- United States

- /

- Banks

- /

- NYSE:NBHC

National Bank Holdings (NBHC): Assessing Valuation After Dividend Increase and Share Buyback Progress

Reviewed by Simply Wall St

National Bank Holdings (NBHC) announced a 3% uptick in its quarterly cash dividend, along with an update that it has completed nearly 1% share repurchase since July. Both moves highlight the company’s focus on shareholder returns.

See our latest analysis for National Bank Holdings.

After a stretch marked by both a higher quarterly dividend and ongoing share buybacks, National Bank Holdings is aiming to rebuild momentum. The stock’s 1-day and 7-day share price returns have both been positive, up 1.3% and 1.9%, respectively, but this comes after a weak year-to-date run. Over the longer term, NBHC’s 1-year total shareholder return of -24.5% clouds its recent efforts. However, a 5-year total return of nearly 25% hints that patient investors have still come out ahead.

If recent buybacks and dividend hikes have you rethinking your investment strategy, it could be the perfect time to discover fast growing stocks with high insider ownership.

But with the stock still well below its analyst price target and trading at a steep discount to some measures of intrinsic value, investors must ask: Is NBHC undervalued, or is the market already factoring in the next leg of growth?

Most Popular Narrative: 16.9% Undervalued

With the most recent price of $36.34, the narrative’s fair value at $43.75 sits notably higher. This reflects a positive gap powered by robust earnings expectations and stable profit margins.

The company's digital platform innovation and regional growth strategy are expected to boost high-margin fee income, customer expansion, and sustainable revenue streams. Focus on commercial banking, disciplined risk management, and ongoing cost reductions should drive resilient profitability, earnings stability, and long-term margin improvement.

Want to know the engine behind this higher fair value? The narrative’s recipe combines ambitious growth, stable margins, and a future earnings multiple that rivals leaders in the sector. Wondering what specific drivers set this valuation apart? Click through to see which bold assumptions put this target within reach.

Result: Fair Value of $43.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing regional concentration and heightened digital adoption risks could quickly undermine projected growth if economic or technological headwinds arise.

Find out about the key risks to this National Bank Holdings narrative.

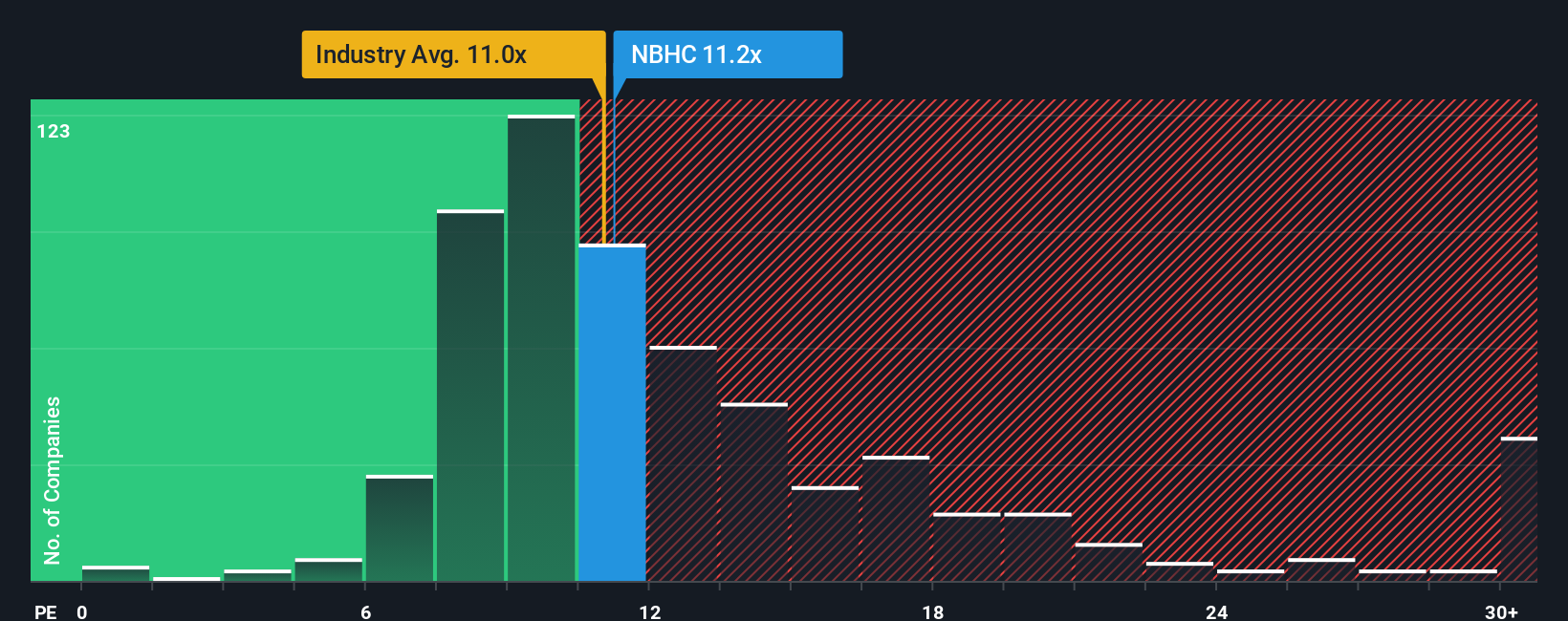

Another View: Market Ratios Raise a Flag

While the analyst consensus points to significant upside, looking at National Bank Holdings’ price-to-earnings ratio tells a different story. Trading at 11.4x earnings, the stock is slightly more expensive than both peer and industry averages. The fair ratio is 12.8x, suggesting some room for the market to move higher; however, that gap is not large. Does relying on this multiple risk missing deeper value, or is it a needed dose of caution?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own National Bank Holdings Narrative

If you see the numbers differently, or want to dig even deeper, you can quickly create your own story in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding National Bank Holdings.

Looking for More Smart Investment Ideas?

Don’t leave your next big win to chance. Take charge of your portfolio by following proven strategies and targeted lists crafted for real results.

- Unleash the hidden potential of growth assets by checking out these 24 AI penny stocks, which offers next-level opportunities in artificial intelligence.

- Secure steady income and peace of mind when you review these 16 dividend stocks with yields > 3% to see which companies consistently reward shareholders.

- Capture long-term value and avoid overpaying by starting with these 870 undervalued stocks based on cash flows, focused on stocks trading below their true worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if National Bank Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NBHC

National Bank Holdings

Operates as the bank holding company for NBH Bank that provides various banking products and financial services to commercial, business, and consumer clients in the United States.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives