- United States

- /

- Banks

- /

- NYSE:PNC

Here's Why We Think PNC Financial Services Group (NYSE:PNC) Is Well Worth Watching

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like PNC Financial Services Group (NYSE:PNC). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Check out our latest analysis for PNC Financial Services Group

How Fast Is PNC Financial Services Group Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. That makes EPS growth an attractive quality for any company. To the delight of shareholders, PNC Financial Services Group has achieved impressive annual EPS growth of 47%, compound, over the last three years. That sort of growth rarely ever lasts long, but it is well worth paying attention to when it happens.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Our analysis has highlighted that PNC Financial Services Group's revenue from operations did not account for all of their revenue in the previous 12 months, so our analysis of its margins might not accurately reflect the underlying business. It was a year of stability for PNC Financial Services Group as both revenue and EBIT margins remained have been flat over the past year. That's not a major concern but nor does it point to the long term growth we like to see.

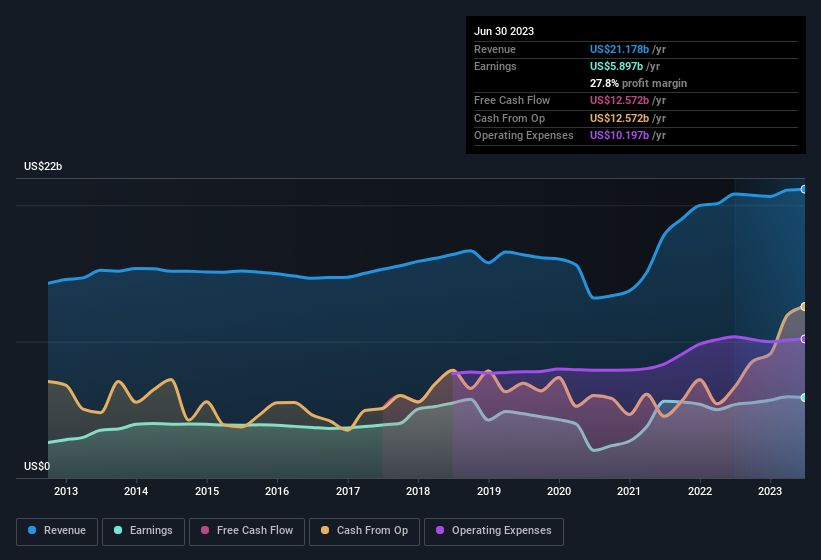

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for PNC Financial Services Group?

Are PNC Financial Services Group Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Despite US$1.2m worth of sales, PNC Financial Services Group insiders have overwhelmingly been buying the stock, spending US$1.4m on purchases in the last twelve months. An optimistic sign for those with PNC Financial Services Group in their watchlist. It is also worth noting that it was Chairman William Demchak who made the biggest single purchase, worth US$1.0m, paying US$153 per share.

Along with the insider buying, another encouraging sign for PNC Financial Services Group is that insiders, as a group, have a considerable shareholding. We note that their impressive stake in the company is worth US$181m. We note that this amounts to 0.4% of the company, which may be small owing to the sheer size of PNC Financial Services Group but it's still worth mentioning. This should still be a great incentive for management to maximise shareholder value.

Should You Add PNC Financial Services Group To Your Watchlist?

PNC Financial Services Group's earnings per share have been soaring, with growth rates sky high. Just as heartening; insiders both own and are buying more stock. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe PNC Financial Services Group deserves timely attention. We don't want to rain on the parade too much, but we did also find 1 warning sign for PNC Financial Services Group that you need to be mindful of.

Keen growth investors love to see insider buying. Thankfully, PNC Financial Services Group isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:PNC

PNC Financial Services Group

Operates as a diversified financial services company in the United States.

Flawless balance sheet established dividend payer.