- United States

- /

- Banks

- /

- NYSE:NPB

Spotlight On AlTi Global And 2 Other Top Growth Stocks Insiders Favor

Reviewed by Simply Wall St

As major stock indexes in the United States gain momentum on optimism surrounding a potential resolution to the government shutdown, investors are increasingly looking for growth opportunities that align with current market conditions. In this environment, companies with high insider ownership often signal confidence from those who know the business best, making them attractive options for investors seeking robust growth prospects.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (SMCI) | 13.9% | 51% |

| SES AI (SES) | 12% | 64.8% |

| Niu Technologies (NIU) | 37.2% | 92.8% |

| FTC Solar (FTCI) | 23.1% | 63% |

| Credo Technology Group Holding (CRDO) | 10.9% | 30.4% |

| Atour Lifestyle Holdings (ATAT) | 18.3% | 23.7% |

| AST SpaceMobile (ASTS) | 11.8% | 64.8% |

| Astera Labs (ALAB) | 11.9% | 26% |

| AppLovin (APP) | 27.5% | 26.4% |

| Accelerant Holdings (ARX) | 24.9% | 66.1% |

We'll examine a selection from our screener results.

AlTi Global (ALTI)

Simply Wall St Growth Rating: ★★★★☆☆

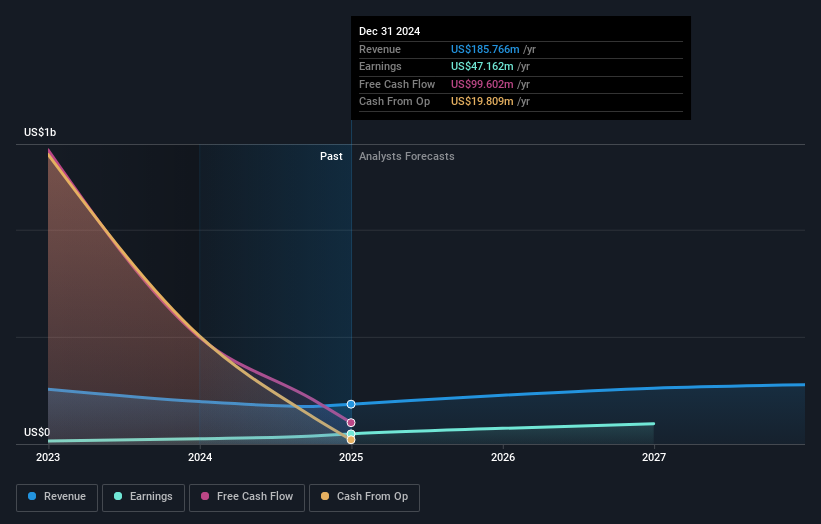

Overview: AlTi Global, Inc. offers wealth and asset management services across the United States, the United Kingdom, and internationally, with a market cap of $596.15 million.

Operations: The company's revenue segments include Wealth & Capital Solutions at $212.71 million and International Real Estate at $5.02 million.

Insider Ownership: 35.1%

Earnings Growth Forecast: 117.7% p.a.

AlTi Global is experiencing a challenging financial period, with its revenue growing at 10.4% annually but still trailing the ideal growth rate for high-growth companies. Despite reporting a net loss of US$24.36 million in Q2 2025, the company is forecast to become profitable within three years, indicating potential long-term growth prospects. However, it currently has less than one year of cash runway and lacks substantial recent insider trading activity to bolster investor confidence.

- Take a closer look at AlTi Global's potential here in our earnings growth report.

- Our valuation report unveils the possibility AlTi Global's shares may be trading at a premium.

Lifeway Foods (LWAY)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lifeway Foods, Inc. produces and markets probiotic-based products both in the United States and internationally, with a market cap of $371.58 million.

Operations: The company's revenue primarily comes from its cultured dairy products segment, which generated $193.02 million.

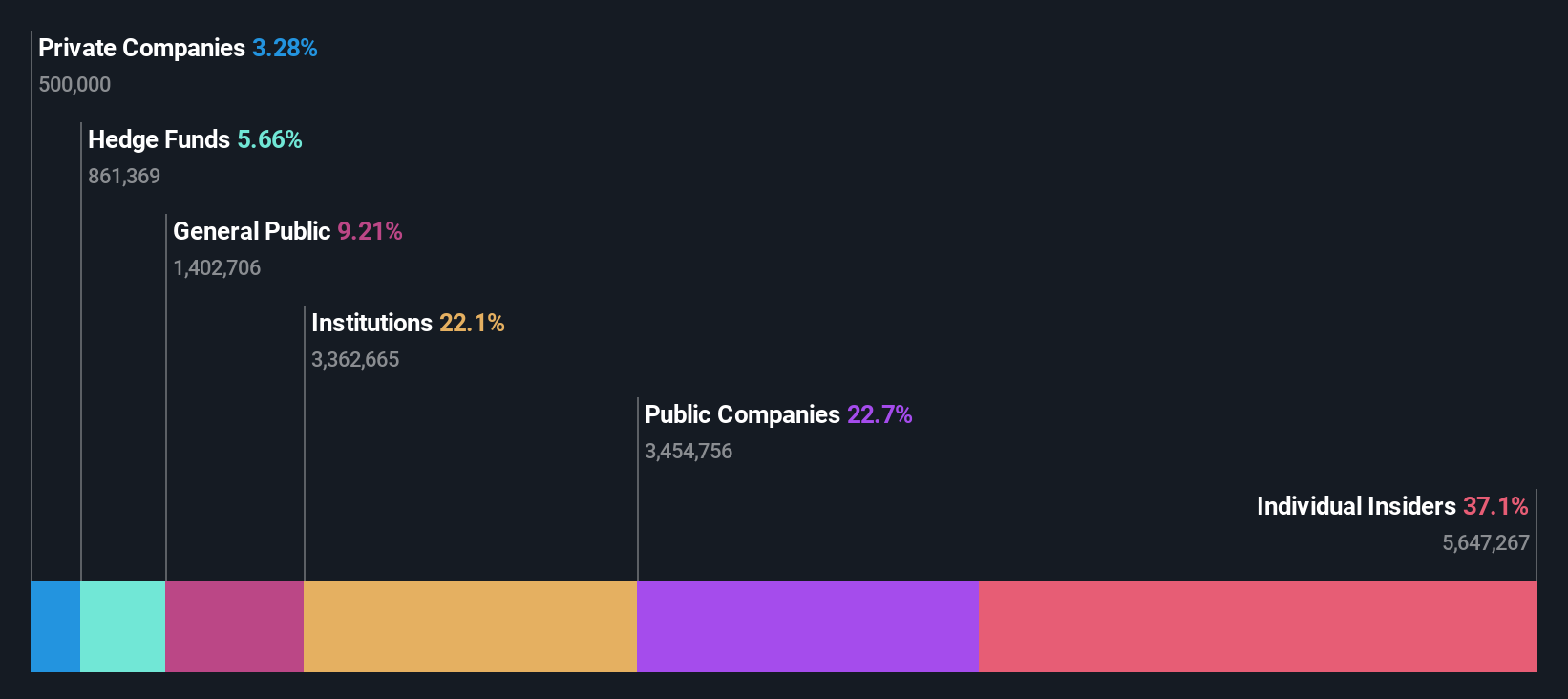

Insider Ownership: 37.1%

Earnings Growth Forecast: 33.6% p.a.

Lifeway Foods is navigating a dynamic phase with significant insider transactions, as more shares have been bought than sold recently. Its earnings are projected to grow significantly at 33.6% annually, outpacing the US market average. Despite slower revenue growth of 14.2%, recent governance changes and strategic collaborations aim to enhance shareholder value and stability. Lifeway's expansion efforts include doubling production capacity in Wisconsin, aligning with its growth trajectory in functional dairy products.

- Unlock comprehensive insights into our analysis of Lifeway Foods stock in this growth report.

- According our valuation report, there's an indication that Lifeway Foods' share price might be on the expensive side.

Northpointe Bancshares (NPB)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Northpointe Bancshares, Inc., the bank holding company for Northpointe Bank, offers a range of banking products and services in the United States with a market cap of $544.68 million.

Operations: Northpointe Bancshares, Inc. generates its revenue through a variety of banking products and services offered across the United States.

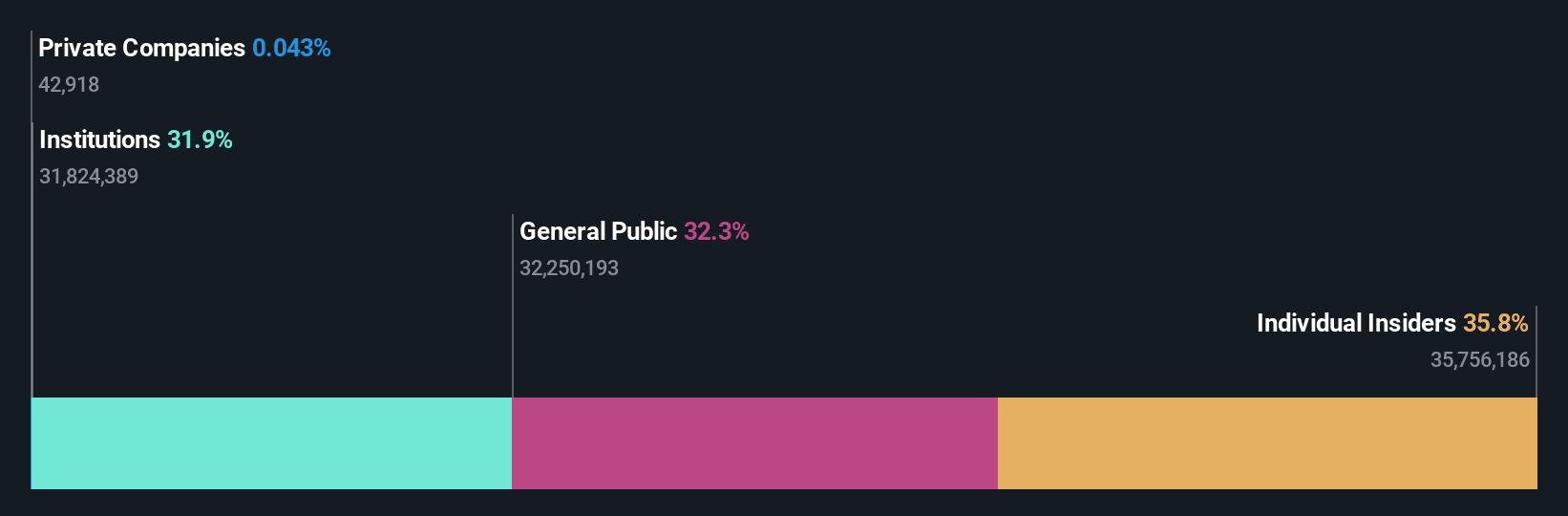

Insider Ownership: 36.3%

Earnings Growth Forecast: 21.7% p.a.

Northpointe Bancshares is experiencing a period of growth with earnings projected to rise significantly at 21.7% annually, surpassing the US market average. Despite slower revenue growth of 13.1%, it trades at a substantial discount to its estimated fair value and below analyst price targets, suggesting potential for appreciation. Recent board appointments bring seasoned expertise in risk management and financial services, though recent insider selling could be concerning for some investors.

- Click here to discover the nuances of Northpointe Bancshares with our detailed analytical future growth report.

- The analysis detailed in our Northpointe Bancshares valuation report hints at an deflated share price compared to its estimated value.

Seize The Opportunity

- Unlock more gems! Our Fast Growing US Companies With High Insider Ownership screener has unearthed 185 more companies for you to explore.Click here to unveil our expertly curated list of 188 Fast Growing US Companies With High Insider Ownership.

- Ready To Venture Into Other Investment Styles? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Northpointe Bancshares might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NPB

Northpointe Bancshares

Operates as the bank holding company for Northpointe Bank provides various banking products and services in the United States.

Very undervalued with excellent balance sheet.

Market Insights

Community Narratives