- United States

- /

- Banks

- /

- NYSE:WAL

How Alleged Borrower Fraud and Legal Probes at Western Alliance (WAL) May Shift Its Risk Profile

Reviewed by Sasha Jovanovic

- Western Alliance Bancorporation recently disclosed it had filed a lawsuit against Cantor Group V LLC, alleging borrower fraud related to collateral loans, which prompted further scrutiny by external parties.

- This led Rosen Law Firm to announce an investigation into potential securities claims, reflecting heightened legal and compliance concerns among shareholders and stakeholders.

- We'll explore how the disclosure of alleged borrower fraud and legal investigations may influence risk factors in Western Alliance's investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Western Alliance Bancorporation Investment Narrative Recap

To be a shareholder in Western Alliance Bancorporation, you need to believe in the long-term strength of its loan and deposit growth in core Western and Sun Belt markets, as well as its ongoing portfolio diversification and digital banking initiatives. The disclosure of alleged borrower fraud and related legal scrutiny introduces new uncertainty but does not appear to materially impact the most important near-term catalyst, continued business momentum and operational efficiency, though it does elevate legal and compliance risk, which is now the most acute concern for the business.

Among the company’s recent announcements, the Q3 earnings release stands out as particularly relevant. The report showed growth in net interest income and net income year-over-year, signaling ongoing core performance despite external pressures. This financial update now sits in sharper contrast to fresh legal and compliance risks, offering investors a reminder that...

Read the full narrative on Western Alliance Bancorporation (it's free!)

Western Alliance Bancorporation's outlook forecasts $4.4 billion in revenue and $1.4 billion in earnings by 2028. This projection assumes an 11.9% annual revenue growth rate and a $566.6 million increase in earnings from the current $833.4 million.

Uncover how Western Alliance Bancorporation's forecasts yield a $102.06 fair value, a 24% upside to its current price.

Exploring Other Perspectives

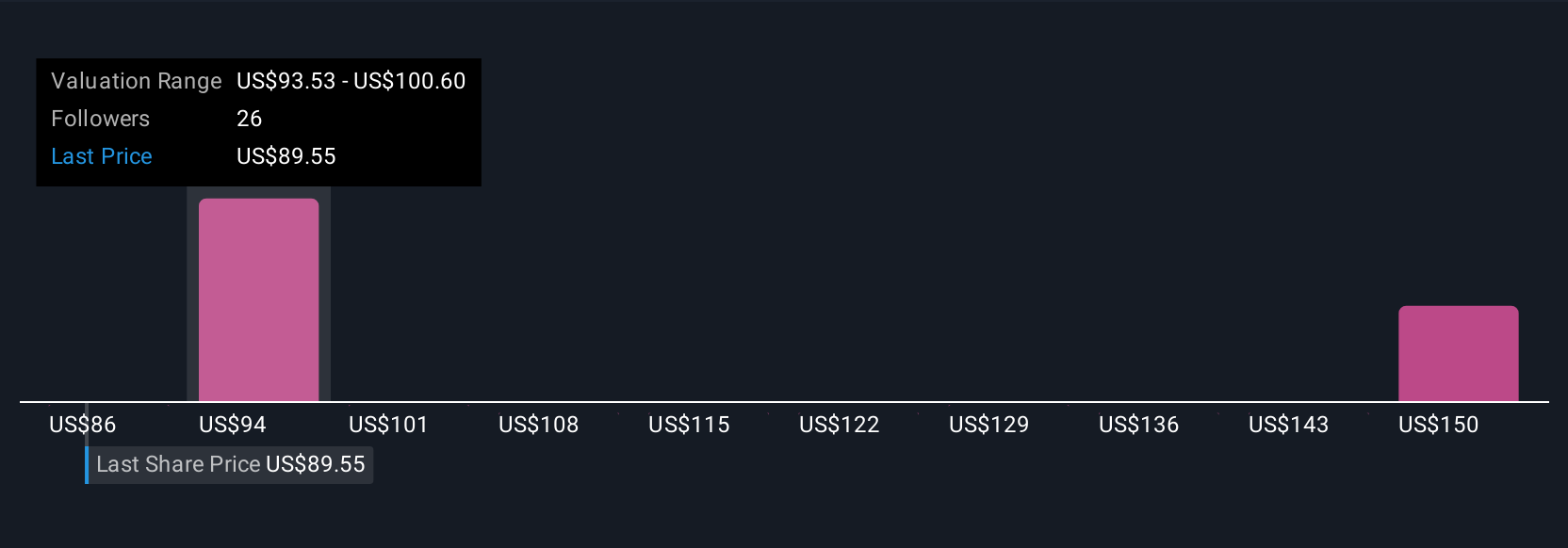

Six Simply Wall St Community fair value estimates for Western Alliance range from US$96.06 to US$169.43 per share. While business performance and earnings resilience are being tested by borrower fraud allegations, differences in investor outlook invite you to explore these competing viewpoints further.

Explore 6 other fair value estimates on Western Alliance Bancorporation - why the stock might be worth just $96.06!

Build Your Own Western Alliance Bancorporation Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Western Alliance Bancorporation research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Western Alliance Bancorporation research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Western Alliance Bancorporation's overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Western Alliance Bancorporation might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WAL

Western Alliance Bancorporation

Operates as the bank holding company for Western Alliance Bank that provides various banking products and related services primarily in Arizona, California, and Nevada.

Very undervalued with solid track record.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026