- United States

- /

- Banks

- /

- NYSE:NU

A Look at Nu Holdings (NYSE:NU) Valuation as It Applies for U.S. National Bank License

Reviewed by Simply Wall St

Nu Holdings (NYSE:NU) has filed for a national bank license in the U.S., aiming to extend its digital banking services directly to American customers. The move highlights a bold step toward global expansion and could reshape future growth prospects.

See our latest analysis for Nu Holdings.

Nu Holdings' latest move comes following accelerating share price momentum, with the stock up 51.55% year-to-date and boasting a three-year total shareholder return of over 230%. While recent results reflect some deceleration in Latin America and higher costs from global expansion, investors are clearly buoyed by the company’s expanding ambitions and growth potential.

If you’re interested in what else is thriving at the intersection of technology and finance, now’s the perfect time to discover fast growing stocks with high insider ownership

The stock has soared over the past year. However, with recent deceleration and ambitious expansion plans, investors must ask: Is Nu Holdings still undervalued, or is the market already anticipating all the growth ahead?

Most Popular Narrative: 6.8% Undervalued

With a current fair value estimate of $17.29 versus the last close at $16.11, the crowd-driven narrative signals a modest upside and sets the scene for a data-driven debate on Nu Holdings' future growth and profitability assumptions.

The ongoing transition from cash to digital payments and online banking in historically underserved markets continues to accelerate Nu's transaction volumes and increases opportunities for cross-sell and ecosystem stickiness. This supports robust net margin expansion as digital penetration deepens.

Is the relentless digital wave across Latin America the secret behind this above-market valuation? Dive into the detailed projections and discover the financial shockers under the hood, including ambitious revenue targets and razor-thin future margins. The real story hides in the delicate balance between rapid expansion and tightening profitability. Want the full picture?

Result: Fair Value of $17.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, mounting competition from established banks and the risk of rising defaults among less mature loan segments could present challenges to Nu Holdings' ambitious growth trajectory.

Find out about the key risks to this Nu Holdings narrative.

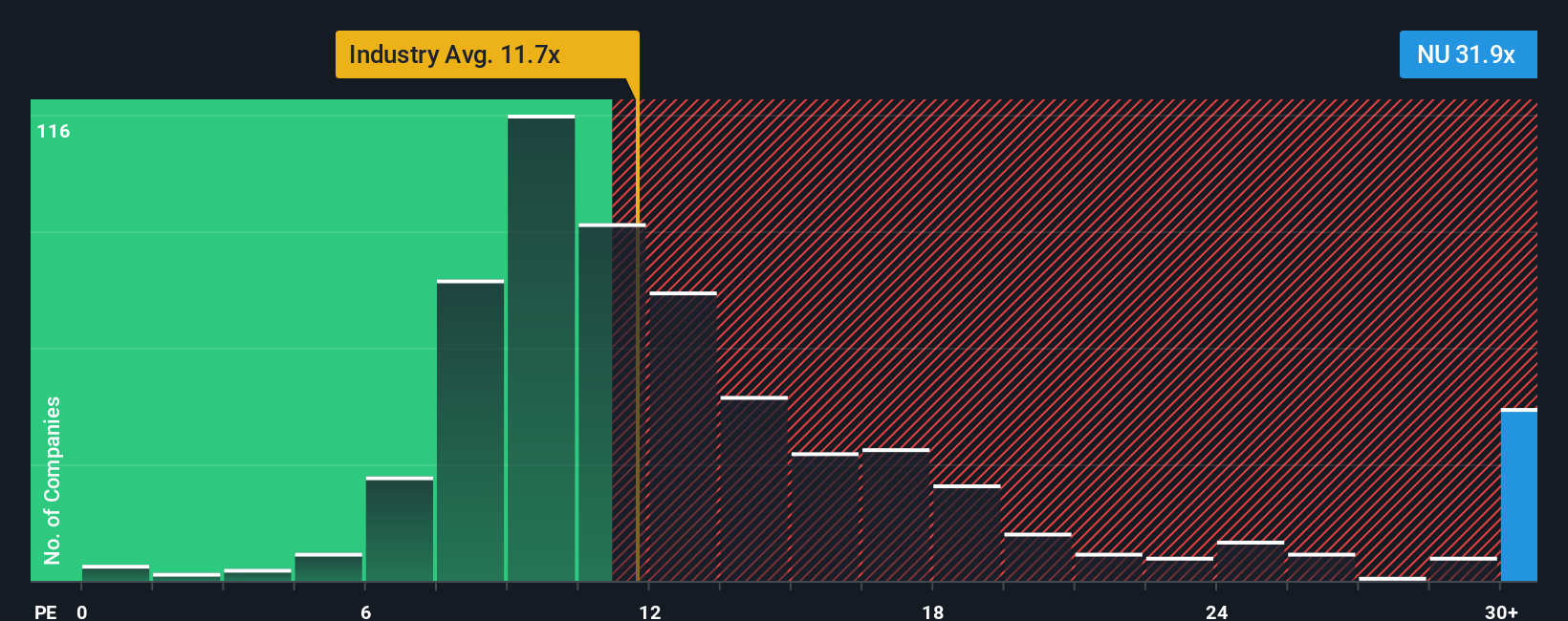

Another View: Valuation Risks Loom Large

While some see upside based on fair value estimates, Nu Holdings currently trades at a price-to-earnings ratio of 33.8x, which is far above both the US banks industry average of 11x and its peers at 11.5x. It also sits well above the fair ratio of 21.7x. This gap means investors are paying a steep premium, raising risks if future growth does not materialize. Is the market betting too much on Nu’s expansion story?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Nu Holdings Narrative

If you have a different point of view or want to dig into the numbers personally, it’s easy to build your own narrative in just a few minutes. Do it your way

A great starting point for your Nu Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t stop at just one stock. Use the Simply Wall Street Screener to spot your next winner and seize new market trends before everyone else does.

- Tap into high-potential tech by starting with these 26 AI penny stocks riding the boom in artificial intelligence, automation, and machine learning.

- Lock in the power of compounding by seeking out strong income picks through these 22 dividend stocks with yields > 3% offering yields above 3%.

- Capitalize on emerging quantum tech advances by researching these 28 quantum computing stocks making their mark in computational breakthroughs and next-gen applications.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nu Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NU

Nu Holdings

Provides digital banking platform in Brazil, Mexico, Colombia, the Cayman Islands, and the United States.

Exceptional growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives