- United States

- /

- Banks

- /

- NYSE:GBCI

Glacier Bancorp (GBCI): Valuation Insights Following Strong Earnings Outperformance

Reviewed by Kshitija Bhandaru

Glacier Bancorp (GBCI) recently made headlines after reporting a quarter in which both earnings per share and tangible book value per share exceeded analyst expectations. This positive performance is putting the spotlight on the company and sparking new investor discussions.

See our latest analysis for Glacier Bancorp.

Following its earnings beat, Glacier Bancorp’s share price hasn’t surged, falling about 4% over the past month and still down roughly 4.5% year-to-date. Still, the stock’s 1-year total shareholder return stands at a healthy 8.9%. Recent events like the ESOP-related stock offering and solid quarterly results have helped maintain positive sentiment, suggesting momentum is holding up even if short-term price swings persist.

If the combination of upbeat earnings and shifting sentiment has you seeking new opportunities, now’s an ideal moment to broaden your search and discover fast growing stocks with high insider ownership

With Glacier Bancorp posting upbeat financials yet trading below analyst targets, the key question emerges: is this regional bank stock undervalued after its earnings surprise, or is the market already factoring in further growth?

Most Popular Narrative: 8.5% Undervalued

The latest consensus narrative from analysts suggests Glacier Bancorp's last close price remains meaningfully below its calculated fair value. This may create a compelling opportunity as expectations shift.

Investments in digital platforms, such as the new commercial loan system and enhanced treasury solutions, are improving operational efficiency, lowering cost-to-income ratios, and attracting younger, tech-savvy customers. All of these factors support higher net margins and the potential for future margin expansion.

What is really driving this upside? The narrative is fueled by ambitious assumptions about digital transformation, next-level operating efficiencies, and margin expansion. Uncover the bolder growth forecasts powering this price target and see what analysts expect Glacier Bancorp to deliver in the years ahead.

Result: Fair Value of $51.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, as future growth depends on the successful integration of acquisitions and the bank’s ability to keep pace with digital innovation.

Find out about the key risks to this Glacier Bancorp narrative.

Another View: The Risk in Paying Up

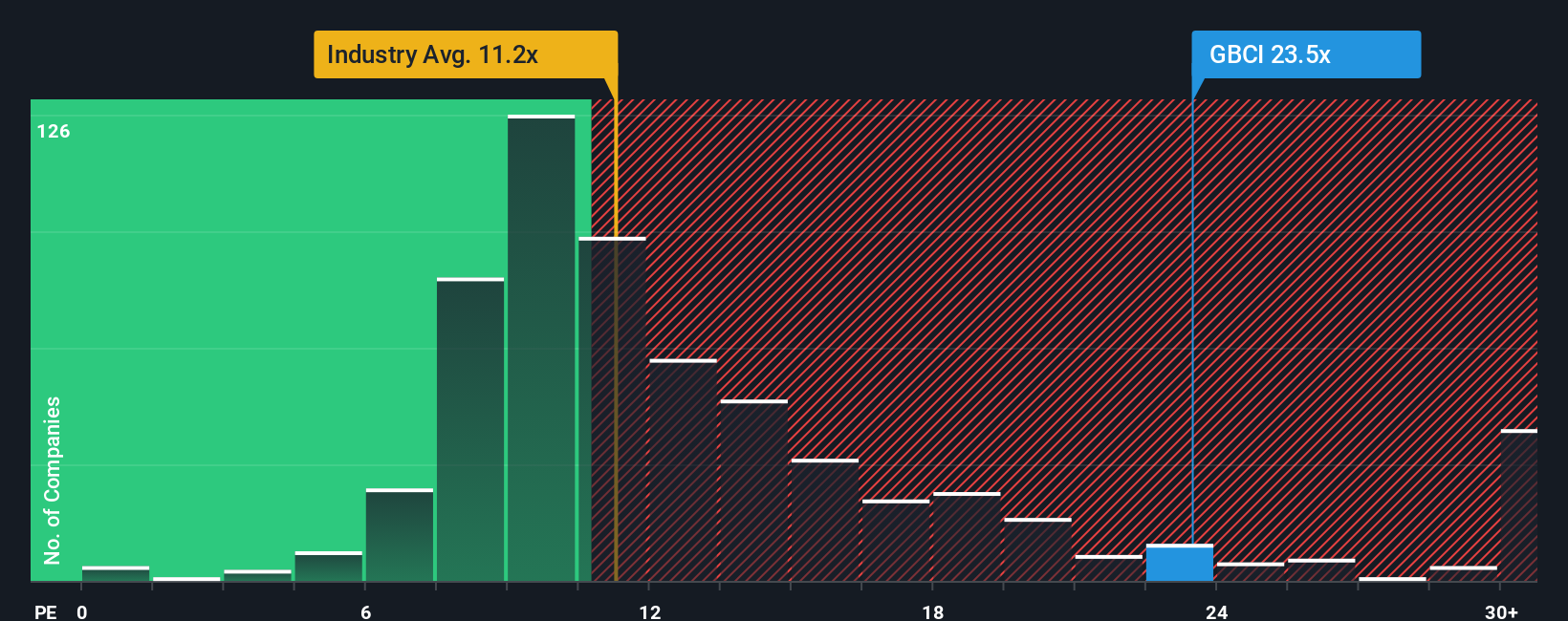

While analysts see fair value near current levels, a look at Glacier Bancorp's price-to-earnings ratio puts things in a different light. The stock trades at 25.5 times earnings, far higher than both the peer average of 12.9 and the US banks industry at 11.8. Even the fair ratio for Glacier's business profile is lower at 18.3.

This big gap means investors are banking on consistently strong growth or margin expansion. What if that does not materialize as planned?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Glacier Bancorp Narrative

If you see the story differently or want to dig into the numbers yourself, you can craft your own narrative in just a few minutes with Do it your way.

A great starting point for your Glacier Bancorp research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Why stop with one opportunity? Give yourself the edge by targeting investments tailored to your goals with the free Simply Wall Street Screener. Make sure you are always a step ahead of the market.

- Boost your income potential by focusing on these 19 dividend stocks with yields > 3%, which regularly reward shareholders with attractive dividends above 3%.

- Catch the tech wave and start building a portfolio with strong long-term potential by selecting from these 25 AI penny stocks powering AI advancements.

- Stay a step ahead of Wall Street by identifying these 898 undervalued stocks based on cash flows, currently trading below their intrinsic value. This gives you a head start on bargains others may overlook.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GBCI

Glacier Bancorp

Operates as the bank holding company for Glacier Bank that provides commercial banking services to individuals, small to medium-sized businesses, community organizations, and public entities in the United States.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives