OFG Bancorp's (NYSE:OFG) investors are due to receive a payment of US$0.08 per share on 15th of July. This means the annual payment will be 1.2% of the current stock price, which is lower than the industry average.

See our latest analysis for OFG Bancorp

OFG Bancorp's Earnings Easily Cover the Distributions

Even a low dividend yield can be attractive if it is sustained for years on end. OFG Bancorp is quite easily earning enough to cover the dividend, however it is being let down by weak cash flows. We think that cash flows should take priority over earnings, so this is definitely a worry for the dividend going forward.

Looking forward, earnings per share is forecast to rise by 20.4% over the next year. If the dividend continues on this path, the payout ratio could be 13% by next year, which we think can be pretty sustainable going forward.

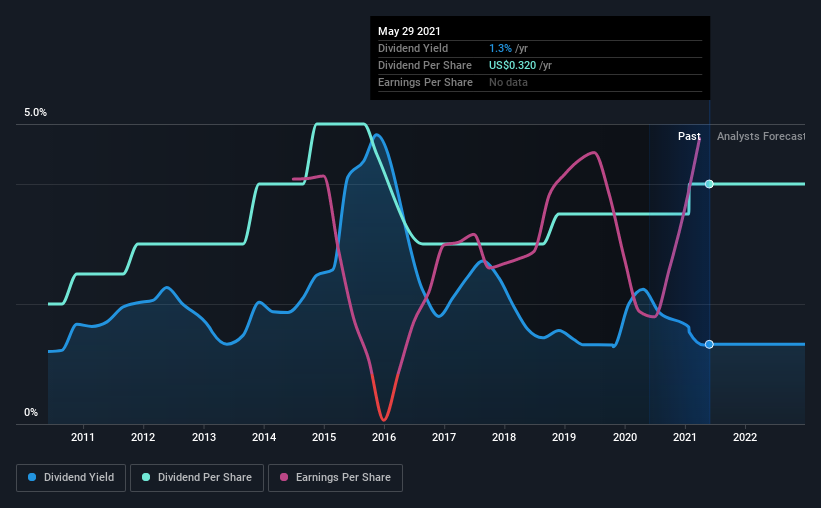

Dividend Volatility

The company's dividend history has been marked by instability, with at least 1 cut in the last 10 years. Since 2011, the dividend has gone from US$0.16 to US$0.32. This works out to be a compound annual growth rate (CAGR) of approximately 7.2% a year over that time. We like to see dividends have grown at a reasonable rate, but with at least one substantial cut in the payments, we're not certain this dividend stock would be ideal for someone intending to live on the income.

The Dividend Looks Likely To Grow

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. OFG Bancorp has impressed us by growing EPS at 153% per year over the past five years. Earnings per share is growing at a solid clip, and the payout ratio is low which we think is an ideal combination in a dividend stock as the company can quite easily raise the dividend in the future.

In Summary

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. The company hasn't been paying a very consistent dividend over time, despite only paying out a small portion of earnings. This company is not in the top tier of income providing stocks.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. As an example, we've identified 2 warning signs for OFG Bancorp that you should be aware of before investing. If you are a dividend investor, you might also want to look at our curated list of high performing dividend stock.

When trading OFG Bancorp or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:OFG

OFG Bancorp

A financial holding company, provides a range of banking and financial services.

Flawless balance sheet, undervalued and pays a dividend.