- United States

- /

- Banks

- /

- NYSE:NU

Nu Holdings (NYSE:NU) Valuation Check as Tech‑Driven Profits and Growth Momentum Strengthen in Latin America

Reviewed by Simply Wall St

Nu Holdings (NYSE:NU) is back in the spotlight after fresh data highlighted how its tech driven banking model in Latin America is still translating into rising profits and better unit economics, sharpening focus on what the stock is truly worth.

See our latest analysis for Nu Holdings.

That optimism has not gone unnoticed in the market, with Nu’s share price up a strong year to date on the back of consistent earnings beats and expanding margins. At the same time, recent pullbacks suggest some investors are locking in gains while momentum is still broadly positive.

If Nu’s run has you rethinking your watchlist, this could be a good moment to explore other high potential names using fast growing stocks with high insider ownership.

With profits compounding and the share price already up sharply this year, the key question now is whether Nu remains attractively priced or if the market is already baking in years of future growth.

Most Popular Narrative: 9.8% Undervalued

With Nu closing at $16.62 and the most followed narrative pointing to a fair value near $18.43, the market is seen trailing robust growth expectations.

Introduction and scaling of new financial products such as personal loans, insurance, crypto, and investments are driving higher ARPU and fee based revenue. Operating leverage from Nu's efficient tech driven platform is likely boosting profitability and net income as mature cohorts monetize. Continued investment in proprietary technology and AI driven credit modeling is improving risk management and reducing non performing loan (NPL) ratios, positioning Nu for both mitigating credit risk and sustainable net income growth, even if market headwinds or cyclical pressures emerge.

Want to see the financial engine behind that upside gap? The narrative leans on aggressive compound growth, shifting margins, and a future earnings multiple that might surprise you.

Result: Fair Value of $18.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising competition and heavier exposure to riskier borrowers could pressure Nu’s margins and may force analysts to reassess those optimistic long term growth assumptions.

Find out about the key risks to this Nu Holdings narrative.

Another Angle on Valuation

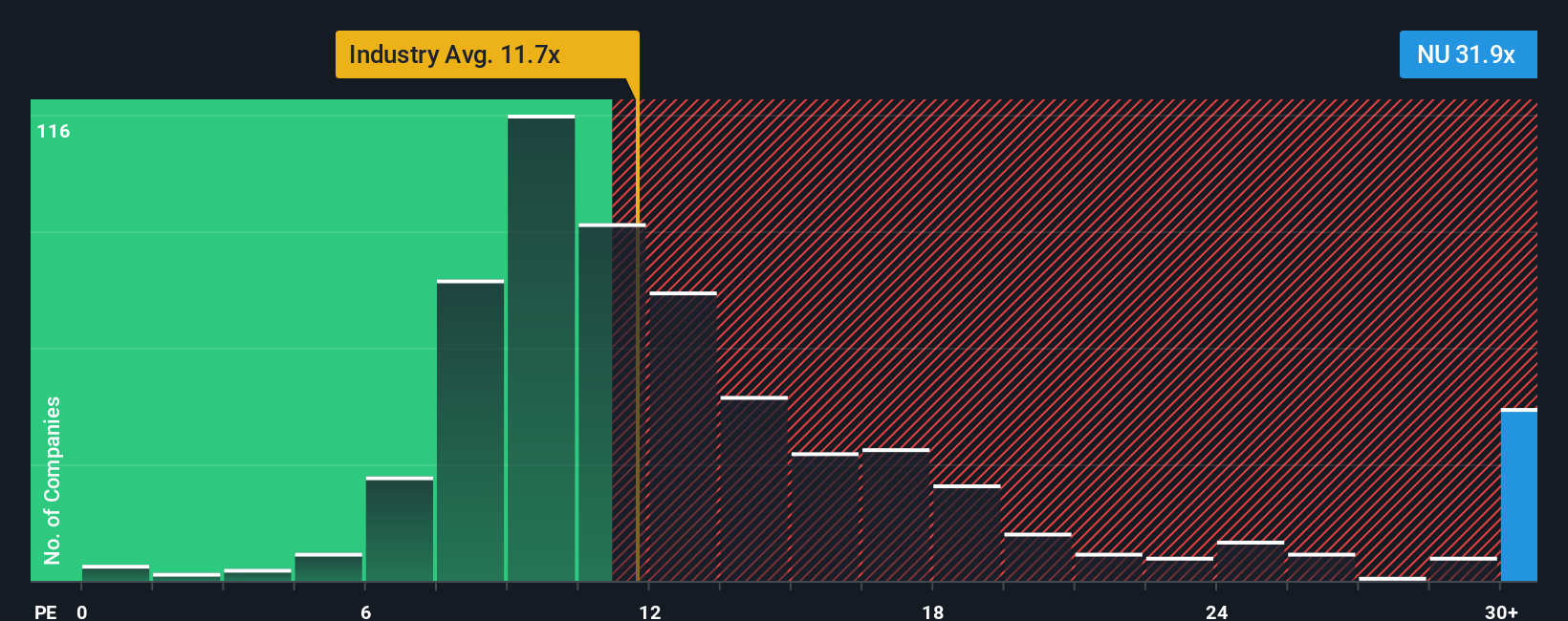

On earnings, the picture flips. Nu trades at about 31.8 times profit, well above its fair ratio of 22.6 times and far richer than US bank peers near 12 times. That premium prices in a lot of future growth, raising the question: how much upside is really left?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Nu Holdings Narrative

If you view the story differently or want to dig into the numbers yourself, you can craft a custom narrative in just a few minutes: Do it your way.

A great starting point for your Nu Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider your next move by scanning fresh stock ideas on Simply Wall Street’s powerful screener so potential opportunities do not slip past you.

- Explore early stage potential by targeting companies that punch above their weight using these 3593 penny stocks with strong financials.

- Position your portfolio within the AI theme with these 27 AI penny stocks.

- Identify value focused opportunities that the market may be mispricing through these 909 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nu Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NU

Nu Holdings

Provides digital banking platform in Brazil, Mexico, Colombia, the Cayman Islands, and the United States.

Exceptional growth potential with solid track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026