- United States

- /

- Banks

- /

- NYSE:OBK

Assessing Origin Bancorp (OBK): Is the Current Valuation Justified by Growth Prospects?

Reviewed by Simply Wall St

Origin Bancorp (OBK) shares have recently seen some movement. This activity has caught the attention of investors who are interested in the bank’s pace of growth and current valuation. Several factors may be influencing the latest trends.

See our latest analysis for Origin Bancorp.

Origin Bancorp’s share price has steadily gained nearly 10% so far this year, putting its latest close at $36.53. Its 1-year total shareholder return of just over 8% points to ongoing confidence in the bank’s growth story. While some volatility emerged in recent months, overall momentum has been building, underscoring investor interest as Origin reports solid annual revenue and net income growth.

If you’re ready to look beyond banks, now is a good moment to broaden your investing horizons and discover fast growing stocks with high insider ownership

But with the stock still trading at a meaningful discount to analyst targets and showing strong underlying fundamentals, the key question now becomes: is Origin Bancorp undervalued, or has the market already accounted for all future growth?

Most Popular Narrative: 17% Undervalued

Origin Bancorp’s widely followed narrative sets its fair value at $44 per share, notably above the recent close of $36.53. This price gap reflects ambitious expectations about the bank’s growth runway and strategic initiatives currently in play.

Targeted investments in digital banking platforms, automation, and data management, including strategic projects leveraging robotics and AI, are set to improve operational efficiency, enhance customer acquisition, and reduce expenses. These efforts are expected to contribute to higher net margins over time.

Ever wondered what bold bets support this compelling valuation? The narrative’s hidden engine is a blend of relentless margin expansion and bigger bottom-line growth, but there is one surprising future earnings projection you will want to uncover. Get a glimpse at the thinking behind these confident numbers by clicking through to see what drives the story.

Result: Fair Value of $44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent competition from fintechs and high exposure to regional economies could challenge the optimistic growth assumptions in Origin Bancorp’s outlook.

Find out about the key risks to this Origin Bancorp narrative.

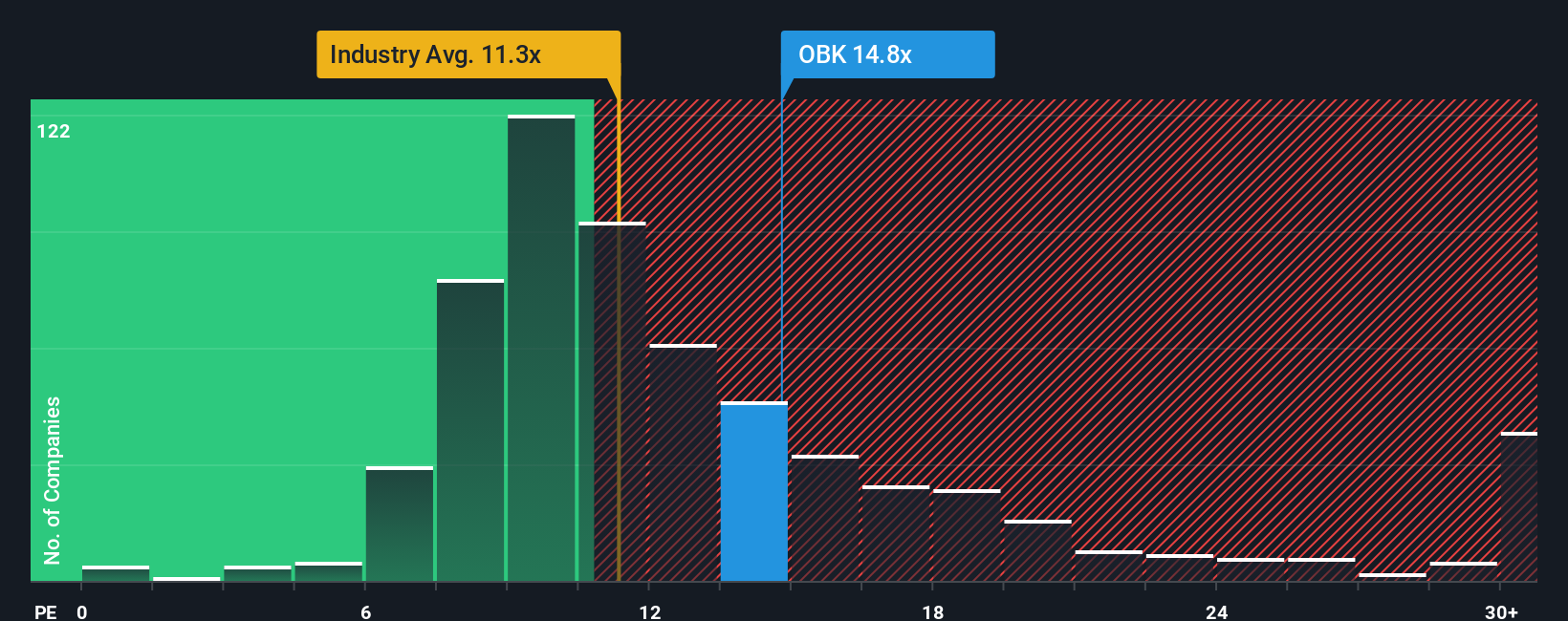

Another View: Market Multiples Raise Questions

When looking at Origin Bancorp’s valuation through the lens of price-to-earnings ratios, things appear less optimistic. The company trades at 18.9 times earnings, above the fair ratio of 15.3, and considerably higher than both industry (11.4) and peer averages (10.5). This premium suggests investors are pricing in a lot of future success. Does it mean more risk, or an opportunity if growth keeps surprising?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Origin Bancorp Narrative

If you see the numbers differently or want to dive deeper into the data, it’s easy to create a personalized take in just a few minutes, so Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Origin Bancorp.

Looking for more investment ideas?

Opportunity moves quickly in today’s markets, and the smartest next investment could be just a click away. Don’t settle for the obvious when standout ideas are waiting for you.

- Capture tomorrow’s growth by targeting reliable returns from these 15 dividend stocks with yields > 3%, which have consistently paid out yields above 3%.

- Follow innovation at the intersection of medicine and technology, with these 30 healthcare AI stocks working to revolutionize patient care and medical breakthroughs.

- Uncover fresh possibilities with these 25 AI penny stocks powering artificial intelligence trends that are transforming industries worldwide.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OBK

Origin Bancorp

Operates as a bank holding company for Origin Bank that provides banking and financial services to small and medium-sized businesses, municipalities, and retail clients in Texas, Louisiana, and Mississippi.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.