- United States

- /

- Banks

- /

- NYSE:NBHC

How Investors Are Reacting To National Bank Holdings (NBHC) Seventh Consecutive Dividend Increase

Reviewed by Sasha Jovanovic

- In recent days, National Bank Holdings announced a seventh consecutive annual dividend increase, raising its dividend by 7.1% to an annualized US$1.20, with a payout ratio of 37% reflecting sustainability relative to earnings.

- This marks five straight years of dividend growth averaging nearly 9% annually, setting the bank apart with a yield above industry and S&P 500 averages.

- We'll examine how the company’s consistent and above-average dividend growth impacts its investment narrative and future outlook.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

National Bank Holdings Investment Narrative Recap

For National Bank Holdings, shareholders need to believe in the company’s disciplined approach to dividend growth, effective risk management, and its ability to capitalize on the long-term migration and economic expansion within its core markets. The latest dividend hike underlines management’s confidence in sustainable earnings; however, the announcement does not materially shift the most pressing catalyst, digital banking adoption via 2UniFi, or diminish the concentrated regional lending risks that remain central to the company’s near-term outlook.

Among the company’s recent updates, the July 2025 launch of the 2UniFi partnership and the accompanying US$5 million Nav investment are particularly relevant. These moves further underpin the bank’s shift toward digital solutions for small businesses and could play a role in driving future noninterest income, supporting the major growth catalyst highlighted by its commitment to expanding technology-driven banking services.

By contrast, investors should be aware that NBHC’s concentrated exposure to select regional sectors and markets could...

Read the full narrative on National Bank Holdings (it's free!)

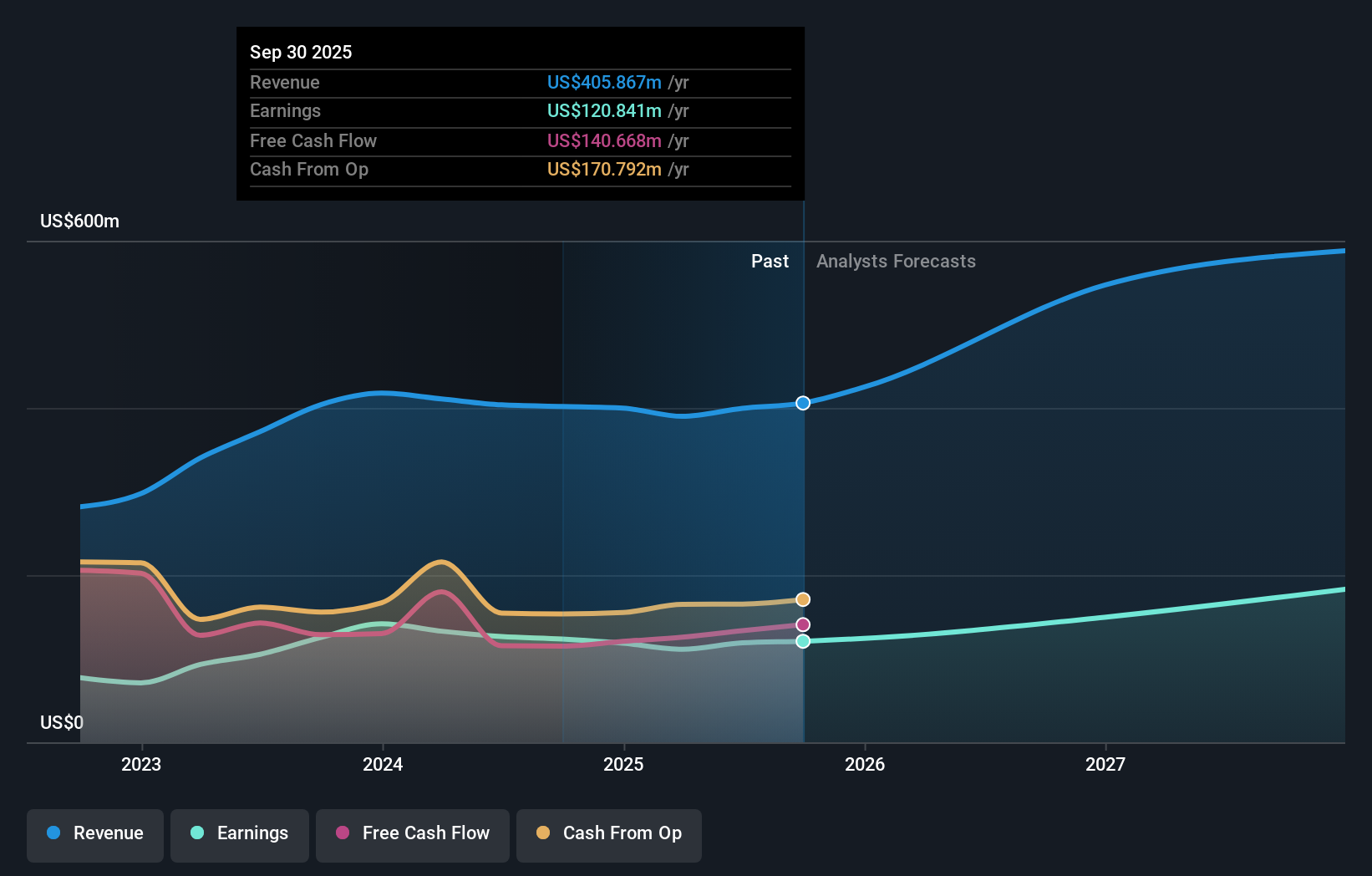

National Bank Holdings' narrative projects $500.3 million revenue and $142.3 million earnings by 2028. This requires 7.8% yearly revenue growth and a $23.4 million earnings increase from $118.9 million.

Uncover how National Bank Holdings' forecasts yield a $43.75 fair value, a 14% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community produced 2 fair value estimates for NBHC, ranging widely from US$43.75 to US$59,691.06. With such a spread and given the continued focus on digital transformation as a growth driver, you should explore the different scenarios these investors consider before drawing your own conclusions.

Explore 2 other fair value estimates on National Bank Holdings - why the stock might be worth just $43.75!

Build Your Own National Bank Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your National Bank Holdings research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free National Bank Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate National Bank Holdings' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if National Bank Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NBHC

National Bank Holdings

Operates as the bank holding company for NBH Bank that provides various banking products and financial services to commercial, business, and consumer clients in the United States.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives