- United States

- /

- Banks

- /

- NYSE:FHN

First Horizon (FHN): Fresh Analyst Confidence Sparks Valuation Reassessment After Barclays’ Upgraded Price Target

Reviewed by Simply Wall St

First Horizon (FHN) caught some attention after Barclays reaffirmed its positive view, standing out by maintaining its rating and projecting further upside. This signals a shift in analyst sentiment compared to recent cautious takes.

See our latest analysis for First Horizon.

First Horizon’s share price has moved steadily this year, with the stock up 8.45% year-to-date and a 12.4% total shareholder return for the past year. While the latest analyst confidence is making waves, recent executive changes and board expansions in October and November suggest the company is focused on strengthening leadership and strategy for further growth. Momentum appears to be building, especially as performance in recent years has been resilient, with a remarkable 108% total shareholder return over five years.

If you’re curious about what else is gaining traction in the market, this could be a perfect moment to discover fast growing stocks with high insider ownership.

With First Horizon trading below both its analyst price target and estimated intrinsic value, investors may be wondering if there is still room for the stock to run or if the future is already reflected in its price.

Most Popular Narrative: 11.4% Undervalued

First Horizon's most widely followed valuation narrative sets its fair value at $24.49, notably higher than the last close of $21.69. This suggests analysts see further upside, with critical assumptions driving this view.

The company's diversified business model and focus on cost discipline may boost earnings stability and shield against economic fluctuations. Economic uncertainty and credit risks may hurt First Horizon’s revenue, net interest margins, and earnings as market volatility and potential recession loom.

Think a high but justified price target is just about market momentum? Think again. The narrative is built on bold assumptions around margin resilience and top-line growth, plus a confidence that volatility can be weathered. Want to see which numbers drive the analysts’ conviction? Unlock the full narrative to see what’s shaping this valuation.

Result: Fair Value of $24.49 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, near-term economic headwinds or rising credit costs could still undermine the bullish case for First Horizon. This serves as a reminder for investors to tread carefully.

Find out about the key risks to this First Horizon narrative.

Another View: Through the Lens of Market Multiples

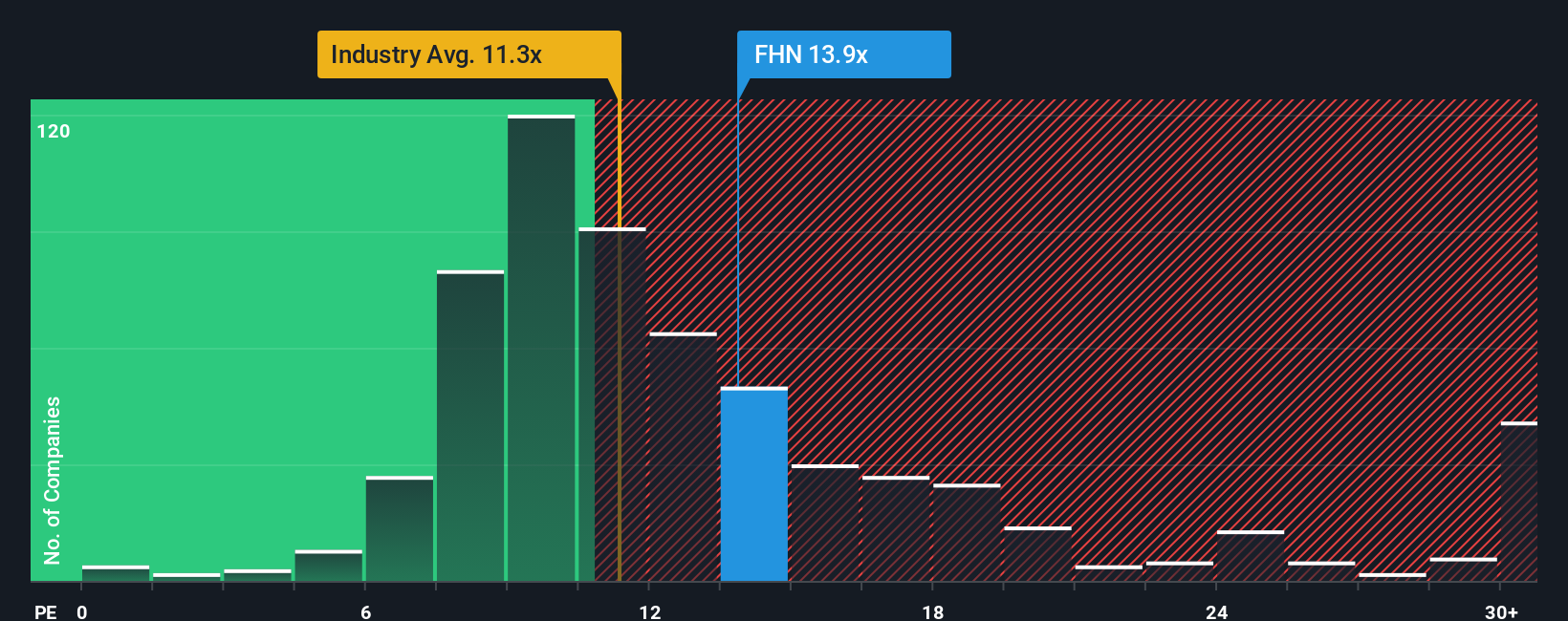

Take a look at how First Horizon stacks up on a price-to-earnings basis. At 12.5x, it trades above the average for both the US Banks industry (11.1x) and its peer group (10.3x). It is also above its own fair ratio of 11.7x. This premium could signal confidence, but it also raises the bar for future growth and means investors risk paying up for less upside.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own First Horizon Narrative

If you’re the type who wants to dig into the numbers and build your own perspective, you can have a fresh narrative up in minutes. Do it your way.

A great starting point for your First Horizon research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more smart investment ideas?

Opportunities move fast, and the market rewards those who seek out emerging trends before everyone else. Use these proven shortcuts to target unique growth potential and value others often overlook. Miss out now and you risk missing the next big winner.

- Capitalize on the potential for stable passive income by reviewing these 16 dividend stocks with yields > 3% with above-average yields and solid financials on your side.

- Get ahead of the curve by tapping into breakthrough innovation with these 24 AI penny stocks poised at the intersection of artificial intelligence and business transformation.

- Spot untapped opportunities and stretch your money further. See these 869 undervalued stocks based on cash flows benefiting from attractive valuations before they catch on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FHN

First Horizon

Operates as the bank holding company for First Horizon Bank that provides various financial services.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives