- United States

- /

- Banks

- /

- NYSE:TFC

Truist Financial (TFC) Valuation After Tech Leadership Hire Signals Renewed Digital Push

Reviewed by Simply Wall St

Truist Financial (TFC) just tapped former Capital One retail bank technology leader Lo Li to run technology, data and operations for its Consumer and Small Business Banking unit, underscoring a fresh push into digital execution.

See our latest analysis for Truist Financial.

Investors seem to be warming to that message, with a roughly 6 percent 1 month share price return and year to date gains near 10 percent. A solid 3 year total shareholder return above 30 percent suggests momentum is gradually rebuilding rather than fading.

If this kind of tech focused leadership shift has you thinking more broadly about financial innovation, it could be worth exploring fast growing stocks with high insider ownership as potential next wave candidates.

Yet with Truist still trading at a meaningful intrinsic discount despite recent gains, investors face a key question: Is this an understated value story in the making, or has the market already priced in its digital growth ambitions?

Most Popular Narrative Narrative: 6% Undervalued

With Truist Financial last closing at $47.53 against a narrative fair value near $50.55, the gap points to modest upside if the story plays out.

Ongoing technology investments, such as launching innovative payment capabilities and fully integrating legacy and new digital lending platforms, are expected to further improve operating efficiency and operating leverage, leading to structurally lower cost to income ratios and higher earnings over time.

Want to see what kind of revenue runway and margin lift could justify that higher value, including how future earnings and share count are expected to evolve? Dig into the full narrative.

Result: Fair Value of $50.55 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sizable branch and CRE exposure means cost pressures or credit losses could quickly erase the upside implied by today’s modest valuation gap.

Find out about the key risks to this Truist Financial narrative.

Another Lens On Valuation

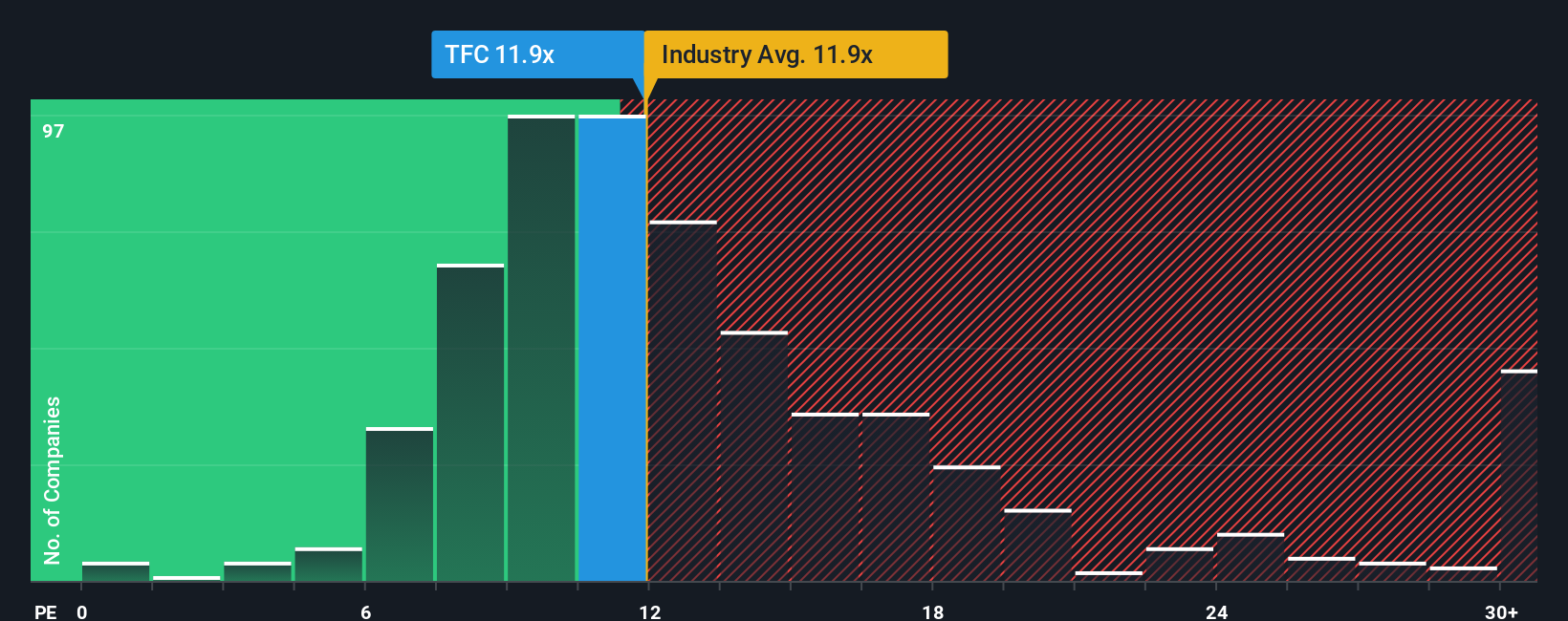

On earnings, Truist trades at 12.4 times, a little richer than the US banks average of 11.6 times but slightly cheaper than its peer group at 12.6 times and below a fair ratio of 14.2 times. This hints at upside if sentiment improves but also leaves less room for missteps.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Truist Financial Narrative

If you see the numbers differently or want to stress test your own assumptions, you can quickly build a personalized thesis in minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Truist Financial.

Looking for more investment ideas?

Do not stop your research with one bank. Use the Simply Wall St Screener to uncover high conviction ideas that could reshape your portfolio’s next big winners.

- Capture income opportunities by targeting companies in these 15 dividend stocks with yields > 3% that aim to deliver cash returns above market average.

- Position your portfolio for the next wave of automation and data disruption by screening for innovators among these 26 AI penny stocks.

- Explore potential long term upside by hunting for quality businesses trading below intrinsic value through these 907 undervalued stocks based on cash flows based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Truist Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TFC

Truist Financial

A financial services company, provides banking and trust services in the Southeastern and Mid-Atlantic United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026