- United States

- /

- Banks

- /

- NYSE:JPM

JPMorgan Chase (JPM): Evaluating Whether the Recent Share Price Strength Signals Undervaluation

Reviewed by Simply Wall St

See our latest analysis for JPMorgan Chase.

JPMorgan Chase’s year-to-date share price return of almost 31% has outpaced most of its banking peers, underscoring growing optimism about the company’s stability and earnings power. With momentum holding steady, the 1-year total shareholder return stands at an impressive 35%.

If you’re looking to uncover standout names beyond the banking giants, now is a perfect moment to explore fast growing stocks with high insider ownership. Discover fast growing stocks with high insider ownership

With shares trading near record highs, investors are now weighing whether JPMorgan Chase remains undervalued by the market or if current prices already reflect its future earnings growth. This raises the question of whether there is a true buying opportunity.

Most Popular Narrative: 4.1% Undervalued

With JPMorgan Chase closing at $314.21 and the most widely followed narrative putting fair value at $327.70, attention now turns to what makes up this premium. The divergence between market price and narrative fair value hints at some bold growth expectations and critical drivers powering this projection.

"Analysts are assuming JPMorgan Chase's revenue will grow by 4.5% annually over the next 3 years. Analysts assume that profit margins will shrink from 33.7% today to 29.7% in 3 years time."

Want to know which growth forecasts and margin twists create this high target? Under the surface: ambitious expansion, shrinking profitability, and a profit multiple more often found in high-flying sectors. What justifies such a punchy price? The numbers used may surprise even seasoned bank stock watchers. Discover the assumptions before everyone else.

Result: Fair Value of $327.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, potential shifts in regulation or unexpected slowdowns in digital banking growth could challenge JPMorgan Chase's positive trajectory and change the current outlook.

Find out about the key risks to this JPMorgan Chase narrative.

Another View: Peer Comparisons Paint a Different Picture

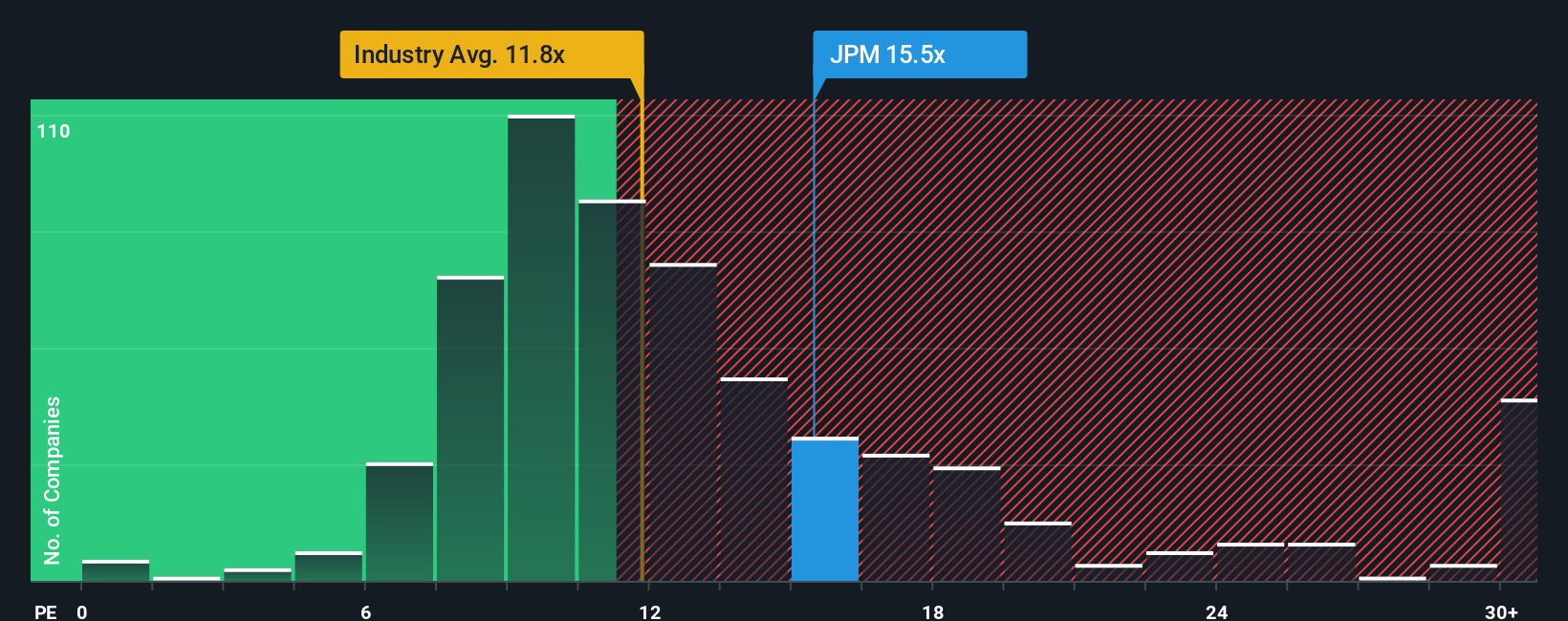

While the first approach suggests JPMorgan Chase is undervalued, looking at its price-to-earnings ratio tells a different story. The company trades at 15.1 times earnings, which is notably higher than the US Banks industry average (11.1x), its peers (12.9x), and even its own fair ratio (13.9x). This premium could signal investor confidence, but it also raises valuation risk if expectations fall short. Is the current enthusiasm justified, or is the stock at risk of a sentiment shift?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own JPMorgan Chase Narrative

If you want to interpret the numbers differently or prefer to dive into your own analysis, you can easily build your perspective in just a few minutes. Do it your way

A great starting point for your JPMorgan Chase research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Missing out on tomorrow’s big winners does not have to be your story. Use the Simply Wall Street Screener to help you confidently spot the next breakout opportunity.

- Spot opportunities for impressive cash flow by reviewing these 876 undervalued stocks based on cash flows that are trading below their intrinsic value.

- Accelerate your portfolio’s future with exposure to cutting-edge technology by considering these 25 AI penny stocks before they make headlines.

- Boost your income potential instantly by targeting these 16 dividend stocks with yields > 3% offering attractive yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JPM

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives