- United States

- /

- Banks

- /

- NYSE:PNC

Does Recent M&A Speculation Make PNC a Bargain or a Stock to Avoid in 2025?

Reviewed by Bailey Pemberton

- Wondering if PNC Financial Services Group is a hidden bargain or an overhyped name? You are not alone; many investors are taking a closer look at its value right now.

- The stock has posted a modest rise of 2.1% in the past week and 5.4% over the last month, but it is essentially flat for 2024 and has dipped 5.6% from a year ago despite strong multi-year gains.

- Market sentiment has shifted recently after increased activity around large bank stocks, including regulatory policy changes and an uptick in M&A speculation that have put regional banks like PNC in the spotlight. Headlines around digital banking trends and sector consolidation have also driven short-term volatility for the stock.

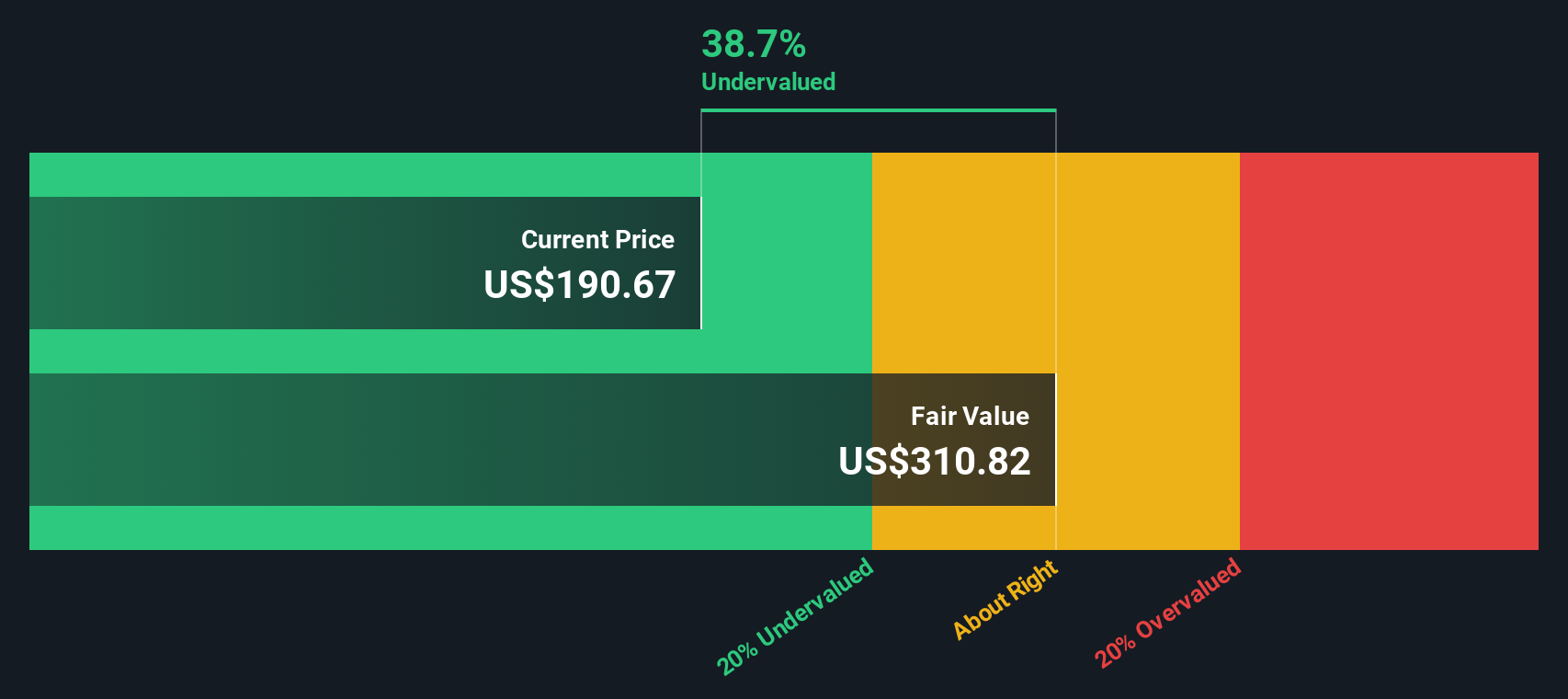

- Out of six key checks, PNC Financial Services Group is undervalued in four according to our valuation score (4/6). Let's break down the numbers using some classic valuation approaches, and stay tuned to discover an approach that could give you a clearer picture than traditional models alone.

Approach 1: PNC Financial Services Group Excess Returns Analysis

The Excess Returns valuation model focuses on analyzing how much value a company can create by earning returns above its cost of equity. This method looks at whether the returns generated on shareholders’ equity, after covering the required return of investors, translate into intrinsic value for shareholders over the long term.

For PNC Financial Services Group, the numbers tell a compelling story:

- Book Value: $135.67 per share

- Stable EPS: $18.33 per share (Source: Weighted future Return on Equity estimates from 13 analysts.)

- Cost of Equity: $11.26 per share

- Excess Return: $7.08 per share

- Average Return on Equity: 12.29%

- Stable Book Value: $149.20 per share (Source: Weighted future Book Value estimates from 12 analysts.)

Based on these inputs, the Excess Returns model estimates PNC’s intrinsic value at $314.31 per share. With the current market price sitting nearly 39% below this estimate, the model suggests that PNC Financial Services Group is significantly undervalued relative to its long-term return potential.

Result: UNDERVALUED

Our Excess Returns analysis suggests PNC Financial Services Group is undervalued by 38.8%. Track this in your watchlist or portfolio, or discover 923 more undervalued stocks based on cash flows.

Approach 2: PNC Financial Services Group Price vs Earnings

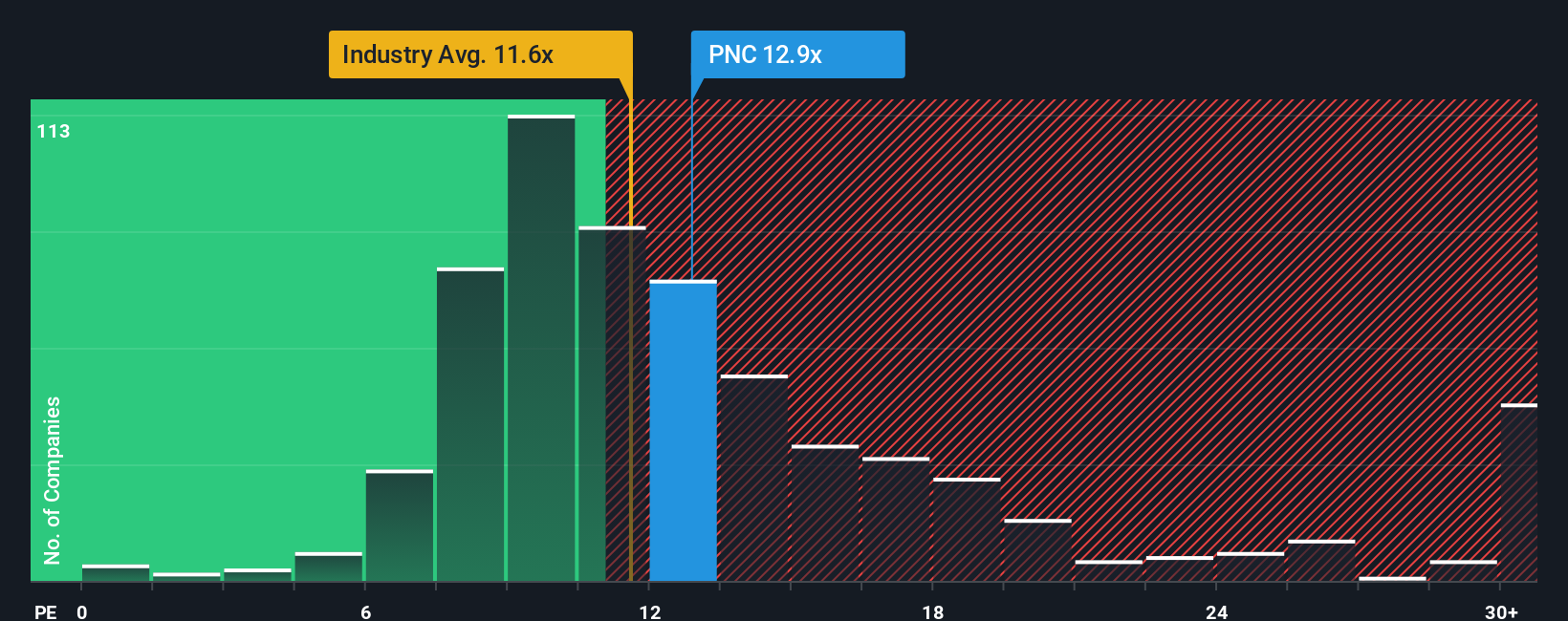

The Price-to-Earnings (PE) ratio is a popular valuation metric for profitable companies like PNC Financial Services Group because it connects a company’s share price directly to its earnings. This makes it easy for investors to quickly gauge how much they are paying for each dollar of earnings, which is especially useful when comparing companies across the same industry or sector.

Growth expectations and risk play a big role in what a “normal” or “fair” PE ratio looks like. Fast-growing firms or those with stable, predictable profits often trade at higher PE ratios, while slower-growth or riskier companies often command a lower multiple. Macro factors, earnings volatility, and the company’s size can all influence where a company’s PE ratio should sit relative to peers and the broader industry.

Right now, PNC Financial Services Group trades at a PE ratio of 12.25x. This is slightly higher than the banking industry average of 11.40x, but lower than the peer group average of 17.81x. More importantly, Simply Wall St’s proprietary "Fair Ratio" for PNC is 13.99x. The Fair Ratio goes beyond basic peer and industry comparisons by incorporating the company's expected earnings growth, profit margins, company size, sector trends, and risk profile. This offers a more holistic perspective on what investors should be willing to pay.

Since PNC’s actual PE ratio is just below the Fair Ratio and within a tight range, the stock appears fairly valued on this measure.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1443 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your PNC Financial Services Group Narrative

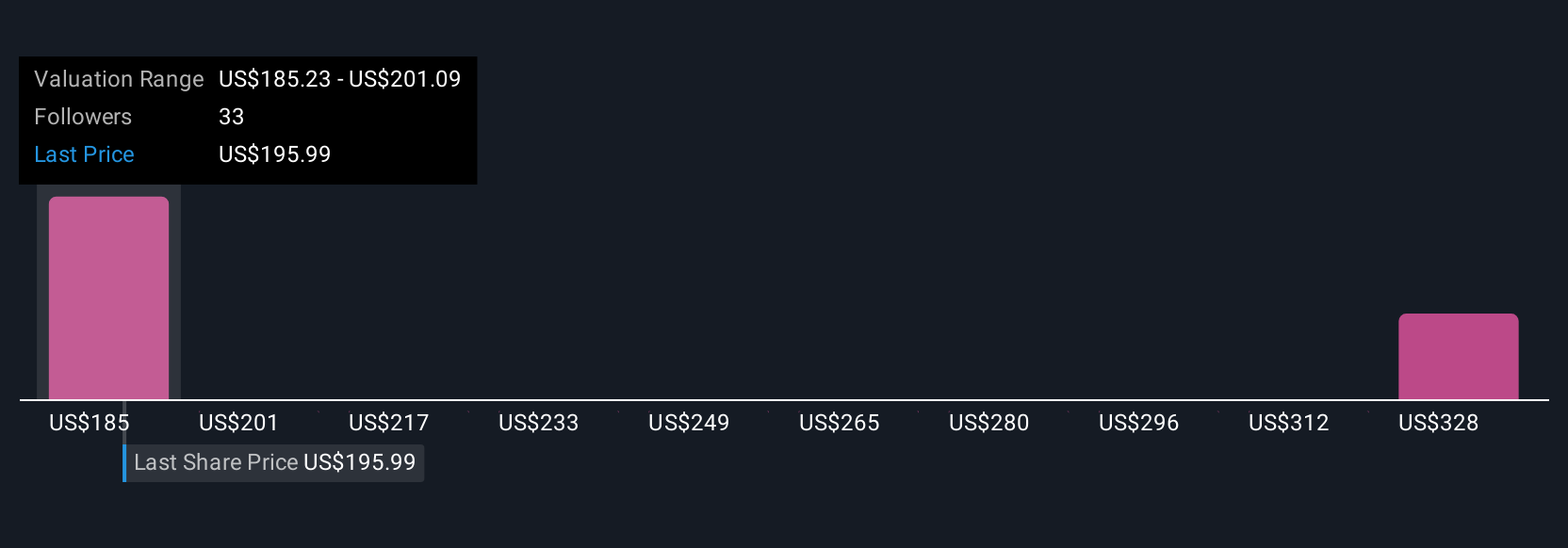

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, story-driven approach where you combine your own perspective on PNC Financial Services Group, considering its business, growth potential, risks, and strategy, with hard numbers like estimated fair value, future revenue, earnings, and margins. Narratives directly link the company's story to a financial forecast and then to a fair value, giving your investment decisions a personalized, data-driven foundation.

This tool is easy to use and built right into Simply Wall St’s Community page, where millions of investors share their takes. Instead of just crunching numbers, Narratives help you decide when action may be warranted by comparing the Fair Value, based on your story and estimates, to today’s Price. Each Narrative also automatically updates as fresh news or earnings are released. For example, regarding PNC Financial Services Group, some investors have a bullish narrative driven by anticipated post-acquisition expansion and see a fair value near $238, while others are more cautious, citing legal and earnings pressures with estimates closer to $186. Narratives empower you to make informed decisions by making both numbers and story dynamic, accessible, and actionable.

Do you think there's more to the story for PNC Financial Services Group? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PNC

PNC Financial Services Group

Operates as a diversified financial services company in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026