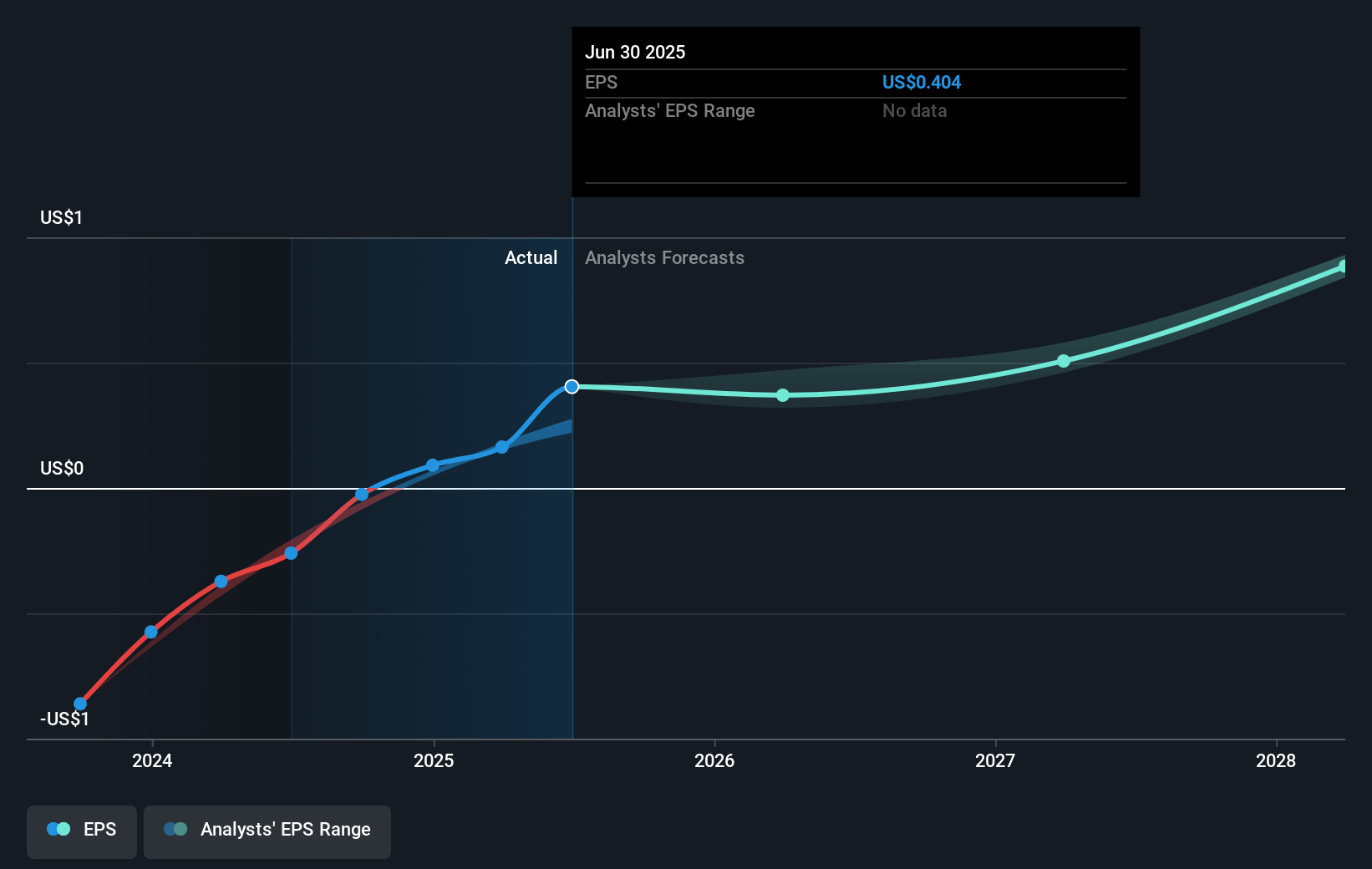

The recent guidance from American Superconductor (AMSC), projecting Q2 revenues between US$65 million and US$70 million with a net income exceeding US$2 million, aligns well with its previously reported strong Q1 performance. This robust outlook has contributed to a significant short-term share price increase, up 86% over the past quarter. This momentum echoes the company's broader three-year performance, where total shareholder returns have seen a very large increase of 1014.46%, illustrating its capacity for substantial long-term growth. Notably, over the past year, AMSC has surpassed both the US market, which returned 19.1%, and the US Electrical industry, with a return of 53.6%.

The bullish revenue projections continue to affirm analysts' positive forecasts, anticipating annual revenue growth of 12.4% over the next three years and a significant rise in earnings. This latest guidance reinforces expectations and potentially justifies the consensus price target of US$66.67, suggesting a 21.8% upside from the current share price of US$54.72. If the company's ability to leverage global semiconductor demand and renewable energy trends materializes as expected, it could solidify its revenue trajectory and justify substantial earnings growth forecasts. However, risks remain from one-time factors and reliance on cyclical markets, which could challenge margins if growth momentum decelerates. Hence, while the recent positive news supports AMSC's current valuation, ongoing performance relative to sector dynamics and internal efficiency will be crucial to achieving the price target.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMSC

American Superconductor

Provides megawatt-scale power resiliency solutions worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives