- United States

- /

- Banks

- /

- NYSE:NU

Nu Holdings (NYSE:NU): Valuation Insights After Record Results and Landmark Amazon Brazil Partnership

Reviewed by Simply Wall St

Nu Holdings (NYSE:NU) shares have grabbed attention after the company posted record net income and outpaced revenue forecasts in its latest quarterly update. The announcement of a new partnership with Amazon Brazil also fueled optimism.

See our latest analysis for Nu Holdings.

Nu Holdings’ shares have surged over 60% year to date, with the latest momentum accelerating after the record quarterly results and a landmark partnership announcement. With a multi-year total shareholder return of over 320%, investors are clearly recognizing both strong recent execution and the company’s long-term growth potential.

If Nu's latest moves have you thinking about the next big opportunity, this is the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With the stock trading near all-time highs and analysts raising their targets, the central question now is whether Nu Holdings remains undervalued or if the market is already pricing in its next chapter of growth potential.

Most Popular Narrative: 3.3% Undervalued

Nu Holdings' most popular valuation narrative prices the company at $17.98 per share, slightly above the last close of $17.39. With a fair value that nudges past current levels, the market is signaling just a modest undervaluation, raising the stakes for what analysts expect next.

The ongoing transition from cash to digital payments and online banking in historically underserved markets continues to accelerate Nu's transaction volumes and increases opportunities for cross-sell and ecosystem stickiness, supporting robust net margin expansion as digital penetration deepens.

Want to know what’s fueling the buzz around Nu’s potential? The narrative hinges on ambitious revenue expansion, tightening margins, and a forward-looking profit multiple that sets high expectations. Wondering just how optimistic the growth and earnings projections are? Read the full narrative to uncover the numbers driving this bold valuation.

Result: Fair Value of $17.98 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising competition from established banks and increased exposure to subprime loans could pose challenges to Nu Holdings' growth outlook in the coming years.

Find out about the key risks to this Nu Holdings narrative.

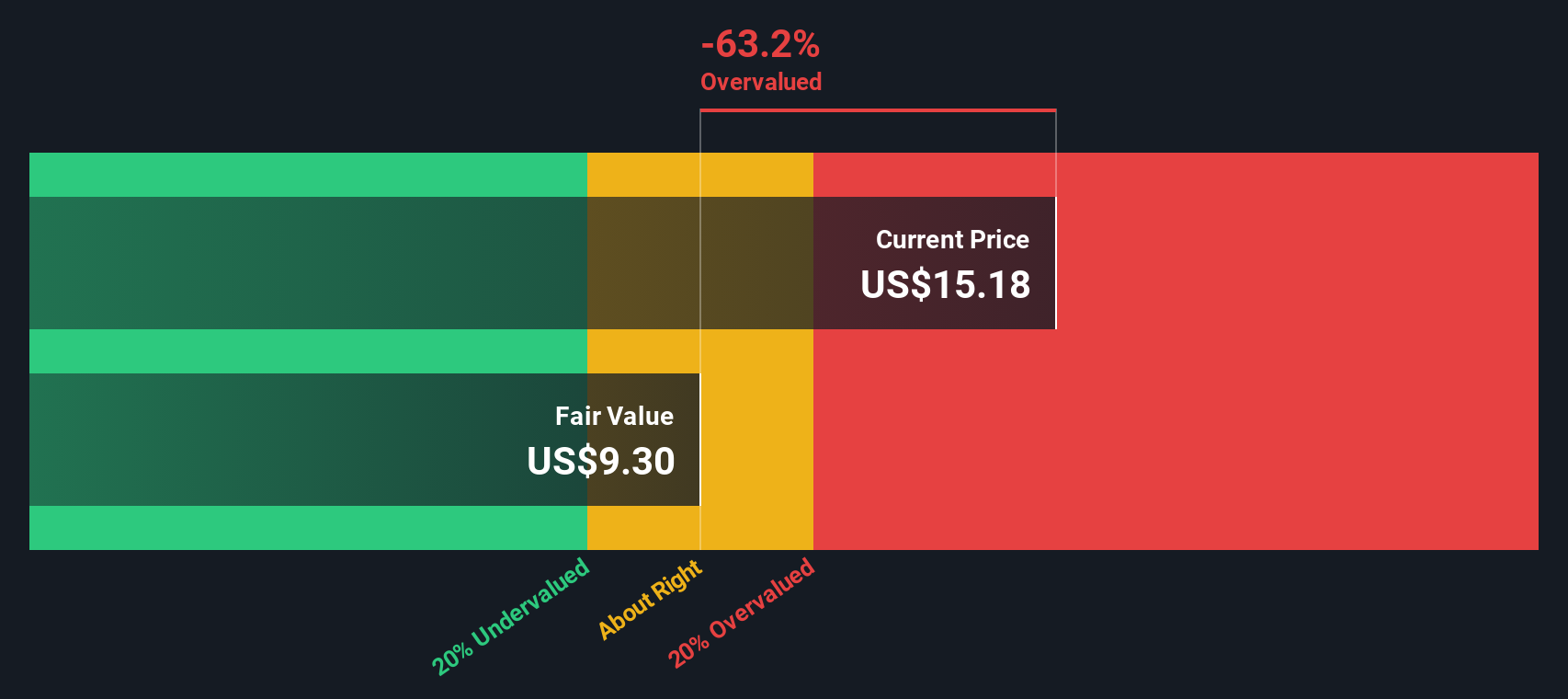

Another View: SWS DCF Signals Overvaluation

While the prevailing narrative sees Nu Holdings as modestly undervalued, our DCF model presents a different perspective. It estimates a fair value of $10.14 per share, indicating that Nu is trading well above what our cash flow projections suggest. Does this point to overheating, or are analysts overlooking something in their earnings outlook?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Nu Holdings Narrative

If you see the numbers differently, or want to dig in and tell your own story, you can shape your narrative in just minutes. Do it your way

A great starting point for your Nu Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Moves?

Don't let great opportunities slip by. Fuel your portfolio with fresh ideas using the power of Simply Wall Street’s expert-built screeners designed for every advantage.

- Maximize your income and uncover top yields by scanning these 15 dividend stocks with yields > 3% that consistently deliver payouts above 3%.

- Spot market bargains others might miss by checking out these 916 undervalued stocks based on cash flows that stand out with strong cash flow fundamentals.

- Get ahead of tomorrow’s tech trends when you browse these 25 AI penny stocks shaping industries with innovative artificial intelligence breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nu Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NU

Nu Holdings

Provides digital banking platform in Brazil, Mexico, Colombia, the Cayman Islands, and the United States.

Exceptional growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026